Choosing the right trading engine is one of the most critical decisions while creating a crypto exchange. The trading engine is the core system that matches sell and buy orders, executes trades, and maintains user balances in real time. It is the core of the speed, reliability, and performance of your platform.

To make the right choice, you need to examine how the engine performs under high load, how protected it is from attacks, how easy it is to scale up with a growing user base, and whether it can be adapted to suit your platform’s specific needs.

In this article, we’ll explain what the best trading engine for crypto exchange is, why it’s so important, and how to choose one that aligns with the goals of your crypto exchange.

What is a сrypto trading engine?

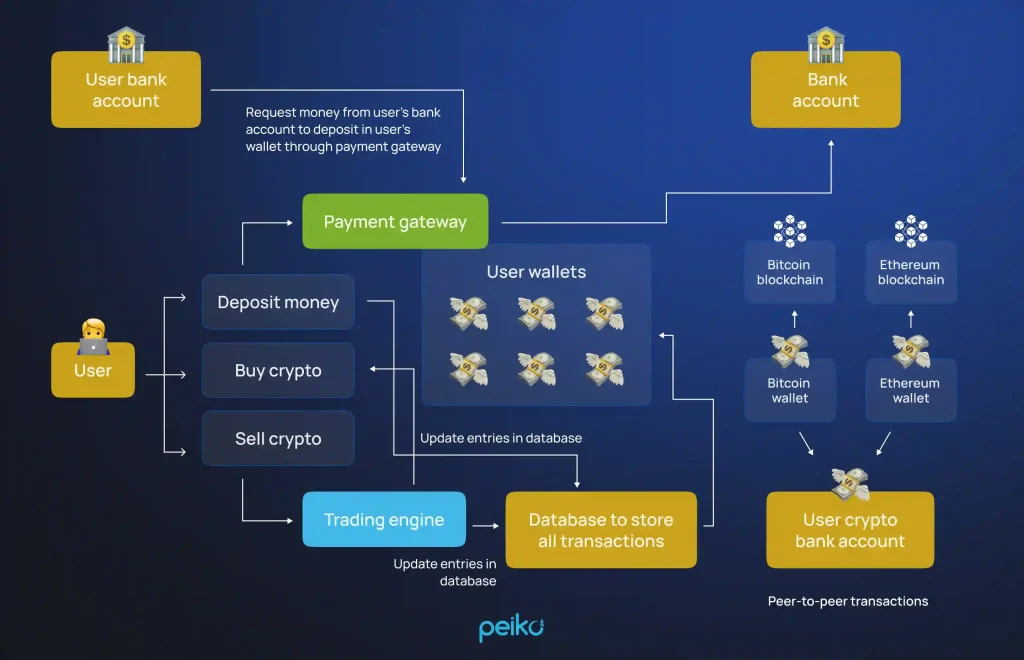

A crypto trading engine is the backend infrastructure of any crypto exchange — the component that actually processes trades and maintains the integrity of the order book. It’s what manages order matching, price calculation, and trade execution — all in real time, typically a matter of milliseconds.

Most fundamentally, the engine runs an order-matching algorithm, generally a price-time priority model, or First-In-First-Out (FIFO). That is, orders are matched first by price and then by submission time.

Some engines support more complex order types and algorithms like iceberg (hiding large orders), TWAP (spreading orders evenly over time), or VWAP (buying or selling based on average price), depending on the needs of the platform.

In general, a high-performance trade engine is designed to:

- Match thousands of orders per second with ultra-low latency

- Enable high-concurrency scenarios with a large number of users placing, canceling, and amending orders concurrently

- Offer atomic transactions, i.e., each trade executes in its entirety or not at all — eliminating inconsistent states

Trade engines are created in the following languages: C++, Rust, Go, Java, and Node.js (JavaScript runtime environment). These programming languages and Node.js are favorites due to their speed and ability to handle concurrency. The architecture of trading engines often follows event-driven, asynchronous patterns to ensure performance and scalability.

The trading engine is what enables a crypto exchange to actually work as a market. Without one, the platform is merely a front-end with no actual trading capability.

Why the trading engine is critical

The trade engine is the core processor in a crypto exchange, processing every trade with unmatched speed and precision to allow smooth market operations. In a world where milliseconds make a difference, how well the trading engine delivers and how reliable it is play a critical role in maintaining a competitive advantage and user confidence.

In essence, the engine runs complex algorithms that match buy and sell orders real-time, constantly refresh the order book, and update user balances atomically to eliminate discrepancies. How it can keep up perfect performance under high trading volumes or sudden market fluctuations is what makes an exchange reliable and trustworthy.

Delays or failures in the core trading engine can lead to trade mismatches, delays, or platform crashes—meaning that it has financial risks, reputation damage, and/or regulatory exposure. Therefore, maximizing throughput, minimizing latency, and fault tolerance are top-of-mind concerns for exchange developers.

Some key technical advantages of a high-performance trading engine are:

- Low-latency order matching Able to handle thousands of orders per second, necessary for high-frequency and algorithmic trading.

- Atomic trade execution Ensures transactions either succeed or roll back completely, with data remaining consistent even upon failure.

- Dynamic order book updates Provides real-time order status and depth of market to traders, maintaining accuracy and transparency.

- High concurrency and scalability Handles a high level of concurrent orders and cancellations without losing performance, supporting platform expansion.

- Very good fault tolerance and recovery Built with functionality to avoid downtime and data loss in the event of unexpected failure.

- Sophisticated trading strategy support Allows usage of complex order types like iceberg and VWAP, appealing to professionals and market makers.

The trading engine is the technological backbone of a crypto exchange that enables it to deliver fast, secure, and scalable trading experiences that can address the demands of today’s digital financial markets.

Key factors to consider when choosing a trading engine

Choosing the best trading engine for crypto exchange involves weighing a series of technical along with operational requirements. Some of the key considerations include:

Latency and throughput

Your engine must process orders with ultra-low latency—typically in microseconds—and high throughput, sustaining thousands or even tens of thousands of transactions per second. This is necessary to facilitate high-frequency traders and volatile markets effectively.

Order matching logic

Different trade engines support different matching algorithms, such as FIFO, pro-rata, or hybrids. You need to ensure that the engine supports the order types and trading strategies you will offer, such as complex ones, such as iceberg, TWAP, or VWAP orders.

Concurrency and scalability

The engine’s architecture should be able to deal with concurrent order submissions, updates, and cancellations without creating bottlenecks or data races. Event-driven, asynchronous, or multi-threaded architectures are extremely suitable for this.

Data consistency and atomicity

Every trade should be executed completely or not at all in order to maintain system integrity. Real-time synchronization of order books and user balances across distributed environments is a key attribute, especially for multi-node setups.

Resilience and expandability

The engine should be built with horizontal scaling and robust fault tolerance in mind. Features of crypto trading engines such as clustering, automatic failover, and load balancing ensure maximum uptime and enable the platform to scale well.

Build vs. buy: The main dilemma

There are two ways to integrate a trading engine into your crypto exchange platform. You can build this engine from scratch or use a ready-made solution. Let’s consider the differences between these two approaches:

| Criteria | Build from scratch | Buy a ready-made solution |

| Time to develop | Typically 6-18+ months due to complex system design, testing, and debugging | Deployable within weeks or a few months, including customization and integration |

| Cost of trading engines for exchanges | High costs for expert engineers, infrastructure, and extended development cycles | Lower upfront fees, usually via licensing or subscription |

| Performance tuning | Requires deep technical expertise to reach low latency and fault tolerance benchmarks | Engineered and optimized for peak performance out of the box |

| Level of customization | Unlimited flexibility to tailor features and algorithms | Customizable within framework limits; faster feature rollout |

| Maintenance responsibility | Ongoing burden on internal teams for updates, security patches, and regulatory compliance | Vendor manages upgrades, bug fixes, and compliance updates |

| Speed to market | Longer development time can delay launch and revenue generation | Rapid deployment accelerates market entry and user acquisition |

With the very high technical demands of a trading engine—real-time order matching, atomicity, fault tolerance, and scalability—the notion of starting from scratch is a daunting undertaking.

Startups as well as established companies capitalize on buying open source trading engines. Not only does it accelerate rollout, but it also capitalizes on savings from costly errors and downtime.

By using a white-label trading engine, you have access to a robust infrastructure, yet still have the ability to customize features through APIs (application programming interfaces) and modular extensions. This balance between speed, reliability, and flexibility makes ready-made engines the pragmatic solution for most crypto exchanges in today’s times.

Due diligence and evaluation process

Selecting a trading engine is a critical choice for your cryptocurrency exchange. A rigorous evaluation process helps you choose a solution that is technically sound, secure, and scalable to keep pace with the growth of your platform.

Technical evaluation

Begin by assessing the engine’s design, performance, and scalability. It needs to be capable of handling high-frequency trading with minimal latency and support for real-time order matching and balance updating.

Assess whether the engine can handle complex order types and whether the architecture can handle concurrent trading activity efficiently.

Security and stability

Evaluate how the trading engine prevents DDoS attacks, front-running, and order manipulation. Verify whether the system ensures data consistency and transaction atomicity. Stability is also important—get a system with high uptime and that recovers quickly from faults without loss of data or inconsistencies.

Vendor evaluation

The technology itself won’t cut it—get to know the vendor behind it, too. Research their experience in the crypto space, ask for client references, and understand their support structure. Your good vendor will have clear documentation, sound integration tools, and regular updates to meet changing security and compliance needs.

Testing and validation

Before the final decision, request a sandbox environment or live demo. This allows you to get a true test of the engine’s real-world performance, API behavior, and integration flexibility. Check service-level agreements, uptime commitments, and support responsiveness — the vendor should meet your operating needs.

Launch a crypto exchange powered by a robust trading engine

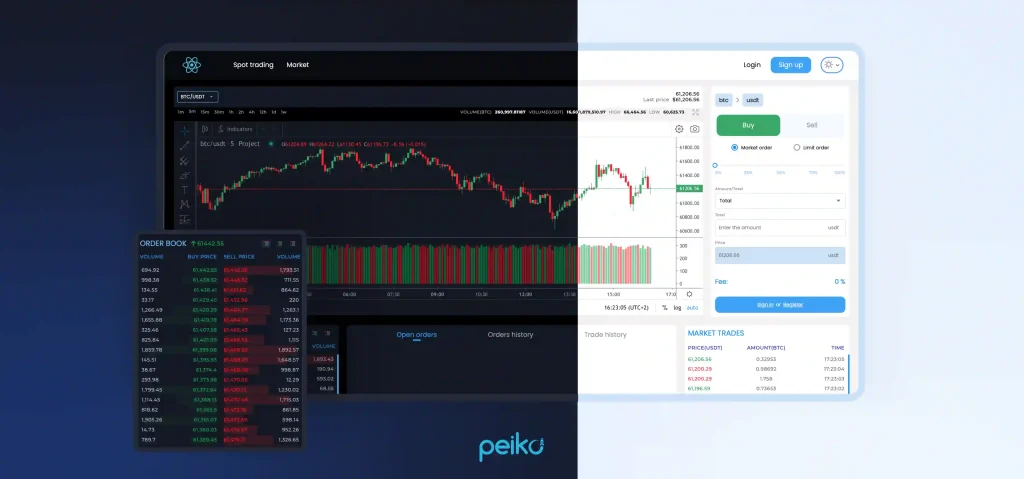

Join the crypto universe with confidence through our white-label exchange platform, boasting a powerful, pre-integrated trade engine designed with real-time processing and swift order execution in mind.

No need to begin from the ground up — our solution is entirely customizable, secure, and scalable, so you can launch a full-featured centralized exchange (CEX) in just 3 weeks. Engage retail customers or pro traders; the platform will scale high-volume action with ease.

With native TradingView charts, intelligent order-matching, and out-of-the-box liquidity, your platform will be ready to go on day one.

What you’ll get:

- Super-fast trade matching with spot and market order support

- Trading interface pro by TradingView

- Fireblocks security, SumSub KYC, and native liquidity

- Commodity commission model & real-time admin dashboard

- Cloud-based deployment on AWS, Azure, or Google Cloud

- Microservices architecture with auto scaling for high demand

With our solid infrastructure and skilled blockchain professionals, you can go live faster, scale up with ease, and start making money sooner.

Conclusion

The trading engine is the core system behind any crypto exchange — it’s what processes, matches, and executes trades in real time. Its speed, stability, and scalability directly impact user experience and platform reliability. Whether you’re launching a startup exchange or upgrading an existing one, choosing the right trading engine is critical.

To reduce risk and accelerate time to market, many businesses opt for open source trading engines — like ours. With a battle-tested trading engine, advanced trading tools, full customization, and enterprise-level security, you can launch a fully operational exchange in just 3 weeks.

Ready to launch your exchange fast? Contact us to book a call or request a demo of our white-label CEX solution today.

FAQ

A trading engine is the backend system that matches buy and sell orders on a crypto exchange. It handles order execution, manages the order book, updates balances, and ensures real-time transaction accuracy.

Look at performance (latency, throughput), scalability, supported order types, fault tolerance, security features, and ease of integration. Vendor reputation and support quality also matter.

With our white-label solution, you can launch a fully featured exchange in as little as 3 weeks.

Yes, our platform is fully customizable — from user interface to fee structures, trading pairs, and backend integrations.