Centralized exchanges (CEXs) will face immense pressure to grow in 2025. Including but not limited to raw speed, latency, security, interoperability across chains, and round the clock availability.

Looking at scalability in the year 2025, this article analyzes the changing argument between modular vs monolithic blockchains designs. To start, we will define each architecture in detail, outlining the fundamental engineering concepts that underpin each. Following that, we will examine each design in detail to see how it manages scalability in the face of modern challenges.

We’ll touch on topics such as throughput for millions of simultaneous trades, upgrade cycles, fault isolation, resilience, and latency. Trends in cloud-native adoption, the increasing intersection of AI/ML in operations, and comparative analysis extracted from current CEX infrastructure will be also presented.

For architects responsible for exchanging infrastructure, chief technology officers (CTOs) for planning technical strategy over the next five years, and devops leaders for optimizing throughput pipelines, this isn’t merely abstract theory. The best way to position your exchange for 2025 is to read on to find out difference between monolithic and modular blockchain architecture, which model scales better and why.

Understanding monolithic exchange architectures

Exchange operators face a critical architectural juncture due to the increasing amount and complexity of digital assets and financial products. Modular exchange is a huge change from the traditional all-in-one deployment method in the monolithic vs. modular blockchain architecture debate. It offers a framework for deploying services independently inside a network of loosely coupled services.

Please be aware that throughout this article, the term “modular” refers to a service-oriented or microservices architecture, in which the main exchange functions are divided into separate, but interdependent, modules. This differs from the modular monolith design approach, which maintains tight internal coupling yet results in a single deployable codebase with an internal modular structure.

Are tightly coupled, monolithic structures still the best way to optimize? Or is it better to consider breaking down features into smaller, more decentralized services? Survival in operations and competitive advantage are at stake in this monolithic and modular blockchain tech-stack argument.

For startups in their early stages, when getting products to market quickly is more important than being scalable in the long run, monolithic exchange designs are common.

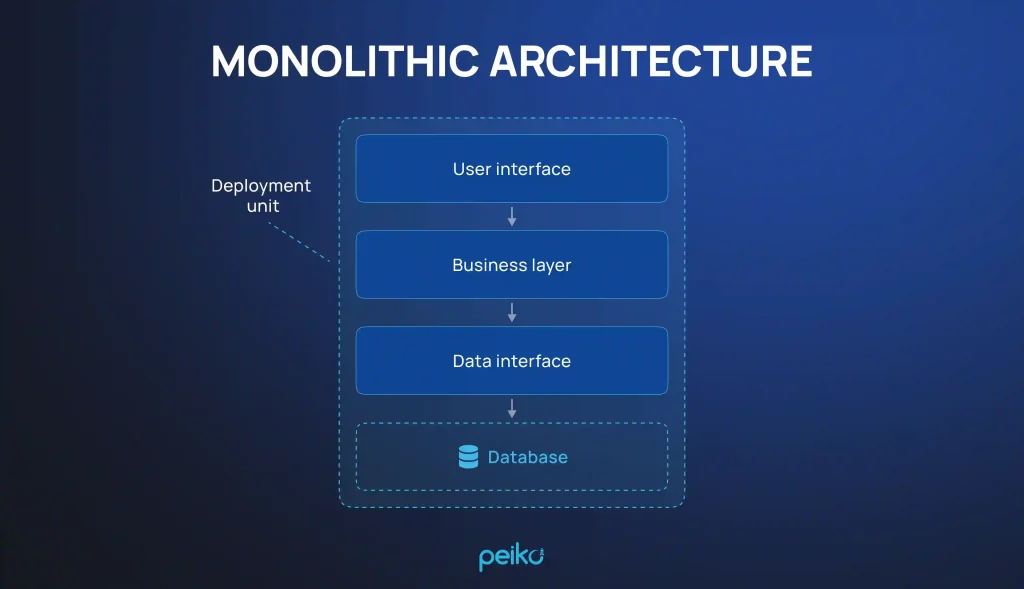

Simply said, comparing monolithic blockchains vs modular blockchains, monolithic systems merge all essential features. It includes analytics, risk engines, fiat gateways, custody, market data distribution, and know-your-customer/anti-money-laundering (KYC/AML) checks. They appear in one tightly-coupled codebase and deployment artifact.

This link tightly controls the flow of data and communication within the company. In turn, this cuts down on initial delay and cross-service orchestration overhead. In contexts with multiple markets, assets, and jurisdictions, the demands on the system grow dramatically, making the architectural cohesiveness a crucial trade-off.

When discussing centralized crypto exchanges, the single-process deployment model is what defines a monolith. Because of this, scaling is typically done vertically, by increasing the amount of memory, compute, or I/O capacity on a single node or cluster, rather than horizontally.

Vertical scaling can be helpful in some stateful parts, like order books and account ledgers, but only until it gets too complicated. Because in modular vs monolithic blockchains monoliths are generally tied to synchronous processing models, throughput may also be slowed down when there is a lot going on. If one part of a monolith fails, it can affect the whole stack, so a lot of high-availability engineering and backup planning is needed.

Monolithic or semi-monolithic stacks are still in use by a number of prominent exchanges. These stacks are sometimes supplemented with separate microservices to provide features like as analytics dashboards or customer support tooling. Still, the crucial trade core is tied very closely even under these conditions. Usually, these designs have these features:

- Centralized, stateful services with shared memory or database access

- Tight coupling between components, often within the same runtime

- Heavy reliance on direct function calls or intra-process queues, rather than event buses or message brokers

- Rigid deployment pipelines and long rollback times

- High interdependence of features and modules, resulting in poor fault isolation

Challenges with monolithic exchange architecture

From an operational point of view, monolithic exchanges are typically weak during the development and deployment cycles. Because the whole app is built and sent as a single unit, even small changes like adding a new API route or changing how charges are calculated need to be tested against the old version of the platform.

The rate of innovation slows down, the chance of downtime during rollouts rises, and problems that come up out of the blue have a bigger effect. Log noise from highly integrated systems makes it harder to find the root cause, which makes live debugging a lot harder. To put it simply, monoliths slow down both growth and the ability to grow.

But monoliths aren’t always out of date. Truthfully, monolithic designs provide a degree of simplicity and performance that might be realistic and economical for lowvolume exchanges, jurisdiction-specific deployments, or those early in their lifecycle. The single problem of monolithic versus modular blockchain architecture is that they get technical debt faster than they can be refactored, especially when usage grows and business logic gets more complex.

The composable, always-on, globally-regulated financial marketplaces of 2025 will not be able to rely on them because their architectural gravity causes them to become technical and organizational bottlenecks.

Understanding modular exchange architectures

In a monolithic & modular blockchain architecture argument, modular exchange is a radical departure from the conventional all-in-one deployment strategy. It provides a network of services that are loosely connected and can be deployed individually.

Each of a CEX’s essential functions—including custody, market surveillance, order book management, trade execution, and KYC/AML enforcement—is separated into its own microservice or limited context, rather than depending on a single codebase or runtime environment.

Event buses, gRPC, and high-performance message queues such as NATS and Kafka are commonly used for communication between these services accessible through clearly-defined APIs or asynchronous messaging layers. Key characteristics for managing the complicated, always-on trading environment of 2025 include an architecture intended for dynamic scaling, fault isolation, and quick iteration.

Technically speaking, modular architectures embrace distributed systems engineering concepts. To handle spikes in demand, stateless services may be instantly horizontally expanded. To improve throughput and fault tolerance, stateful components like ledger engines and order books can be replicated, sharded, or containerized. By decoupling different aspects of a service, teams are free to use whichever language is most suited to solving their specific problems.

For example, the matching engine may be built in Rust, infrastructure daemons in Go, or analytics and AI-based monitoring agents in Python. Crucially, modularity enables a decoupled deployment process. It allows for the autonomous delivery of new features or fixes without jeopardizing platform-wide reliability.

Usually, a modular CEX will include these features:

- Service isolation Each service is versioned, deployed, and scaled independently.

- Domain-driven design Business logic is partitioned by domain (e.g., risk, matching, settlement), allowing for specialized performance tuning.

- Event-driven communication State changes (e.g., order matched, withdrawal initiated) are propagated asynchronously, enabling downstream services to react without blocking.

- Observability-first architecture Metrics, logs, traces, and events are emitted at service-level granularity, supporting better monitoring and faster debugging.

- Cloud-native infrastructure Kubernetes or similar orchestrators are used to handle service lifecycle, resiliency, and elastic scaling.

The organizational agility of modular vs monolithic blockchain architecture systems is as impressive as its technical agility. By taking full ownership of individual services, teams can improve responsibility and decrease friction. To implement a new fraud-detection module, for instance, the risk engine management team doen’t necessitate extensive coordination with the wallet service team.

This independence promotes a mindset of constant deployment and shortens time-to-market. In modular blockchain architecture vs monolithic blockchain architecture enable genuine DevSecOps methods, such as integrating integration testing, security scanning, and chaos engineering into service pipelines.

Challenges with modular exchange architecture

However, there are several difficulties specific to modular designs. Distributed system design is challenging and calls for high engineering maturity to handle issues like managing service discovery, addressing eventual consistency, and assuring transactional integrity across services.

Careful management of network latency between services and versioning of shared schemas are necessary to prevent data drift. These obstacles may be a deterrent, but they are necessary for CEXs to spread across regions, assets, and legal frameworks in the long run.

For exchanges to thrive in the always-on, fiercely competitive global market of 2025, modularity is no longer a nice-to-have feature; it’s an operational need.

Scalability in 2025: The verdict

The focus of CEX scalability measures has shifted from raw transactions per second (TPS) to elastic throughput under duress, geo-distributed consistency, and extensibility that complies with regulations by 2025.

A contemporary monolithic & modular blockchain architecture CEX will be able to scale infrastructure without interruptions in service or downtime, integrate additional assets and jurisdictions in a matter of days rather than months, and manage traffic surges caused by volatile markets.

Considering this, it’s clear that modular designs provide better scalability than monolithic systems in almost all important metrics. At lesser scales, monoliths still have some latency and simplicity benefits, but their dynamic adaptability is severely constrained.

Direct comparison of scalability

| Dimension | Modular architecture | Monolithic architecture |

| Horizontal scaling | Native; services can scale independently | Limited; vertical scaling dominates |

| Service isolation | High; failures contained within modules | Low; one fault can affect entire system |

| Latency under load | Resilient; distributed backpressure possible | Degrades rapidly as system bottlenecks |

| Deployment agility | CI/CD per service; minimal downtime | Full redeployments required; longer cycles |

| Resource utilization | Fine-grained scaling reduces overprovisioning | Overhead from uniform resource scaling |

| Global distribution | Easier to geo-shard services | Complex and rigid to split regions |

| Regulatory flexibility | Jurisdictional isolation per service possible | Entire system must meet compliance holistically |

Why modular is generally better positioned for 2025 scalability

These days, scalability is a major concern, and modular architectures solve that problem. The operational and regulatory landscape in 2025 is going to be very complicated, thus their adaptability will be very useful. Services can grow, adapt, and become more resilient when they are partitioned by domain. Some of the reasons why modular designs are leading:

- Modular services provide for fine-grained infrastructure elasticity, thanks to cloud-native compliance with Kubernetes, service meshes, and auto-scalers.

- A fail-soft architecture ensures that important pathways, such as trading or custody, are not affected when faults occur in a single service, such as KYC throttling.

- The ability to independently roll out, A/B test, and roll back features without affecting the overall exchange allows for faster innovation velocity.

- Improved observability and AI integration: Anomaly detection and ML-based auto-remediation become achievable at scale with the help of structured telemetry sent by modular services.

- Exchanges can localize operations that are latency sensitive thanks to multi-region scaling, which allows services to be duplicated or sharded regionally.

In 2025, CEXs are more akin to financial hyperscalers than fintech startups, and this architecture is in perfect harmony with their operations.

Considerations for monolithic in 2025

In the modular blockchain architecture vs monolithic blockchain architecture discussion, monolithic systems still have tactical advantages, especially in certain trade circumstances where flexibility is more important than scalability and deterministic latency.

- Ultra-low latency requirements High-frequency trading engines with co-located infrastructure may still benefit from monolithic designs due to direct memory access and minimal inter-process communication.

- Regulatory environments requiring full-system auditability A single codebase can be easier to audit in some tightly regulated jurisdictions, albeit at the cost of flexibility.

- Low-throughput, niche exchanges Emerging markets or localized platforms with low trade volume and minimal product complexity may find monoliths cheaper and faster to operate initially.

- Simplified debugging Developers working within a single environment can more easily trace code paths without distributed tracing tools—though this benefit erodes rapidly with scale.

This is still just an extreme modular vs monolithic blockchain architecture example. The monolithic nature of the CEX becomes more of a burden as its size and complexity increase, rather than an asset. In the year 2025, several exchanges that still use monolithic stacks are either actively restructuring or are being surpassed by their more modular rivals.

Put simply, 2025 is going to be a watershed year. Exchanges need to function in a fragmented, fast-moving, multi-asset world, and modular architectures are strategically suited to this environment. They are also technically superior in scaled environments. If an exchange doesn’t modularize, it runs the danger of becoming obsolete, which is worse than downtime.

Future outlook on monolithic & modular blockchain architecture

In 2025, centralized exchange design is more and more influenced by larger software infrastructure concepts. Dispersed systems, cloud-native computing, and intelligent automation are now at the forefront of a discussion that was previously exclusive to financial technology circles.

Institutional acceptance, regulatory compliance, and round-the-clock market needs put increasing pressure on CEXs, forcing them to change their technology stacks. In most cases, this means adopting modularity with a modern, cloud-native perspective.

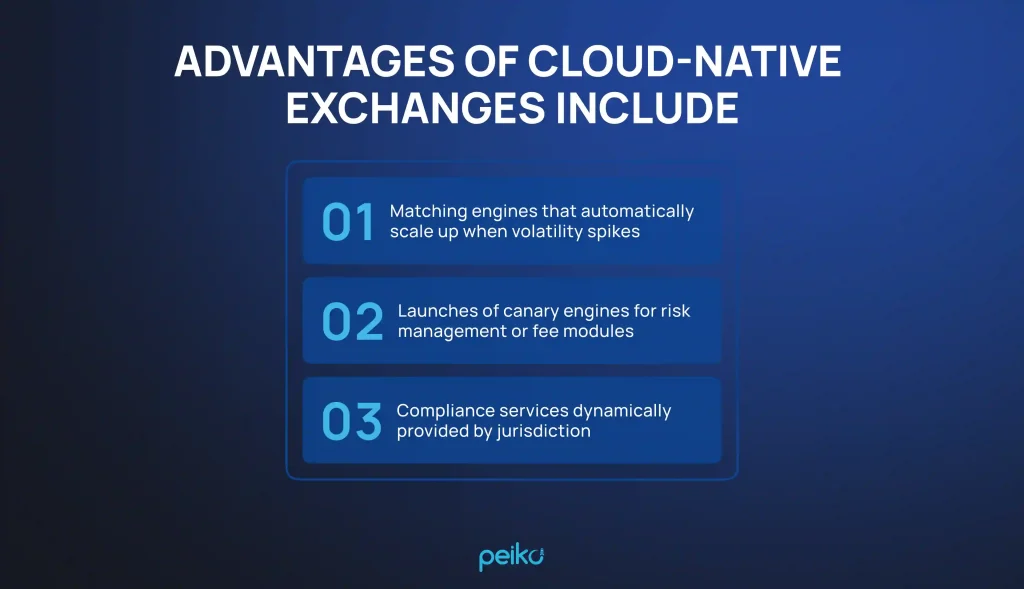

Cloud-native architectures

The concepts of cloud-native architecture and modular exchange design work hand in hand. More and more, exchanges use Kubernetes clusters that span many regions to offer key services as containerized workloads. Elasticity on demand, self-healing resilience, and visibility into the underlying infrastructure are all benefits.

To keep up with the ever-changing market, ensure compliance, reproducibility, and rollback safety, and cut operational overhead, cloud-native architectures separate infrastructure management from application logic. This allows for infrastructure-as-code (IaC) techniques.

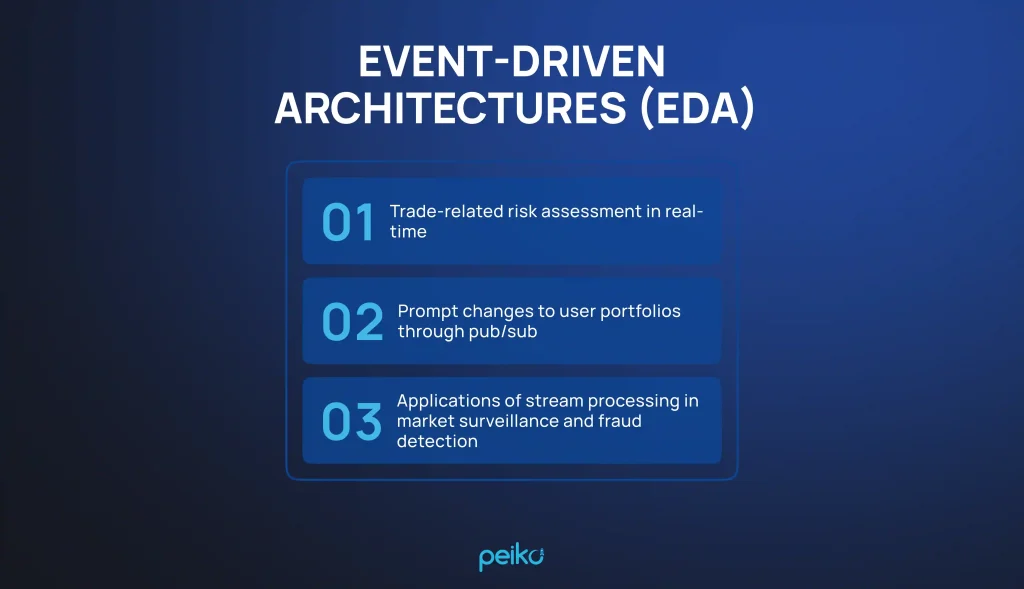

Event-driven architectures (EDA)

An increasingly important part of modular CEX design is event-driven systems, since real-time responsiveness is no longer negotiable. In order to establish event-based, asynchronous communication between modules, exchanges are utilizing message brokers such as Kafka, NATS, and Redpanda.

Upstream systems can post events without blocking downstream users thanks to EDA’s temporal service decoupling. This is a crucial scaling lever for exchanges that want to handle millions of users at once with little latency and great consistency.

Containerization and orchestration (Kubernetes)

Not for the sake of ease of deployment, but to enable scalability, containerization is a boon to the modular CEX. Kubernetes and other orchestration platforms make it possible for exchanges to manage a large number of services.

Orchestration also enables DevOps and SRE teams to automate failover/restarts, enforce security standards using service meshes, and develop advanced observability pipelines—essential for ensuring five-nines availability in a dispersed trading environment.

Serverless computing

In the monolithic blockchain architecture vs microservices blockchains argument, serverless computing is quickly becoming a viable alternative to modular design for some exchange components with large event traffic and intermittent activity.

Serverless systems, like as AWS Lambda and GCP Cloud Functions, allow exchanges to acquire practically infinite horizontal scalability for non-core activities and save the cost of idle resources. However, due to the dominance of persistent memory and low-latency I/O, serverless is not a good fit for stateful or latency-critical pathways such as order matching.

AI/ML for operations

Modularity increases operational complexity. This is why forward-thinking exchanges are incorporating AI and ML into their observability and maintenance pipelines directly.

Each service’s telemetry data, including logs, metrics, and traces, is used by these AI-infused procedures. This level of granularity is made possible by modular architecture, which results in a data-rich substrate that cannot be exposed with the same level of accuracy by conventional monoliths.

Hybrid approaches

Even while modularity is gaining popularity, very few exchanges really begin with it. Most well-established platforms are currently in a state of flux, slowly breaking down monoliths into modular domains.

Full modularity is a goal that should be approached incrementally, and our hybrid paradigm represents that pragmatic reality. While in the monolithic blockchain architecture vs microservices blockchains argument, modularity isn’t always a determinant of a CEX’s performance, having a well-defined roadmap for modularization and the technical discipline to implement it in the face of real-world traffic is.

A synthesis of microservices, event-driven design, artificial intelligence, and cloud-native technology is crafting the exchange architecture of the future. By coordinating their technical approaches with these vectors, exchanges are constructing not only scalable platforms, but also worldwide agility, competitive endurance, and institutional trust.

While there will always be a place for monolithic systems, by 2025 modularity will have been the de facto standard in architecture.

Scale with modular white-label architecture by Peiko

The architectural discourse has moved beyond theory as centralized exchanges confront increasing pressure in 2025 from regulatory scrutiny, global 24/7 availability, and an increase in cross-chain asset diversification. This is now a race for our lives. Not only does performance play a role in the trade-offs between modular and monolithic architectures, but so do product velocity, operational resilience, and strategic positioning.

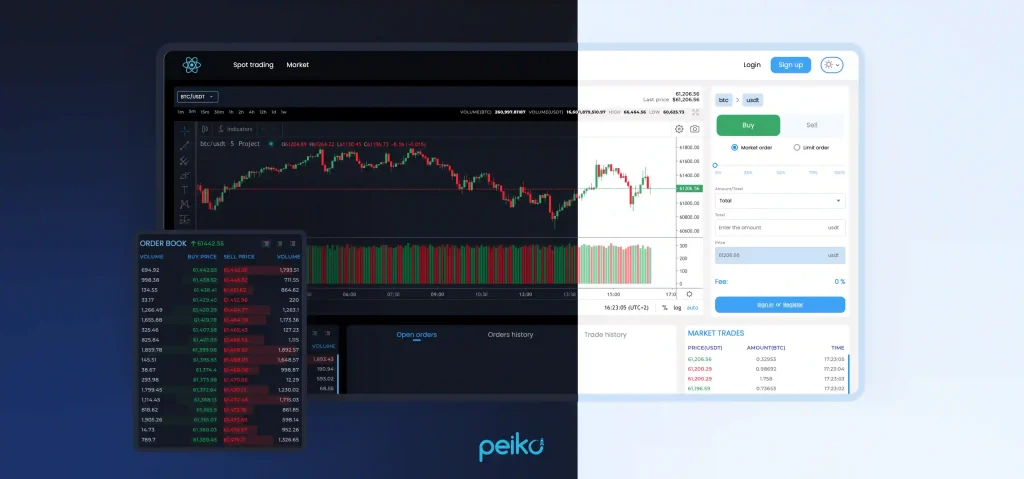

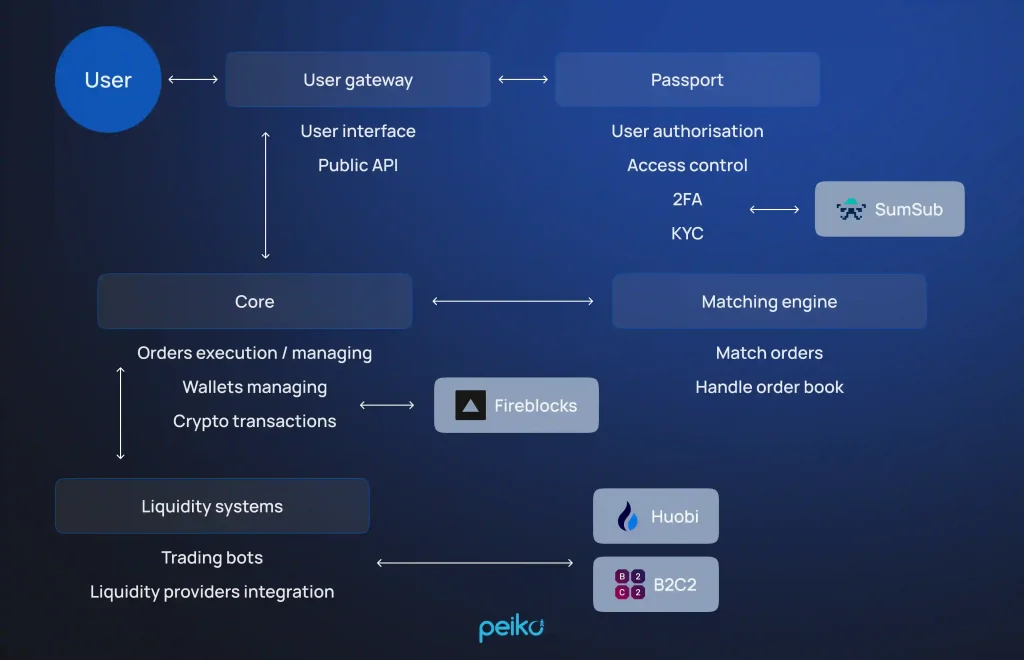

Here we can see Peiko’s white-label CEX platform, which exemplifies well-executed modular design.

A priority on microservices engineered for expansion

Peiko’s CEX platform is a production-ready microservices architecture that breaks down all of the exchange’s essential functions into their own, scalable modules. Every part of the system, from the matching engine to the KYC/AML compliance modules, is built independently, versioned, and deployed using a CI/CD pipeline. Because of this modularity, transactions can:

- Diversify service scaling to account for market fluctuations or high-traffic areas

- To keep platform redeployments to a minimum, when releasing updates or new features,

- Manage worldwide operations while enforcing restrictions tailored to each jurisdictions

This applies the flexibility that is natural to the cloud to the infrastructure of an exchange. Containerization with Kubernetes across AWS, GCP, and Azure, among others, allows for services to function in a highly available and fault-tolerant fashion. Peiko addresses latency-critical pathways, such as order execution.

Completely modifiable

Peiko gives you full access to the code and the freedom to customize it, unlike strict white-label solutions that force you to use their architecture. Teams have complete control over their roadmap, whether it’s rebranding the user interface with your logo, adding new asset pairs in minutes, or integrating fraud detection pipelines based on artificial intelligence.

Most importantly, the system is compatible with:

- Enhanced charting capabilities using TradingView integration

- Destroys custody for maximum safety in institutional settings

- Verifying your identity with SumSub

- Binance-style zero-fee internal trading logic

In the monolithic blockchains vs modular blockchains conversation, modular components are designed with domain-specific isolation and production resilience in mind.

Rollout in as little as three weeks

In as little as three weeks, Peiko can provide a fully functional, cloud-hosted CEX platform thanks to their proven deployment methodology. That encompasses the administration panel, all compliance tooling, liquidity integrations, user management system, and core trading engine. This is not only lightning fast, but it’s also perfectly timed to give exchanges the jump on the current bull cycle.

Reliable, extensible, and future-proof

Protection against distributed denial of service attacks, two-factor authentication, encryption at the database level, and custody supported by Fireblocks are all firmly ingrained layers of security. Exchanges can sandbox experimental features, isolate risk, and prevent errors in one module from propagating across the entire platform when combined with a modular architecture.

The expertise that goes into making Peiko products is what really makes them stand out. With an emphasis on high-throughput, low-latency exchange systems, the Peiko team has produced over 100 blockchain projects since 2017. Whether it’s for institutional standards or retail volatility, they’ve got the nuances of constructing covered.

Conclusion

In 2025, centralized exchanges can’t rely on monolithic designs that break down under stress, slow down new ideas, and can’t keep up with the needs of global multi-asset, always-on financial systems. Now, it’s very important to be able to scale up or down quickly, separate risk, and respond quickly to changes in the market or regulations.

Modular design is a must for business success.

There is no need for exchanges to choose between speed, flexibility, and resilience with Peiko’s white-label CEX technology. A fully modular, cloud-native exchange infrastructure that is built for speed, security, and growth can be set up by operators in just three weeks. Peiko gives you an ecosystem that is ready to go. It has powerful custody, compliance, and TradingView-powered user interfaces, as well as containerized services and real-time event processing.

Right now is the time to move with confidence, whether you’re joining the market or making changes to the tech stack you already have. Some people may still need monoliths, but for a modern market that works on a large scale, modularity is the only way to go.

The future is quick and made up of modules. Schedule your call with Peiko and get excited about launching!

FAQ

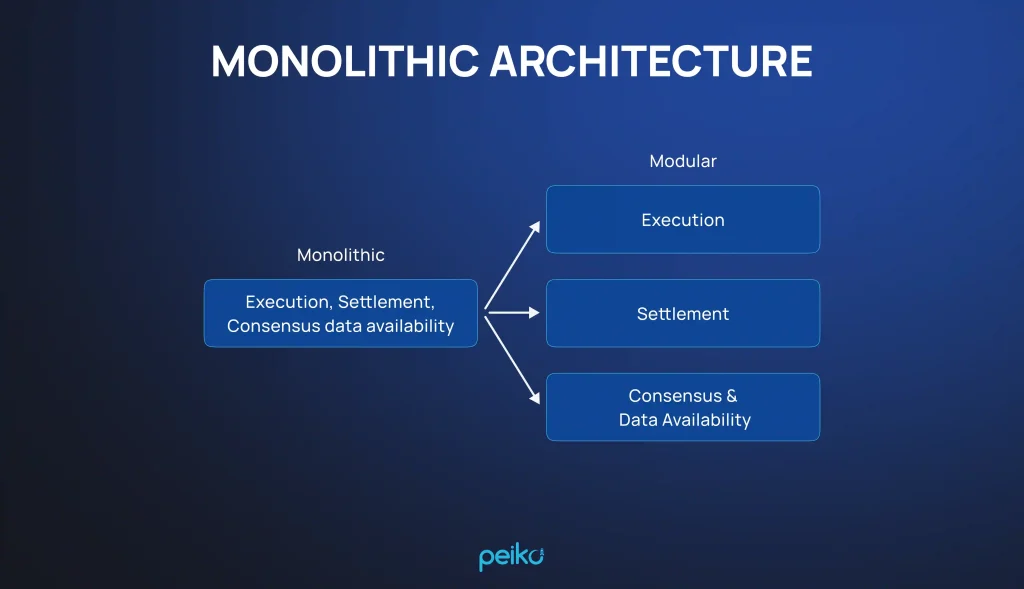

The scalability of monolithic blockchains is often hindered because they combine the three layers of execution, consensus, and data availability into one. Decoupling these layers in a modular blockchain allows for more efficient and adaptable designs to meet individual performance requirements.

Core blockchain services like as execution, consensus, settlement, and data availability are separated into specialized layers in a modular blockchain. This design facilitates interoperability across various blockchain ecosystems, makes upgrades easier, and increases scalability.

All transactions take place on a single layer of the monolithic blockchain, as is the case with Ethereum 1.0 and Solana. Despite the benefits of speed and simplicity, this approach may limit scalability and flexibility when faced with heavy loads or changing infrastructure needs.

In the name of modularity, a tightly coupled monolith can restrict scalability. They are an improvement over pure monoliths, but without proper responsibility separation, they can become difficult to maintain and modify.

Peiko offers comprehensive blockchain development services, including helping companies decide between modular and monolithic architectures. Peiko guarantees secure, scalable, and future-proof implementations because to his expertise in layer-1 and layer-2 solutions.

By separating tasks into their own levels, modular architecture improves scalability, streamlines upgrades, and facilitates quicker innovation. It’s perfect for changing needs. Peiko assists teams in establishing growth-oriented modular systems.