Liquidity is a factor that affects the stability of prices in the cryptocurrency market. This term refers to how easy it is to exchange a coin for cash or another digital asset. A liquidity provider (LP) maintains liquidity on a cryptocurrency exchange. They facilitate the smooth execution of trades by offering a continuous flow of buy and sell orders. In this way, they help reduce the impact of large trades on cryptocurrency prices.

Who exactly are liquidity providers, and what do you need to know about them? We will figure it out in this article.

What is liquidity, and why does it matter?

Liquidity means how effective the trade conclusion between operating buyers and sellers is in the crypto exchange.

High liquidity guarantees that trades may be executed swiftly with minimal impact on asset prices. Low liquidity means that it takes more time for trades to be executed. So, the price movements are more volatile.

Cryptocurrency market liquidity depends on several factors:

- Market depth. The number of open bids and asks at diverse price levels in the order book.

- Volume. The aggregate value of an asset traded within a specified time.

- Bid-ask spread. The difference between the best bid price (the price at which buyers will pay) and the best ask price (the price at which sellers are offering).

The benefits of high liquidity

Liquidity is at the heart of the functioning of any type of financial market, including the world of cryptocurrencies.

Price stability

Prices of assets in liquid markets tend to be more stable because large orders will have smaller impacts on the asset price. Conversely, illiquid markets have large price swings even if only one big order is executed.

Correct pricing

With greater liquidity, the bid-ask spread is narrower, making easy buying or selling at fair prices possible. Active participation in the market by different market participants is a guarantee that the price of an asset reflects its best fair value using supply and demand.

Fast trades execution

Adequate liquidity ensures that trades are executed instantly, and traders can close or open positions at will with no fear of precipitous price variations. This is particularly vital for institutional traders or high-frequency trading models, where precision and timing are extremely important.

Broader set of assets

There is more liquidity available in markets that have a diverse selection of assets to trade. These are the kinds of markets institutional investors and liquidity providers like, which form a greater number of tokens and pairs, thereby creating diversity opportunities within the ecosystem.

Greater trading volume

Higher liquidity tends to result in greater trading volume, which is beneficial to the entire market. With more activity, prices are more accurately discovered, and the market is more stable.

Confidence of investors

Liquid markets lead to the confidence of participants since more stable and reliable market conditions prevail. Higher liquidity also renders manipulation of the markets less likely, thus creating still more confidence amongst investors and traders.

Examples of liquidity issues

Liquidity problems can have a great impact on market performance and the overall trading experience.

Increased bid-ask spread

When there are fewer sell-and-buy orders within the market, the bid-ask spread tends to increase.

For example, a trader might see a bid of $200 and an ask of $220, where there is an immediate loss if one buys at the ask price and cannot sell at the bid price. This is especially prevalent in low-cap altcoin markets or newly minted tokens.

Filling order challenges

It is difficult to fill large orders in illiquid markets. A person who has a large amount of cryptocurrency to sell may be unable to find enough buyers at the planned price, and therefore, the price will drop sharply. Buyers may not be able to find sellers and will be forced to wait for their buy orders to be filled or pay a premium price to buy their desired quantity of cryptocurrency.

Price slippage

Slippage is a condition where the price of an asset fluctuates between when an order to trade has been placed and when it is actually being executed. This can be more likely to happen more frequently in thin markets, especially for large trades.

For example, if a trader is willing to buy an enormous quantity of Bitcoin at $25,000, but because of the quick price movement, it reaches $25,500 when the order is placed, then the trader will lose slippage and be in a poorer situation.

More volatility

Markets that are not so liquid carry more exposure to dramatic price fluctuation. It can dramatically alter the price of an asset for one big buying or selling order.

Suppose that one of the whales, or significant owners of crypto, unexpectedly sells off a significant portion. The price will sharply go down, initiating a sell cascade, which will increase volatility in the market.

Susceptibility to market manipulation

Reduced liquidity increases the susceptibility to market manipulation. “Pump and dump” is more readily achieved in low-liquidity markets, where few traders can artificially inflate the price of an asset, sell out after having “pumped up” the price, and leave other unsuspecting traders with huge losses when the artificially inflated price crashes.

Who are crypto exchange liquidity providers?

Now, we come to the liquidity provider definition. These providers are the entities and individuals who place buy and sell orders on a trading platform’s order book or contribute digital assets to crypto liquidity pools.

High liquidity guarantees that trades may be executed swiftly with minimal impact on asset prices. Low liquidity means that it takes more time for trades to be executed. So, the price movements are more volatile.

Types of liquidity providers

LPs’ types depend on the type of crypto exchange.

Centralized exchanges operate with an order book system. This means users place buy and sell orders at specific prices. The exchange matches these orders when a vendor and purchaser agree on the price. Liquidity on CEXs is represented by the orders listed on the order book, and trades happen when there is a match.

On decentralized exchanges (DEXs), crypto liquidity pools are used. They are applied instead of order books. Users put their assets into these pools, and trades are executed via smart contracts. The prices are determined by an algorithm based on the ratio of digital assets in the pool. Liquidity providers earn a portion of the transaction fees generated by the conducted trades in the pool.

Centralized liquidity providers

These providers, also called CLPs, are also named institutional liquidity provider. They are typically large exchanges that possess the order books and conduct trades. Some of such exchanges examples are Binance, Coinbase, and Kraken. With sophisticated algorithms, these exchanges match the balance between buy and sell orders. Thus, the exchanges offer liquidity by providing trading services for retail and institutional participants.

How do they work?

- CLPs maintain order books on their platforms, where liquidity is sourced from market makers, institutional traders, and retail users.

- They earn fees from transaction costs, market-making services, and spreads.

Decentralized liquidity providers

Decentralized liquidity providers (DLPs) operate on decentralized networks, such as decentralized exchanges and smart contract-supported liquidity pools. SushiSwap and Uniswap are examples, whereby individual users add liquidity.

How do they work?

- Individual users (DLPs) contribute to liquidity pools on DEXs, which use algorithms (like automated market makers) to facilitate trades without order books.

- Trades on DEXs are conducted peer-to-contract (not peer-to-peer like on CEXs).

- Liquidity providers earn money from the trades executed within the liquidity pool for example, when the Arbitrum (ARB) token drop took place, liquidity providers earned commissions from sales on the Uniswap exchange by investing their assets there.

OTC (over-the-counter) liquidity providers

Over-the-counter liquidity providers (Cumberland, Digital Galaxy) facilitate large, off-exchange trades. These providers, typically institutional traders or brokers, help carry out high-volume trades without disrupting the public order books.

How do they work?

- Trades are conducted directly between buyers and sellers. OTC providers ensure smooth execution and favorable pricing.

- OTC deals are usually arranged privately, offering tailored services to institutional clients or high-net-worth individuals.

Crypto-native liquidity providers

Crypto-native liquidity providers like B2C2 are institutions that are present in decentralized, blockchain-based environments, having a tendency to support decentralized exchanges, OTC services, or liquidity pools.

How do they work?

- They typically operate market-making or join liquidity pools on decentralized exchanges, ensuring there is adequate liquidity for traders to execute neat trades.

- Most crypto-native liquidity providers employ algorithmic trading practices or smart contracts to automatically tweak buying and selling orders, keeping liquidity of its own and reducing slippage, even in the extremely volatile crypto markets.

How liquidity providers operate on CEXs

Liquidity providers crypto entities ensure market efficiency by entering buy and sell orders and hedging risks related to their positions.

Placing orders

LPs place orders on an exchange order book, frequently in the form of limit orders ready to buy or sell at set prices. Orders are entered strategically on a number of price levels along the prevailing market price. By keeping these orders, LPs provide a constant pool of liquidity for other market players. Market makers, for example, maintain active sell and buy orders, scaling them up and down as they wish in an effort to be competitive.

Risk management

LPs are also faced with market volatility, where they are exposed to price fluctuation in the securities they hold. To hedge risk, liquidity providers can use methods such as:

- Delta-hedging: LPs can neutralize the impact of price adjustments on their portfolios by using the application of derivatives like options or futures.

- Arbitrage: LPs are able to engage in arbitrage by exploiting differences in prices on exchanges or assets to harvest profits without exposing themselves to large directional risk.

- Dynamic adjustments: Liquidity providers continuously make adjustments to their orders according to changes in market conditions, such as volatility or a change in trading volume, to restore equilibrium and minimize exposure to spikes in prices.

- Incentives for liquidity: LPs are rewarded with governance tokens, transaction fees, or some other form of incentives to provide liquidity in pools in decentralized platforms. This encourages users to supply liquidity, especially in volatile or low-volume markets. LPs get rewarded based on their share of the pool and are entitled to a portion of the trading fees the platform makes.

- Automated trading: Many liquidity providers, especially institutional ones, employ automated trading algorithms that place and adjust orders in perpetuity. The algorithms are designed to respond to current market conditions and optimize order placement for profitability and risk mitigation. High-frequency trading (HFT) strategies are employed to reap small price variations in various market scenarios to make sure liquidity in crypto remains consistent.

There are some differences between how liquidity providers work on DEX and CEX. DEX LPs provide liquidity by adding tokens to liquidity pools instead of order books. While CEX LPs may rely on high-frequency trading and algorithms, DEX LPs depend on automated systems that adjust token reserves to reduce impermanent loss and optimize returns.

How liquidity providers benefit the crypto ecosystem

Let’s talk about the huge contribution liquidity providers make to the liquidity provider cryptocurrency market and how their efforts build trading volume as well as the overall environment.

Increased market efficiency

Market efficiency is increased by the cryptocurrency liquidity provider through narrower bid-ask spreads and prompter trade execution. Their availability in the market at all times enables faster trade and stable prices, maximizing overall market performance.

Price discovery

LPs facilitate effective price discovery through liquidity provision at multiple price points. Their active participation guarantees that the true market value of assets is reflected, and trades can be made at reasonable prices in accordance with real-time supply and demand.

Less volatility

The best liquidity provider crypto guarantees the absorption of large orders, hence preventing price changes suddenly. Its market-stabilizing role at the time of large transactions eliminates sudden price shocks, creating more stable market conditions.

Higher trading volume

Having enough liquidity, LPs encourage increased trading volumes. The market becomes more likely to attract traders whenever there is liquidity since it assures easier execution of trades with lower slippage, and this leads to an active market condition.

Provided support for new projects

LPs are essential for the success of new tokens by providing front-running liquidity. Through their involvement, active trading is enabled for new ventures, making them more liquid and constructing initial investor confidence in the upstart assets.

Challenges faced by liquidity providers

Of course, liquidity providers are critical to the cryptocurrency market, yet their involvement comes with risks. The following are the main challenges LPs face, along with how to mitigate them.

Market volatility risk

LPs are at risk of price volatility, which may result in massive losses during downturns in the market.

A crypto liquidity provider can diversify their portfolios across different assets and liquidity pools. Some platforms also provide tools such as “impermanent loss protection” or insurance to safeguard against sudden price dips.

Regulatory uncertainty

The constant change in regulatory environments can put LPs at a disadvantage trying to stay compliant and optimize assets.

LPs can remain abreast of regulatory changes and remain compliant with local laws. Selecting platforms that have robust legal systems and clear regulatory compliance guidelines also serves to reduce this risk.

Competition and costs

LPs usually experience high levels of competition, which can decrease profits, particularly when transaction costs and operational expenses increase.

LPs can optimize the provision of liquidity in crypto through automated infrastructure and algorithms that respond to fluctuating market circumstances. Entering niche markets of lesser competition or fee-lower platforms can maximize profitability as well.

Flash crashes and manipulation

Manipulative strategies or flash crashes might initiate sudden price fluctuations, incurring LP losses.

To protect against this, LPs can place stop-loss orders or use automated means for quick unwinding of positions in periods of high market volatility. Membership in known platforms with stricter anti-manipulation controls can also reduce exposure to such risks.

Smart contract risk (in DeFi)

Smart contracts in DeFi platforms can be vulnerable to exploits or bugs, and this can result in a loss of funds.

LPs can avoid smart contract risks by leveraging trusted, thoroughly audited platforms. Additionally, partnering with platforms offering insurance or using smart contract monitoring tools can provide an added layer of protection.

The role of technology in liquidity provision

Technologies significantly enhance liquidity provision by streamlining operations and efficiency for the crypto exchange liquidity provider.

Automated trading systems

LPs can execute trades effectively using algorithms and bots, which run liquidity in real time. The systems maximize the placement of orders and minimize risk, responding quickly to market conditions.

APIs and connectivity

Reputable exchange APIs (Binance API, Kraken API) ensure smooth integration with trading platforms, enabling LPs to trade and manage positions smoothly. Smooth connectivity is of the utmost importance for successful competitive pricing and responding to market volatility.

Data analytics

LPs employ data analytics to analyze market trends, volumes, and order book depths to make educated decisions and optimize profitability and risk management techniques.

DeFi and automated market makers

AMMs and DeFi protocols enable the automation of liquidity provision using smart contracts to align asset prices with supply and demand, allowing LPs to earn fees without traditional order books. This technology enables more decentralized and efficient provision of liquidity.

Choosing a crypto exchange with good liquidity

How to assess an exchange’s liquidity? Pay attention to the following indicators:

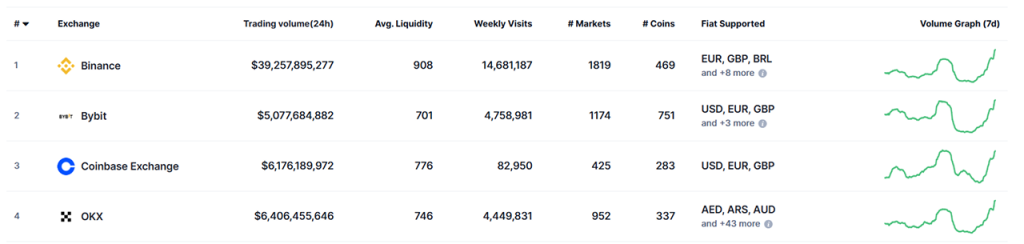

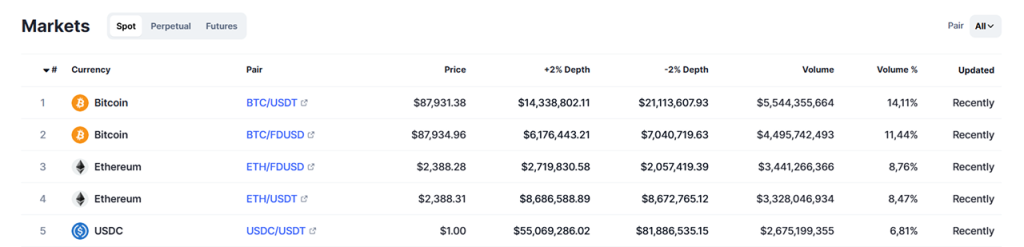

Trading volume

A high trading volume usually means more active participants. The more participants – the better liquidity and more stable prices. Platforms like CoinMarketCap and CoinGecko display trading volume by exchange, helping you identify which platforms have the most activity for your chosen assets.

Order book depth

A well-developed order book, with multiple buy and vendor orders at various price levels, indicates a liquid market.

Observe the live order book on an exchange to see if there are sufficient buy and sell orders across various prices.

Bid-ask spread

A smaller difference between the bid (buy) and ask (sell) prices reflects high liquidity, ensuring you can trade near your intended price. Tight bid-ask spreads indicate liquidity and a more predictable trading experience. High-volume pairs (such as BTC/USD) tend to offer better liquidity than obscure pairs with fewer participants.

Exchange reputation

Long-established exchanges like Binance usually provide more stable liquidity thanks to a larger user base and consistent trading volume.

Future trends in crypto liquidity

Technology become more advanced, regulation has evolved, and digital asset markets become more sustainable. The following trends are important for the future of liquidity provision.

Development of DeFi and AMMs

DeFi protocols and AMMs are changing the offering of liquidity by eliminating intermediaries. Users will be able to engage with liquidity pools directly through smart contracts, leading to a more decentralized and efficient system. With these protocols growing, liquidity will become more scalable and efficient.

Example: Uniswap V3 introduced concentrated liquidity, which allows providers to choose particular ranges of prices, maximizing returns and capital efficiency.

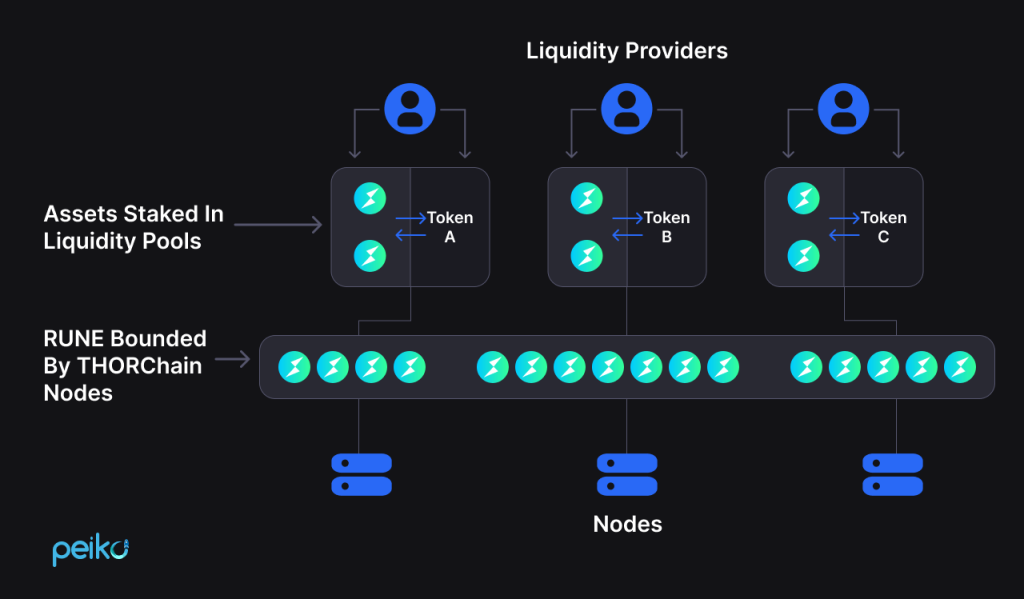

Cross-chain liquidity solutions

Perhaps, the largest problem in crypto markets is liquidity fragmentation between blockchains. Cross-chain technologies, such as bridges and omnichannel protocols, are designed to allow for seamless, frictionless transfer of liquidity between blockchains, increasing price discovery and reducing inefficiencies.

Example: ThorChain is among the top crypto liquidity providers list. This protocol allows decentralized liquidity pools to move across multiple blockchains, with users having the ability to swap assets without intermediaries.

Regulatory clarity

As regulatory landscapes for crypto change, liquidity providers adapt to new requirements. Greater transparency in regulations will attract institutional investors, raising liquidity and offering more stable market conditions by providing more predictable operating landscapes.

Example: Liquidity providing crypto exchanges like Binance and Kraken have adapted to stricter regulations, staying compliant and establishing market confidence across various jurisdictions.

AI and machine learning in liquidity management

These technologies are increasingly assuming the task of optimizing liquidity provision. They enable predictive market analysis, dynamic risk management, and real-time portfolio adjustments. Liquidity providers for cryptocurrency exchange can respond quickly to market movements and adjust risks accordingly.

Example: GSR Markets uses AI to enhance its liquidity strategies, making real-time adjustments as market conditions evolve.

Decentralized autonomous organizations (DAOs) in liquidity provision

DAOs are now entering the offering of liquidity, allowing community-sourced liquidity pools and collective determination of yield optimization. This shift to decentralized management of liquidity brings more transparency and inclusivity to the process.

Example: MakerDAO has its liquidity pools and collateral reserves, securing the stability of its DAI stablecoin via decentralized decision-making.

Tokenization of real-world assets

RWAs such as property and equities are providing new ways to liquidity. Through being in the state of blockchain-locked conventional assets, tokenized assets can then seamlessly be traded, and access can be provided to more investment alternatives.

Example: Platforms like Synthetix and RealT are advancing the frontier with tokenized physical assets to be traded on the decentralized level.

Peiko is your reliable partner for developing crypto projects

Peiko is your trusted partner in developing next-generation crypto solutions, such as custom crypto exchanges. Working since 2017, our experts have the expertise to deliver secure, scalable, and efficient systems supporting both decentralized and centralized ecosystems.

Regardless of whether you need the development of smart contracts, management of liquidity, or tokenomics, or any liquidity provider crypto exchange, we offer complete sets of services to construct and maintain a highly effective exchange.

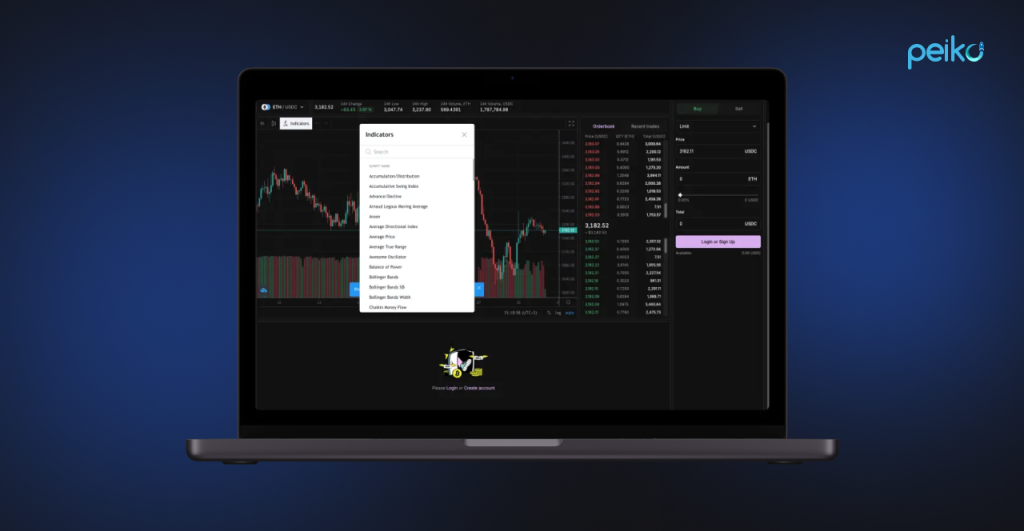

Let’s consider one of our best projects – Bitsten. It is a white-label crypto exchange platform with customization we recently created.

Bitsten is a white-label product aimed to facilitate the rapid deployment of blockchain projects, and its primary field of focus is cryptocurrency exchange services.

Key results the client obtained

- Scalable trading platform Built on the Node.js microservice architecture, Bitsten has the ability to process up to 10,000 transactions every second to ensure optimal performance and scalability.

- Instant trading Real-time price refresh and execution of orders, instant trading experiences seamless and responsive trading.

- Better liquidity management It is accompanied by automated robots and top-notch liquidity suppliers such as Huobi and B2C2 to stabilize and reduce slippage.

- Comprehensive security The platform leverages KYC (know-you-customer) through DDoS protection, SumSub, and secure cryptocurrency storage to protect both user funds and information.

- Integrated solutions Third-party services such as Fireblocks for asset management, TradingView for charting, and SendGrid for notifications supplement platform capabilities and educate users.

- Flexible and Scalable solution Bitsten is a flexible white-label solution that is easily scalable and customizable to fit various blockchain projects as well as future business growth.

Now, the platform is a robust foundation for blockchain projects, delivering scalability and effectiveness to meet both domestic and global markets’ needs.

Conclusion

Crypto exchange liquidity provider ensures the stability and functionality of virtual asset markets. Whether in a centralized or decentralized market, liquidity is paramount to facilitating efficient trading, price consistency, and minimizing slippage.

Contact us to create an effective and resilient liquidity solution or crypto exchange tailored to meet your unique requirements.

FAQ

Various sources, including liquidity providers (LPs), market makers, institutional investors, and decentralized finance (DeFi) platforms.

A crypto liquidity provider is responsible for supplying assets to exchanges so that there are enough buy and sell orders to facilitate efficient trade execution at competitive prices.

Crypto liquidity services ensure that there are sufficient assets available on an exchange to enable efficient trading by maintaining a balance of sell and buy orders, making the market more efficient.

The biggest projects among the crypto liquidity providers list are financial institutions such as Cumberland and Jump Trading, and market-making firms on centralized and decentralized exchanges.