There is no single authority that regulates crypto assets, but there are many regulators among which this management is divided. Therefore, it is easy to get confused. Therefore, we decided to reveal this topic to save you from confusion.

United States crypto regulations are guided by a comprehensive framework of federal and state laws. At the federal level, regulators include the SEC, CFTC, FinCEN, and IRS. Each of these regulators regulates various kinds of digital assets—from securities compliance and commodities trading to taxation and anti-money laundering controls.

At the state level, regulatory approaches vary. Some states embrace innovation, some adhere to rigid licensing requirements. In this article, we will consider the most significant federal and state laws that investors and crypto businesses need to be aware of.

US crypto regulation: Federal and state guidelines

Cryptocurrency regulation in the United States is carried out on two levels—federal and state—creating a complicated and at times conflicting legal landscape.

At the federal level, the SEC, CFTC, FinCEN, and IRS regulate securities, commodities, anti-money laundering, and taxation, ultimately applying nationwide and providing the regulatory structure for crypto activity.

However, state governments can implement their own cryptocurrency law, licenses, and compliance requirements. For example, New York’s BitLicense framework imposes strict licensing and reporting obligations on crypto businesses. Some other states, like Wyoming and Texas, have been more crypto-friendly in their approach.

In 2024, Wyoming even legally recognized DAOs (decentralized autonomous organizations). However, in the SEC 2025 update, DAOs are still in a state of legal uncertainty since they behave like companies but in the absence of a clear regulatory framework. Projects are encouraged to obtain clear legal views or seek no-action letters from the SEC, but these do not happen frequently, and they only tend to apply in specific circumstances.

In general, a crypto business must follow both state-level and federal laws. You should be aware that a business may be compliant federally but can still be prohibited or licensed in separate states. That’s why it is essential to know these crypto regulations. Below, we will consider the main federal and state guidelines.

Federal regulators: The big players

Cryptocurrency in the US is regulated by several key federal agencies, each addressing a different sphere—from securities and commodities to financial crimes and taxation. Below is a brief summary of the key players and what they do.

Securities and Exchange Commission (SEC)

This U.S. government agency has classified some cryptocurrencies as securities. This mandates that any security token comply with federal securities cryptocurrency laws, for example, registration and disclosure obligations.

SEC has brought several projects to enforcement action for offering unregistered securities offerings, primarily through initial coin offerings (ICOs). For example, in 2023, it is embracing a regime of regulation by enforcement, filing big lawsuits against entities like Coinbase.

In 2024, the SEC approved Bitcoin and Ethereum exchange-traded funds (ETFs).

The SEC issued new guidance in 2025, refining the Howey test—a legal standard to ascertain if a token is a security—by making considerations of whether the token was marketed as an investment, the functional use of the token in a decentralized network, and developer control.

- Tokens with clear utility—such as ETH following the Merge and stablecoins—are generally exempt, and investment and centrally controlled tokens remain regulated.

- Even with more transparent rules, gray areas remain between DAOs and governance tokens, so legal advice or SEC no-action letters are recommended but rare.

- Projects must clarify token status, investors can anticipate fewer risk assets, and exchanges must step up compliance, possibly becoming security brokers.

Minimizing SEC penalties in 2025: Practical actions

To reduce SEC penalty risk in 2025, crypto companies should do the following:

- Automate filings using platforms like Workiva to track deadlines and file reports (Forms 10-K, 10-Q, 8-K) via the SEC’s EDGAR system on time.

- Use AI tools to review disclosures for accuracy, especially on ESG and cybersecurity matters.

- Comply with SEC cybersecurity rules (Regulation S-P); report breaches promptly on Form 8-K, “without unreasonable delay.”

- Conduct regular internal audits with audit trails and record-keeping.

- Train staff on crypto regulations, insider trading, and evolving SEC disclosure requirements.

- Deal proactively with the SEC Division of Enforcement or regional offices by reporting issues early and reducing penalties.

Financial Crimes Enforcement Network (FinCEN)

It’s a bureau of the U.S. Department of the Treasury that focuses on AML (anti-money laundering) and CTF (counter-terrorist financing).

FinCEN was the first U.S. government regulator to address cryptocurrency, by issuing guidance in 2013. It clarified that businesses involved in trading with virtual currencies — such as crypto exchanges and wallet providers — are money services businesses (MSBs).

As a result, such companies are required to:

- Register with FinCEN

- Be in compliance with the know your customer (KYC) rules

- Maintain anti-money laundering (AML) programs

- File suspicious activity reports

FinCEN doesn’t possess the role of crypto market regulation, such as the SEC and CFTC, but of assuring that digital assets are free from use for any kind of illegal use, such as money laundering or terrorist financing.

Some of the most significant FinCEN obligations are:

- Money service business (MSB) registration US crypto currency exchanges, wallet services, and other similar crypto businesses must register as MSBs and adhere to FinCEN regulations.

- Customer due diligence (CDD) Crypto enterprises are required to verify customer identities and assess risks regarding transactions.

- Suspicious activity reporting (SAR) Firms must report suspicious transactions, such as highly frequent or unusually high trades.

Commodity Futures Trading Commission (CFTC)

The CFTC U.S. federal agency considers particular crypto like Bitcoin and Ethereum commodities. So that means the CFTC will oversee crypto futures — contracts by which people will buy or sell crypto for a price set ahead of time in the future.

The CFTC doesn’t oversee ordinary crypto trading (known as the spot market, where users exchange and trade crypto outright). But it can step in if fraud or price manipulation is occurring on those platforms.

So while the CFTC’s role is less than others like the SEC, its role is important to making sure that crypto trading — especially futures and other advanced products — is fair and safe.

Key responsibilities of the CFTC are:

- Market integrity Making crypto derivatives platforms comply with anti-fraud and anti-manipulation regulations.

- Regulating exchanges Regulating institutions like the CME, meaning Chicago Mercantile Exchange, where Ethereum and Bitcoin futures are traded.

- Protecting consumers Stopping fraud attempts and ensuring transparency of markets in digital assets.

Internal Revenue Service (IRS)

The U.S. government agency that classifies cryptocurrency as a type of property for tax purposes. Being valued as property, all sales, exchanges, or purchases of cryptocurrency come under capital gains taxation like stocks or property.

Let’s consider the main points of the IRS cryptocurrency regulation US:

- Taxable events The sale, purchase, trade, or even utilization of cryptocurrency to purchase goods and services is a taxable event.

- Capital gains and losses Gains are taxed on the basis of the holding period of the asset (short-term or long-term), while losses are typically deductible to minimize gains.

- Reporting requirements Taxpayers must report all cryptocurrency transactions on Schedule D of the return and on Form 8949.

The SEC, CFTC, FinCEN, and IRS play a vital role in shaping how crypto is regulated in the U.S. For anyone involved in digital assets, understanding each crypto currency law is vital to staying compliant.

State-level guidelines: Patchwork of laws

Crypto regulation US provides is not just a federal question—it’s a complex system, including state-level regulations. While agencies like the SEC, CFTC, and FinCEN set overall national standards, states then add their own requirements.

As of 2024, over 30 U.S. states have introduced or passed crypto-specific laws. States vary significantly in their approach:

New York

NYC has some of the most stringent regulations of crypto in the U.S., primarily through its BitLicense framework introduced in 2015. Any business dealing with virtual currencies—such as exchanges or custodians—must obtain this license, which involves high compliance costs and detailed reporting.

Obtaining a BitLicense in New York in 2025 involves an initial application fee of about $5,000, annual regulatory fees ranging from $15,000 to over $80,000, depending on the size of the business. There are also other expenses, including legal and compliance services, which can range from $50,000 to $100,000. Additionally, a minimum $500,000 surety bond is required, with an annual cost of approximately $25,000 to $75,000.

While the state aims to protect consumers through strict oversight, many in the industry criticize the rules as overly burdensome. Lawmakers are now considering new bills that could ease some restrictions, introduce regulatory sandboxes, and even explore a state-issued digital currency.

Wyoming

This state has been friendly towards crypto and passed several laws to attract blockchain companies to the state, including the endorsement of decentralized autonomous organizations and creating a new banking charter for crypto companies.

California and Texas

These U.S. states have had more balanced or emerging positions, typically highlighting consumer protection and financial innovation until recently. California’s Digital Financial Assets Law (DFAL), simply referred to as the “BitLicense” in relation to New York’s law, requires that companies engaged in digital financial asset businesses obtain a license.

The DFAL becomes effective on July 1, 2026, and allows the Department of Financial Protection and Innovation (DFPI) rulemaking authority in establishing a regulatory framework for the crypto space.

Colorado

This Western state has embarked on a cutting-edge approach to digital innovation as the first U.S. state in 2022 to accept payment for taxes in cryptocurrency—albeit immediately converted to U.S. dollars. The state is also testing how it can use blockchain to accelerate government services, also making it a digitization-leading jurisdiction to try out the use of crypto.

Illinois

Another state of significant significance, showing evident legislative interest in fostering blockchain growth. With the adoption of the Blockchain Business Development Act, Illinois aims to regulate digital asset custody and facilitate financial innovation. This makes the state a potential blockchain hub for the Midwest region, offering both regulatory clarity and incentives for businesses focused on crypto.

Arizona

The State of Arizona has been a first-mover in welcoming blockchain-friendly policies. It passed legislation that considers blockchain-based signatures and smart contracts legally enforceable, an early legal step to the acceptance of decentralized technologies. While its bill permitting crypto payment for tax is still pending, Arizona is clearly positioning itself as an experimental hub for infusing blockchain in public services and the law.

This is not the full list of state-level guidelines – you should research the particular state if you want to launch the crypto project there. Keep in mind that some states actively promote innovation, while others have stricter US cryptocurrency regulation in place to protect consumers.

Challenges and future outlook

US crypto businesses must deal with a wide range of state laws. Wyoming and Texas offer crypto-friendly states, but New York and Washington are too stringent with their licensing laws, making operations difficult.

Main issues include:

- Differences in licensing: Money transmitter licensing varies by state, creating administrative hurdles for nationwide operations.

- Regulatory ambiguity: Without a cryptocurrency law, most states leave businesses to interpret general financial regulations.

- Uneven enforcement: Variations in the enforcement of states’ laws introduce compliance uncertainty.

Companies need strong compliance structures and jurisdiction-specific legal counsel in order to succeed.

Navigating regulatory ambiguities

At the federal level, overlapping jurisdiction among agencies confuses crypto businesses trying to figure out which regulations to comply with.

The most significant ambiguities are:

- Asset classification: The SEC treats many tokens as securities, while the CFTC sees others as commodities, muddying up regulatory lines.

- Tax guidance: The IRS treats crypto as property, yet lacks clear-cut guidelines for uses like staking rewards or decentralized finance (DeFi) income.

- Unified standards deficit: Without federal regulation, companies are exposed to a bewildering array of federal and state rules, increasing compliance costs.

Resolution requires positive regulatory engagement, open legal strategies, and staying relevant with evolving agency guidance.

Future of US crypto regulations

The US regulatory landscape for crypto is evolving rapidly, balancing federal efforts at standardization with ongoing state innovation.

Federal standardization

Pilot legislation and increased cooperation between agencies like the SEC and CFTC could facilitate ease of compliance, reduce jurisdictional conflict, and align crypto regulation USA with international standards. This will open up the market and make it more stable.

State-level innovation

States continue to experiment with progressive crypto laws, from Wyoming’s supportive US regulation on cryptocurrency to regulatory sandboxes in Arizona and Hawaii. Some are also exploring blockchain for public services like voting and records management.

While state innovation fosters growth, the diversity of rules highlights the need for collaboration between federal and state regulators to create a more consistent regulatory environment.

The US regulations on cryptocurrency create both risks and opportunities for startuppers. If you navigate these laws, you will succeed. We at Peiko can help you in this way, knowing the specifics of the crypto space.

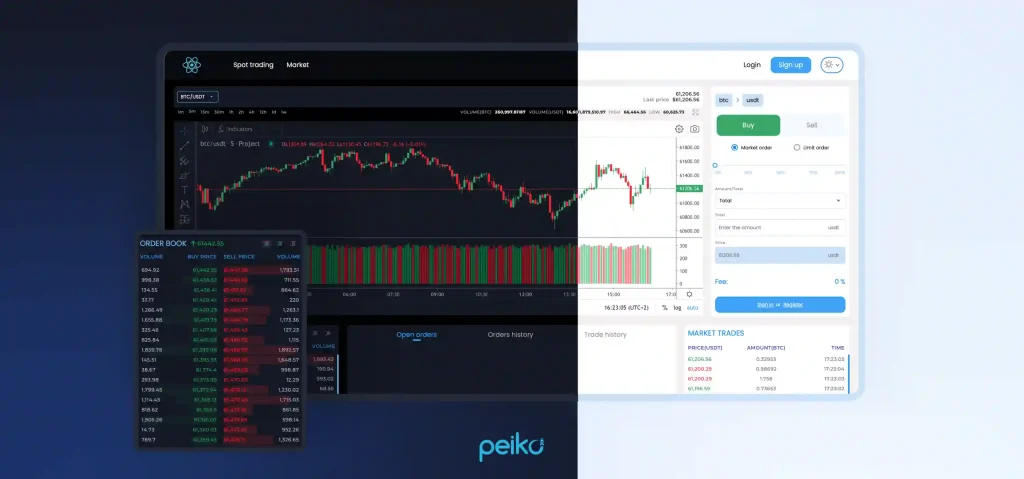

Stay ahead of the competition with our crypto exchange solution

At Peiko, we have a great solution for those who want to launch their own branded cryptocurrency exchange in 3 weeks. And it’s reality! You can use our high-performance white-label solution. Applying our solution, which is secure, feature-rich, and fully customizable, you will offer your users a professional-grade trading experience with cutting-edge features.

Below are the main features of our CEX (centralized crypto exchange) solution:

- Top trading features Real-time spot and order market orders, millisecond trading performance, and a fast matching engine powered by an advanced OrderBook.

- TradingView integration Live candlestick charts and market data analysis tools to facilitate smart trading decisions.

- High liquidity Seamless access to vast liquidity pools and trading providers like Huobi for immediate order fulfillment.

- Microservice architecture Ensures maximum performance, scalability, and fault tolerance.

- User-friendly admin panel Users can manage streams of revenue, modify commission fees, and control exchange activities effortlessly.

Any other cutting-edge features? More than 50 trading pairs are accessible to traders. New crypto pairs are going live in as short a time as 2 to 4 minutes. Security is strictly enforced, with Fireblocks custody integration for protection, and KYC verification handled neatly through SumSub. Additional security features include two-factor log-in authentication.

Your future users will appreciate commission-free trading in the app, along with a personal cabinet and a convenient admin panel.

Our crypto exchange platform is deployable on well-known cloud providers AWS, Azure, and Google Cloud. Based on a proprietary codebase, the solution is well-positioned for future growth and the introduction of new features.

Do you want to enter the crypto market? Our white-label solution includes everything you need to operate a secure, high-performance, and user-centric trading platform. Turn to us to learn more and receive answers to all questions, and a quote customized according to your business requirements.

Conclusion

Crypto regulations US are determined by the federal government and different state legislatures. These US crypto laws and restrictions may differ widely depending on where you are located. They can either be strictly regulated, like in NYC, or pro-innovation, like in Wyoming.

If you aim to succeed in this intricate crypto space, it’s worth considering these state recommendations carefully. Furthermore, it is necessary to consider federal guidelines from the SEC, CFTC, FinCEN, and IRS.

If you wish to enter the crypto space with an effective crypto exchange, Peiko offers an easy, secure white-label solution that will enable you to launch fast. Contact us today to discuss your project!

FAQ

Yes, crypto is legal in the USA. However, your crypto project should be compliant with a complex mix of federal and state legislation governing the trading, use, and taxation of crypto.

The main issue in regulating cryptocurrencies is the absence of a unified regulatory regime determined by one authority. This may cause duplicative agency jurisdiction and rule inconsistency between different US states.

Governing cryptocurrency in the US falls under the hands of different federal agencies. The main regulators include the SEC, CFTC, FinCEN, and IRS, as well as state regulators, which depend on the state.

The legal challenges entail determining how digital assets fall (whether they are securities, commodities, or property), licensing and reporting compliance, tax compliance, as well as combating fraud and illegal use.