Hybrid cryptocurrency exchanges (HEXs) combine two worlds of crypto exchanges and offer a third, totally unique one. Hybrid platforms include the efficiency and liquidity of centralized exchanges like Binance with asset control of decentralized exchanges like Uniswap.

So, how to build a cryptocurrency exchange with a hybrid operation model? In this article, we will consider eight key steps to create your own reliable hybrid exchange. The list includes stages from planning and legal preparation in the early stages to platform design, security configuration, and promotion after the launch. This guide will help you bring your exchange concept to life in 2025.

Step 1: Business planning and market research

Consider to build hybrid crypto exchange platform? At the beginning, ask yourself: What are the main features you want to add to stand out? Perhaps it’s a more user-friendly interface for newbies. Maybe you can offer faster settlement times, or a hybrid custody model that allows users some control over their assets.

Get to know your users

Every trading platform must be designed with its users in mind. You can interview your potential customers, read Reddit, Discord, or Twitter feedback to identify pain points with existing platforms.

Conduct research on competitors

How to create your own hybrid crypto exchange that will stand out? It is important to research your competitors. Look into both direct competitors like other HEXs, and indirect competitors like DeFi protocols or mobile wallets with exchange functionality.

Leverage tools like SimilarWeb to track traffic trends, or look into CoinGecko and Token Terminal to understand trading volume, tokenomics, and platform adoption.

Design a sustainable business model

A hybrid cryptocurrency exchange needs more than a bright idea—it needs a solid economic engine. Most platforms make money from:

Your business plan should outline precisely how the platform will change and grow over time.

Step 2: Meeting regulatory compliance and licensing needs

To start hybrid cryptocurrency exchange development in 2025, it is important to ensure compliance with local regulations governing digital asset platforms.

You should follow the regulations that are created to protect customers, stabilize markets, and prevent financial crime.

European Union (EU)

If you want to build hybrid crypto exchange, consider the following two gigantic regulatory rules:

Markets in Crypto-Assets (MiCA)

This rule provides a legal framework for crypto asset service providers (CASPs) across the whole EU member state territory. It unifies requirements around transparency, whitepaper disclosure, reserve capital, and cross-border operations.

Digital Operational Resilience Act (DORA)

Targeting the improvement of cybersecurity and IT risk management, DORA aims at financial institutions, such as crypto exchanges. This act requires crypto trading platforms to be cyberattack-resistant and maintain service continuity in the event of system failure.

United States

Starting your own hybrid cryptocurrency exchange in the U.S. is a great endeavor. Here, regulation is more decentralized but equally rigorous

Securities and Exchange Commission (SEC)

Regulates any crypto asset that is a security. Exchanges dealing in such assets need to be registered or operate under an approved exemption.

Financial Crimes Enforcement Network (FinCEN)

Forces crypto exchanges to register as money services businesses (MSBs) and implement AML (anti-money laundering) and KYC (know your customer) protocols.

New York BitLicense

One of the most rigorous regulatory frameworks by the NY State Department of Financial Services. It covers asset custody, transaction surveillance, cybersecurity, and financial reporting for crypto businesses in New York.

Malta

This country was among the first to implement crypto legislation. If you start hybrid crypto exchange business in Malta, ensure compliance with the following license:

Virtual Financial Assets (VFA) License

This license is held by the Malta Financial Services Authority (MFSA) and oversees exchanges and custodians of alternative assets trading. It is accompanied by operational, compliance, and auditing obligations and is particularly appealing to those projects looking for stable regulatory legitimacy.

Estonia

This country, once linked with its fast-track crypto license, has in recent years implemented stronger conditions.

Virtual Currency Service Provider License

Regulated by the Estonian Financial Intelligence Unit (FIU), this license extends to exchange and wallet operators. The recent reforms necessitate the physical presence of the local company, increased due diligence, and stricter reporting rules based on EU AML rules.

United Arab Emirates (UAE) – Dubai

Dubai is quickly becoming a crypto hub of the world, with an environment that is regulated but business-friendly:

Virtual Assets Regulatory Authority (VARA)

Developed to oversee all virtual asset business in Dubai, VARA creates a clear framework for starting your own hybrid cryptocurrency exchange, brokers, custodians, and advisory firms. It centers on financial soundness, protection of the consumer, and AML/CFT, making Dubai an ideal location for international operators.

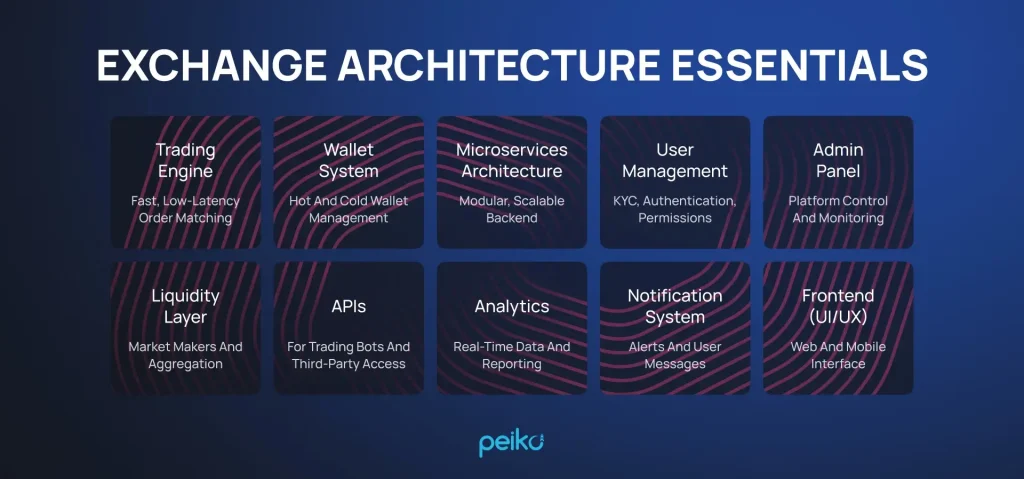

Step 3: Crafting your platform’s core structure

Behind every great hybrid crypto exchange is a well-built technological backbone. It has at its foundation a lightning-quick trading engine. This system should be capable of processing thousands of orders per second with precision and with little lag time.

For long-term agility, new exchanges adopt a microservices architecture. This approach divides the platform into individual services—i.e., trading, user log-in, and wallet services—such that each can be upgraded or scaled independently. This ensures maximum uptime, even during high traffic or maintenance.

Another critical pillar in successful hybrid crypto exchange development is a safe and smart wallet system. Hot wallets enable active transactions, while cold wallets hold most funds offline, safe from online threats.

Advanced systems also include features like automatic rebalancing across wallet levels, withdrawal rate controls, and multi-signature authorization schemes to prevent single-point failure.

On the user-facing front, user trust and retention are fueled by simple interface design. Newbies in crypto must be able to execute basic trades without getting lost. If you decide to build hybrid exchange, consider that professionals need features like live order books, customizable charts, and low-latency APIs.

Cross-device compatibility and lightning-fast data refresh rates are essential for a seamless trading experience.

Step 4: Establishing a robust security infrastructure

Security isn’t an option to build hybrid crypto exchange—it’s your exchange’s first line of defense and must be baked in from day one. A robust strategy includes DDoS protection, end-to-end encryption, and two-factor authentication (2FA) for logins and withdrawals.

Role-based access controls prevent internal abuse. Trusted custodians like Fireblocks secure digital assets with advanced MPC (multi-party computation) technology.

As opposed to conventional single-key private key management systems, Fireblocks employs MPC to divide the private key into several segments and distribute them across various storage locations. This ensures that no institution or individual ever has complete access to the key at any given moment, significantly minimizing the risk of fraud or theft.

Fireblocks also contributes to security by integrating seamlessly with other safeguards, such as 2FA and real-time activity tracking, to ensure continuous asset protection along the entire transaction flow.

Step 5: Driving liquidity and establishing market flow

In the absence of sufficient liquidity, users suffer from slippage and delayed execution, which drives them to alternative exchanges for trading.

To establish proper liquidity right from the start, HEXs can:

- Collaborate with market makers Market makers introduce persistent buy and sell quotes, with tighter spreads and more liquidable prices in centralized as well as decentralized layers.

- Integrate aggregated liquidity HEXs can connect to third-party liquidity providers like Huobi or other exchanges to pool liquidity, offering better prices and reducing order book fragmentation.

- Utilize AMMs With the incorporation of Automated Market Makers (AMMs), HEXs are able to deliver decentralized trading and centralized liquidity for smoother markets.

- Encourage staking and yield farming With the provision of staking and yield farming rewards to users, HEXs are able to provide liquidity on both exchange layers.

- Run launchpad events Launchpad events help HEXs to list new tokens, attract new liquidity, and benefit from both centralized and decentralized market streams.

Step 6: Designing the UI, UX, and platform development

The transaction could be technically flawless, but without a user-friendly UX (user experience) and UI (user interface), customers won’t stick around. If you want to build hybrid exchange, design must take the lead on usability—streamlined onboarding and KYC processes, responsive mobile support, and minimalistic trading dashboards.

Real-time visualization of information, assignable charts, and easy navigation are essential. Platforms like FTX (before its collapse) and Coinbase gained popularity in part because they featured a clean, user-friendly design.

Core design principles

- Simplified onboarding — Fast, smooth KYC with guided setup flows.

- Mobile optimization — Optimize for responsive, smooth performance on all devices.

- Clear interface — Use plain layouts and big action buttons like “Trade” or “Deposit.”

- Live market data — Display real-time price feeds, charts, and order books.

- Visible security features — Highlight 2FA, session tracking, and transparent transaction fees.

- Custom user experience — Allow users to personalize their dashboard, alerts, and themes.

- Accessibility compliance — Design inclusively according to accessibility guidelines.

- Built-in guidance — Use tooltips, help icons, and new user tutorials.

Step 7: Conducting rigorous testing and iteration

Before your hybrid cryptocurrency exchange goes live, every aspect of the system must be pushed to its limits through extensive technical and user-level testing.

From order execution to wallet transactions and KYC integration, every process must execute smoothly under stress. Simulated trading volumes and traffic spikes help measure the robustness of the platform in real-world scenarios.

Security first when launching a hybrid crypto exchange. Conduct penetration tests and vulnerability scans on your centralized infrastructure, and contract third-party audits for any smart contracts or DeFi modules.

The February 21, 2025, Bybit cyberattack, during which approximately $1.5 billion worth of Ethereum tokens were stolen, is a harsh reminder that one weakness can prove disastrous.

Before going public with a hybrid exchange crypto solution, release a closed beta with real users to discover usability issues, improve onboarding, and refine features. Monitor user behavior to find drop-off points and bottlenecks. This iterative approach allows agile updates and ensures the product is rock-solid, user-friendly, and ready for broader adoption.

Step 8: Launching and engaging users

How to create your own hybrid crypto exchange that will generate profit? After the launch of your HEX, it is essential to plan adoption and engagement strategies. Think phasing rollout to bring users aboard in stages and iron out the platform in live conditions. Get your support infrastructure in place to be able to respond quickly to feedback or problems.

To bring users in, launch growth programs like referral rewards, token airdrops, and staking incentives. These campaigns can immediately boost user interaction and liquidity, which are essential to a healthy trading ecosystem in the early stages.

Beyond promotions, focus on community engagement. Leverage platforms like Discord or X to fuel conversation, host AMAs (Ask Me Anything), and show your team’s openness. Educate your users on the benefits of a hybrid model: speedy execution, decentralized ownership of assets, and access to multiple layers of liquidity.

After going to the market with your hybrid exchange crypto project, don’t disappear—keep engaging, refining, and growing. The feedback loop with your user base is now your wellspring of innovation and retention.

Go to the market with the ready crypto exchange in 3 weeks

How to build a cryptocurrency exchange quickly and at a reasonable cost?

At Peiko, we have a great white-label solution for crypto exchanges that will allow you to launch your crypto platform 5-6 times faster than developing the project from scratch. Our ready-made, unique solution offers rich functionality and the ability to fully control the code. It is not typical for template solutions, but ours really stands out.

The white-label solution we created included everything your users expect from a trading experience – a convenient Order Book and admin panel, TradingView candle charts, and outstanding transaction speed. Your future exchange will handle 10,000 transactions per second, the same as professional crypto exchanges that cost much more to develop.

We know that users value when their orders are executed fast, and so your exchanges need high liquidity. This is why our experts connected Huobi and B2C2, liquidity providers with a strong reputation in the industry. If you need more providers, no problem – we can also help.

Furthermore, our white-label solution provides top security. It includes multi-layer DDoS protection, two-factor authentication for login and withdrawals, dynamic user growth handling through autoscaling, and Fireblocks custody for secure storage of assets.

If you want to launch your reliable and efficient crypto exchange before competitors, our white-label solution is the best choice.

Conclusion

In this guide, we have considered the main steps of hybrid crypto exchange development. The path begins from business planning and legal basis to the development of a secure and high-performance platform that will drive profit.

It is essential to implement strong liquidity channels, craft a user-friendly design, and ensure your exchange can run smoothly and scale with user demand.

Want to launch your own secure and user-friendly crypto exchange that users will like? You don’t have to spend years. Choose our white-label solution to get started in just 3 weeks at an affordable cost. Contact us today to learn how we can help you go faster, safer, and smarter.

FAQ

Hybrid exchanges provide ease of trading, reliability of trade, and liquidity depth of the centralized exchange. At the same time, HEXs comprise decentralized features such as non-custodial storage and on-chain transparency.

CEXs control all operations in-house. These operations include user fund management and trade execution. HEXs blend decentralized liberty with centralized efficiency. Users of HEXs can trade while having control over their funds through decentralized protocols.