Fraud is a scourge on the financial system. To combat tax evasion, numerous legislative authorities have been established. So, how can we secure the blockchain and cryptocurrency exchange industries? Two protocols will be useful here: AML and KYC. Their primary responsibility is to prevent anything that breaches the law and platform guidelines.

In this post, we will look at the main difference between AML and KYC and how these two tools are used in practice.

Security measures in crypto exchanges

The cryptocurrency sphere, like any other financial one, is subject to risks. If almost all experts discuss the risks of transactions and asset loss during trading, then for some reason, security measures are mentioned in passing. Hacker activity has evolved to such an extent that protection protocols are now required for each operation of the crypto exchange engine. As a rule, the following measures are highlighted:

- Use of hardware crypto wallets and wallet guards;

- Implementation of anti-phishing tools;

- Additional protection of seed phrases;

- Protection from key logging;

- Blocking SIM-swapping actions.

Cybersecurity guarantees that everyday cryptocurrency transactions run smoothly. As new platforms and security solutions are developed, trade stays at the forefront of talks for everyone participating in blockchain activity. What is AML and KYC in this chain? Let’s find out!

KYC and AML: What do they mean?

Almost every blockchain guide includes a discussion of the KYC/AML protocol. Generally, they are in charge of anti-fraud actions relating to trade. In truth, the KYC and AML difference is tiny and largely dependent on the exchange platform. To pick which protocol to use, you must first grasp what each one is.

What is KYC (know your customer)?

The query of newcomers to suspension development and integration rings with agony in the heart: “Why should I perform verification? I don’t want to share my ID. “Why do you need this?” Their decisions are entirely logical: fraudulent behavior is ongoing.

As the chart below shows, crypto losses in Q1 2025 reached over $1.63 billion, with Bybit alone losing $1.46 billion — a stark illustration of how centralized exchanges become prime targets without sufficient user identification and transaction-level control.

With the goal of reducing this signal, KYC was established. In short, it is similar to a CRM or a database of all users who complete specific transactions. The technology is used to capture and keep information about the client, removing the anonymity from transfers.

KYC transaction monitoring employs multiple levels of authentication to prevent the adoption of fraudulent methods for currency laundering.

What is AML (anti-money laundering)?

Regulation of the cryptocurrency sector at the government level, on par with stock markets and banking activities, is an uncommon occurrence. This is something that the United States, Canada, and a number of other countries can boast about.

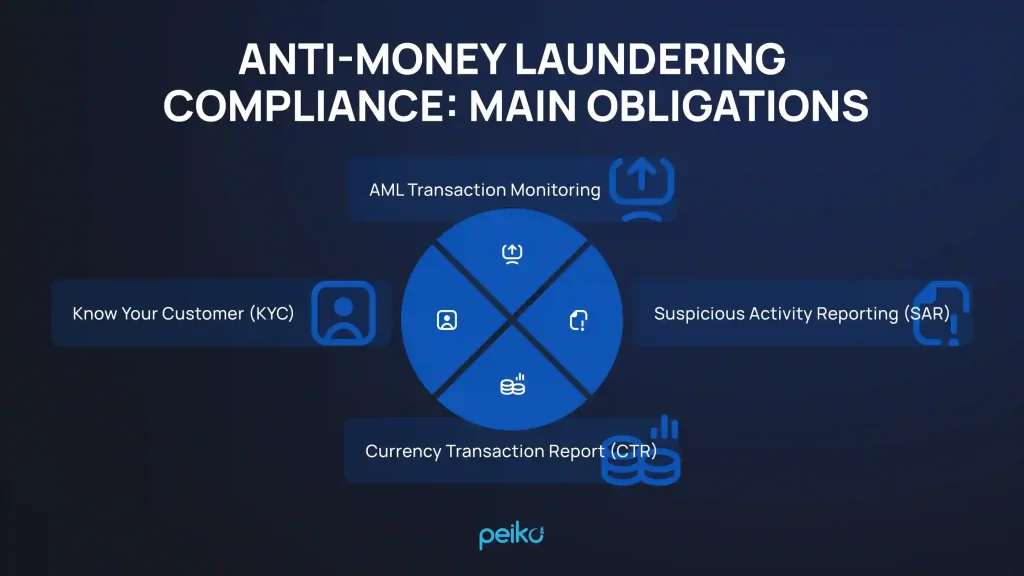

Money laundering strategies for such money are becoming more intricate, and they often turn out to be impossible to track down. In this sense, it was determined to employ previously proven procedures for preventing illegal financial transactions. AML is a collection of measures designed to detect fraud and illicit crypto exchanges.

A comparable system has been utilized in the banking industry for a long time, and the outcomes have largely justified themselves. That is why similar techniques have been used in cryptocurrency transactions. AML best practices are blocking, freezing assets associated with suspicious transactions or addresses on high-risk lists and preventing fraud actions.

Many would be surprised to learn that liquidity has an immediate effect on the risk of fraud. Why is this happening? High liquidity can make cryptocurrencies more appealing to money launderers because huge amounts can be moved and swapped rapidly.

Difference between AML and KYC

Although the terms AML and KYC are commonly employed interchangeably and serve similar purposes, certain distinctions must be recognized. The primary function of AML services is to monitor and analyze money transfers for illegal activity.

In contrast, KYC is a highly specialized process that focuses on identifying a client at the outset of a financial transaction. The KYC and AML difference is listed in the table below.

| AML/KYC features | AML | KYC |

| Target | Preventing and blocking money laundering | User verification and localization |

| Measure | Wallet scoring, transaction monitoring | Verification of financial statements, IDs, and other documents |

| Result | Identify fraudulent deposits and parties involved in transactions; detect suspicious activity and fraud | Processing and registration of documents and photo extracts in the platform system |

| Sanctions | Account blocking: internal investigation, the results of which are reported to law enforcement agencies | Setting limits on input, output, and trading operations; contacting the relevant authorities |

What is AML and KYC in banking? These are measures designed to reduce financial crime. KYC procedures encompass validating clients’ identities, examining their economic activities, and assessing the associated risks.

As a result, AML is a more detailed method requiring transaction monitoring and reporting of corrupt actions. AML KYC compliance regulations form a three-part protection system for banks, as they protect the institution from scandals and infiltrations, check clients’ activities for legality, and preserve trust in the banking institution.

AML KYC purpose and application

Identification of the individual and verification of money laundering are weakly convergent in the newcomer’s logical chain. In actuality, everything is extremely straightforward and is dictated by the factors discussed in this section.

Compliance requirements and regulations

AML and KYC laws are sources of anxiety for cryptocurrency exchanges. Compliance APIs help validate user identities, investigate their backgrounds, and keep the platform legally and regulatory compliant.

AML KYC compliance refers to a regulated entity following AML requirements, such as the EU Anti-Money Laundering Directive (AMLD). Similar government organizations exist in the United States, Canada, Switzerland, and India.

In the US, KYC and AML compliance is enforced by several organizations, including FinCEN (Financial Crimes Enforcement Network), the Federal Reserve, the OCC (Office of the Comptroller of the Currency), and the FDIC (Federal Deposit Insurance Corporation). Within the EU, there are many anti-money laundering directives, including the Fifth and Sixth Directives (5AMLD and 6AMLD).

AML requirements for payment processors are a system of laws, regulations, and processes designed to prevent criminals from misrepresenting illegally obtained funds as legitimate income. Effective AML measures are valuable for financial institutions, as they protect both compliance and the credibility of the banking industry.

In contrast, KYC compliance focuses just on methods for identifying a customer and validating that they are who they claim to be. While the regulations differ by state, financial institutions are typically obligated to collect and verify consumer information before forming a connection with them.

As AML and KYC regulations accelerate, financial institutions require smarter systems, seamless global collaboration, and innovative solutions that address threats such as crypto-based laundering and decentralized finance (DeFi).

AML KYC requirements are being upgraded, just like all other aspects of the blockchain. One of these updates was CDD (Customer Due Diligence). This is an ongoing process of evaluating the risks posed by consumers. A cryptocurrency KYC/CDD policy methodically checks client identities, collects pertinent data, and assesses risks to assure the validity of transactions.

Blockchain and Web3 development

The terms “Web3 development” and “blockchain” are regularly employed interchangeably. This is partially correct, however, not totally. In comparison, blockchain represents building materials, while Web3 resembles a house designed by an architect. KYC and AML are both used in security protocols. At the same time, the tasks are somewhat distinct. How much? The table below provides further information regarding KYC AML checks.

| Security dimension | Blockchain | Web3 development |

| General goal | Enforce compliance within smart contracts — e.g., reverts to sanctioned wallets or automatic freezes | Manage user identities, risk signals, and verification flow in backend systems before UI or chain interaction |

| Data inputs | Wallet addresses, token-transfer events, blacklist oracle feeds, bridge events | ID documents, selfies, wallet metadata, AML watchlists. |

| Core protection controlling | Smart contract oracles for real-time KYC; soulbound token issuance for identity proofs | REST/SDK integrations for KYC/AML APIs, webhook feeds, and device‑risk evaluation |

| AI/ML usage | Graph-based cluster detection for taint analysis and cross‑chain tracing. | Device‑risk scoring, face‑match ML, watch‑list classification, reusable KYC |

KYC and anti-money laundering are inextricably linked. One of the primary responsibilities is to screen beneficial owners for potential concerns, such as politically exposed persons (PEP) status or linkages to criminal activity.

AML KYC transaction monitoring is a multi-stage process that checks all information about a trader and their activities, both overtly and in the background. This category includes:

- Transfers to or from nations with weak anti-money laundering/counterterrorism regimes or a high level of corruption.

- Deposits are followed by quick withdrawals or trades, particularly when they do not match the customer’s recognized profile.

- Regular transactions are those that are considerable and/or occur often enough to contradict known or expected company activity or job status.

- Several customers provide the same home address, phone number, or IP address.

- Companies that use virtual or shared space addresses.

- Unjustified transactions between e-wallets and digital asset exchanges.

To minimize server congestion and platform failures, blockchain and Web3 developers started using AI and ML technologies for basic transaction analysis and continuous monitoring. That’s one of the best practice KYC AML usage.

Exchange gamification

Humans are natural gamers. This manifests itself in the desire to outperform market competition, as well as the more mundane desire to be named “best employee of the month.” The motivation differs, though the premise remains the same. As a result, for cryptocurrency exchange platforms, customization and exchange gamification have become effective strategies for retaining traders and promoting platform popularity.

In terms of KYC AML protocols, these solutions will be comparable to NFTs. For example, your cryptocurrency assets in the program will have poor lighting or a 3D design. Agreed, this strategy of attracting attention to your service will be more effective than traditional advertising.

Here are some of the main benefits attached to gamifying currency exchanges that highlight the relevance of this approach:

- Enhancing the learning curve;

- Creating communities;

- Better risk management;

- Brand differentiation;

- Boosting customer motivation.

In the context of attention deficit and heightened user expectations, one potential update solution is to incorporate a new style. Customization of landing pages, gamification of trade processes, and e-wallets will become popular options and possible mascots in the future.

Best practice for AML KYC

The theory is always challenging to apply without execution. Best practice KYC AML represents both standalone service entries and complete platforms with high security. What approaches do they supply? Let’s sort this out.

Private-label and white-label solutions

White labeling crypto exchanges entails rebranding an existing platform provided by a third-party supplier and tailoring it to match the business’s demands. The product already incorporates all the necessary components, such as trading engines, wallets, and payment connectivity. On the other hand, private labeling provides crypto exchanges with a fully customizable platform, allowing for complete control over all aspects of the exchange.

To comply with technical KYC/AML standards, crypto exchanges must implement automated transaction and behavioral monitoring tools to detect suspicious activity in real time. This includes identifying anomalies in transaction volume, frequency, and counterparty behavior.

In addition, proper data storage and audit mechanisms should be in place: all identification data and transaction records must be retained for a minimum of five years. Systems must be capable of generating secure audit trails and supporting reporting obligations such as STRs (suspicious transaction reports).

Top 5 safest crypto exchange platforms

The UAE has emerged as a hub for crypto and blockchain development over the past five years. A full software ecosystem is built, and conferences highlight the growth of blockchain and Web3. The EU, as well as the UAE blockchain development, implements ideas into a new way of protecting crypto platforms.

Alongside this, both the EU and the UAE continue to enhance platform protection measures. Moreover, strong regulatory frameworks and licensing standards in the United States support safe exchange services. The finest crypto-specific services (according to AML KYC estimates) are:

- Binance,

- Rain,

- OKX,

- Bybit,

- eToro,

If Binance, OKX, and Bybit are well-known, the other two contenders should be covered in greater detail. Rain is a secure and regulated marketplace that allows clients to swap fiat currencies for cryptocurrency, with deposits in AED or BHD.

Aside from typical assets like equities, commodities, and ETFs, eToro supports cryptocurrency trading. The platform’s social trading component allows users to follow the actions of successful traders.

One of the innovations of recent years has been the inclusion of AML/KYC protocols in regulators. VARA (Virtual Assets Regulatory Authority, UAE), DFSA and FSRA make transparency one of their core compliance and licensing requirements.

Trends in 2025 and beyond

Market data predict trends. The anti-money laundering software market size is expected to grow rapidly from 2021 to 2024. It will rise from $2.85 billion in 2024 to $3.22 billion in 2025 at a compound annual growth rate (CAGR) of 13.2%.

Overall, the projection period’s trends comprise regulatory tightening, AI and automation modernization, and an emphasis on transaction monitoring and observation. Best practice KYC and CDD will continue to be enhanced and will be incorporated into state rules. AML will add the option to integrate CDD into its protocol system.

Be on top of crypto exchanges with a stunning CEX platform

Are you interested in the protection and security of cryptocurrency operations? Would you like to build your own exchange space with stunning features and real-world AML/KYC protocols? Our white-label exchange platform features a robust, pre-integrated trading engine optimized for real-time processing and swift order execution.

You can put together an operating exchange (CEX, DEX, or HEX) in the span of three weeks, eliminating the requirement for technical expertise from the start.

The software can swiftly scale to handle massive numbers of processes; therefore, there will be no system overload or stuttering. Experienced traders and retail customers will be excited to participate in such an ecosystem.

Stop money laundering with the safety of Peiko’s solutions

KYC and AML work perfectly together. The first is responsible for identifying and mitigating hazards during trading. The second one is responsible for combating fraud in high-value trade operations. Their implementation and gamification are stages of development that contribute to the ongoing interest in the market segment. Contact us if you dream about an all-in-one CEX service or just a reliable white-label crypto exchange platform.

FAQ

No. KYC is part of AML. AML is the broader anti-money laundering framework. KYC focuses on verifying customer identity.

A system that monitors, detects, and reports suspicious transactions to comply with AML laws.

AML focuses on stopping money laundering. KYC specializes in verifying identity. CDD assesses customer risk during onboarding and ongoing activity.

Internal policies, compliance stack, updating requirements, and an independent audit.

Yes. KYC is a legal requirement under KYC AML regulations.