Creating a cryptocurrency exchange can be a highly profitable business venture—you’re offering users a dependable platform to buy, sell, and store digital assets. But the keyword here is dependable. So, how do you build an exchange that functions securely, efficiently, and at scale?

The foundation of each successful exchange is an advanced and thorough architecture to facilitate speed, security, and scalability.

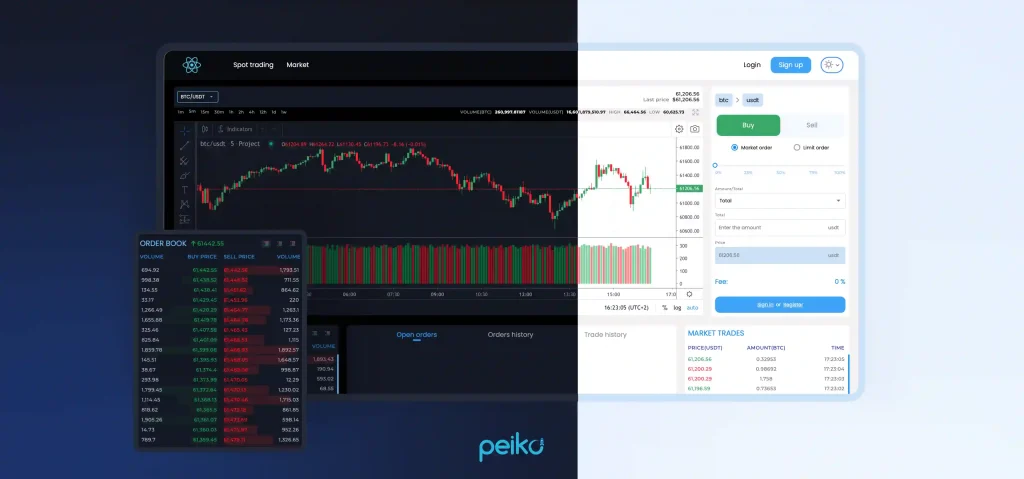

Let’s explore the most essential components of cryptocurrency exchange architecture, namely the trading engine, user interface, wallet infrastructure, security modules, APIs, and others.

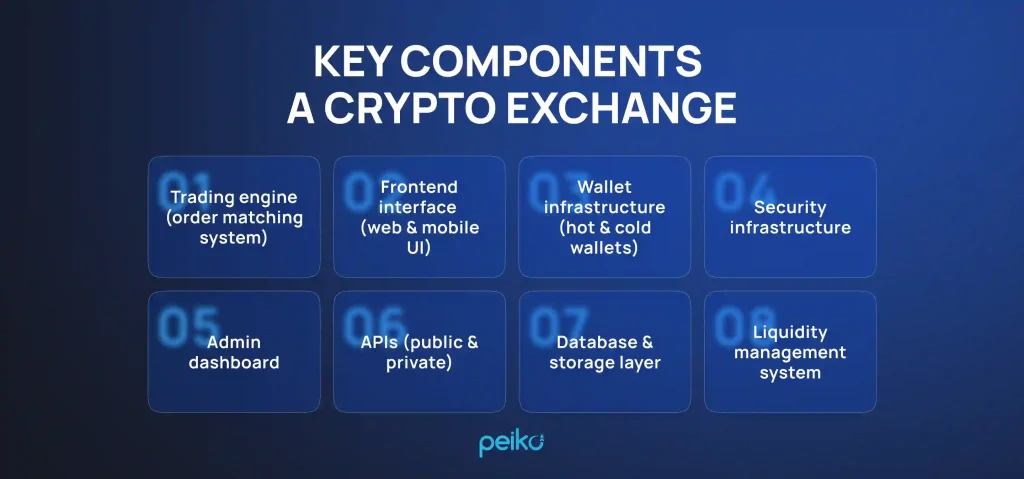

The core components of a cryptocurrency exchange

Building a crypto exchange software architecture is more than building a trading website. It is a complex, high-performance system that can deal with real-time data, high-volume transactions, and high-security needs.

The following are the key elements that make up the bones of a scalable and reliable crypto exchange, along with technical insight into how they work behind the scenes.

Trading engine (order matching system)

This engine is the exchange’s innermost logic layer. It matches the buy and sell orders on a time- and price-priority basis using order-matching algorithms—a limit order book model in the vast majority of instances.

Performance is crucial: modern trading engines are built using high-throughput, low-latency programming languages like C++, Rust, or Go.

- Core functions of a trading engine: Order matching, order cancellation, trade settlement, and fee calculation.

- Cryptocurrency architecture tip: Some platforms utilize event-driven microservices to isolate the trading engine from the other components, allowing for better scalability and fault tolerance.

Frontend interface (web & mobile UI)

This is the presentation layer, which means the users interact directly with the platform in real time. To create modern frontend interfaces, developers utilize frameworks like React, Vue.js, or Angular, often complemented with WebSockets. The integration with WebSockets allows real-time updates of order books, charts, and user balances.

- Features of frontend: Responsive UI (user interface), price charts (using facilities like TradingView), live trade feeds, user dashboards, and portfolio tracking.

- Security tip: Input validation, rate limiting, and secure session management (like via JWT or OAuth) are critical at this layer.

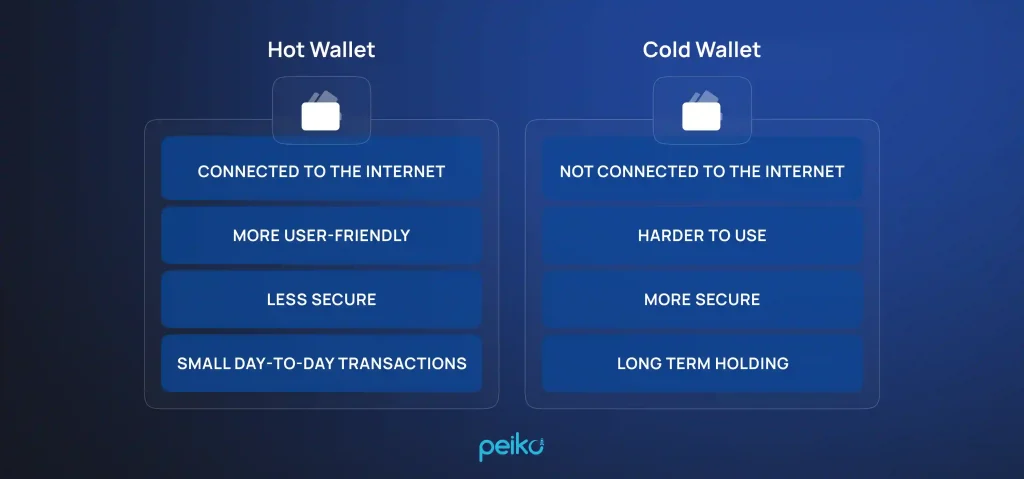

Wallet infrastructure (hot & cold wallets)

The wallet system controls all crypto asset custody. It’s typically split into:

- Hot wallets: They are online and are used for fast and simple processing of withdrawals and deposits. Although they give access to funds in real time, they are not as secure since they are online and therefore more exposed to potential security threats.

- Cold wallets: Stored offline, often with hardware wallets or air-gapped systems, cold wallets are designed for the secure, long-term storage of digital assets. Not being internet-connected, they effectively reduce the attack surface for any compromises.

Sophisticated exchanges automate wallet sweeping—migrating surplus funds from hot to cold wallets at regular intervals—and utilize multi-signature or threshold signatures (TSS) for additional security.

Security practices: Hardware security modules (HSMs), private key storage in encrypted form, whitelisting of withdrawals.

Security infrastructure

Crypto exchanges are high-value targets, so a defense-in-depth approach is essential. Key components are:

- Authentication Two-factor authentication or 2FA (TOTP, which means time-based one-time passwords, SMS-based), biometric authentication.

- Authorization Role-based access control (RBAC) for admins and internal applications.

- Monitoring & alerts Intrusion detection systems (IDS), real-time fraud detection, behavioral analysis.

- Compliance tooling AML (anti-money laundering) screening, blockchain analysis tools (Chainalysis or Elliptic) to flag suspicious activity.

Security must be incorporated into DevSecOps pipelines, with ongoing penetration testing and code reviews.

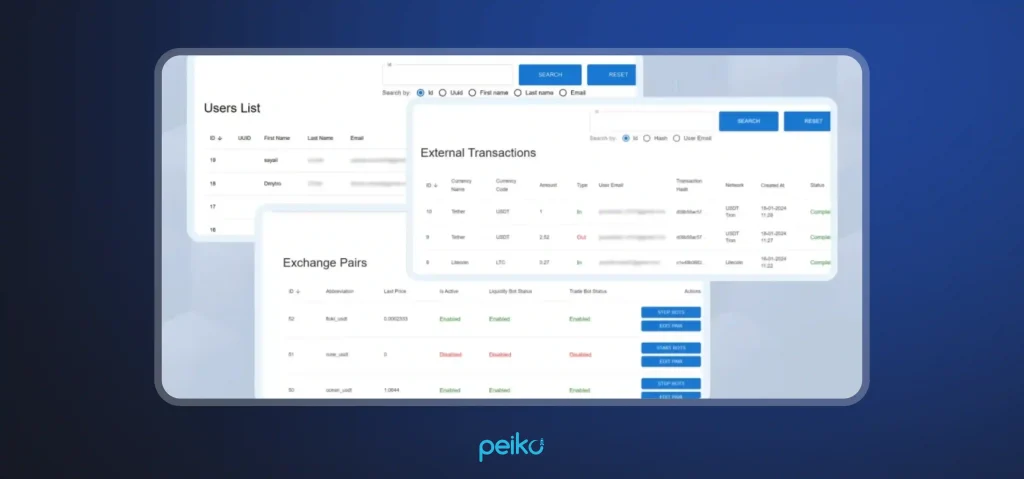

Admin dashboard

This dashboard is also an essential component of the architecture of a crypto exchange. provides system management, operational functions, and compliance enforcement functionality. It typically includes:

- User management: KYC (know your customer) status, account flags (suspicious activity), ban controls.

- Trading & liquidity management: Spread monitoring, fee adjustments.

- Manual overrides: Approval for withdrawals, resolution of support tickets.

Audit logs: All admin actions have to be date-stamped and cannot be modified.

APIs (public & private)

Application programming interfaces or APIs, are critical in driving third-party apps, algorithmic traders, and market makers. Best practices include:

- REST APIs—for simple operations like user account data and market data.

- WebSocket APIs—for live data streaming (order books, trades, tickers).

- FIX protocol—used by institutional traders for high-frequency trading integrations.

Because APIs are direct entry points into the platform, security here is top of mind. So developers may add rate limiting, IP whitelisting, and HMAC-based request signing.

Database & storage layer

Exchanges process millions of transactions and require databases that provide ACID-compliant transactions (guaranteeing reliability with Atomicity, Consistency, Isolation, and Durability) and horizontal scaling. This scaling means the ability to handle increased load by adding more servers.

- Databases used: PostgreSQL, MySQL for core data; Redis for in-memory caching, RabbitMQ or Kafka for event streaming.

- Data types: trade history, order book snapshots, user balances, KYC documents.

- Best practices: encrypted backups, database replication, and partitioning by asset or user ID for performance.

Liquidity management system

High liquidity is what makes the exchange usable. There are a number of ways to achieve it:

- Internal market makers: Using bots that place buy/sell orders to simulate activity.

- External liquidity aggregation: Connecting with other exchanges (for example, Binance, Kraken) via APIs to mirror order books.

- Cross-exchange arbitrage: Trading computers buying low on one exchange and selling high on another to profit and normalize prices.

Certain decentralized exchanges (for example, Uniswap) use automated market maker (AMM) models to facilitate transactions. Instead, in the heart of centralized exchange architecture is an order book system backed by a fast matching engine.

Key crypto exchange architectural considerations

Creating a stable, secure, and scalable crypto exchange requires careful architectural planning. Below are the most important aspects of crypto exchange software architecture development that must be addressed:

Security by design

In crypto exchanges, security must be built into the core of the architecture. Establishing great security means including multi-factor authentication, encryption of data at rest and in motion, role-based access controls, and secure key management. Both the security of user funds and personal data are paramount.

High availability and fault tolerance

Cryptocurrency architecture exchanges must be created to operate 24/7 with minimal downtime. This requires redundant infrastructure, automatic failover, and distributed systems with quick recovery from node or service failures.

Scalability

With fluctuating trading volumes, the architecture of a crypto exchange must support horizontal scaling—adding new servers or nodes to handle increased loads—without sacrificing performance. Microservices, load balancers, and container orchestration (e.g., Kubernetes) are standard tools.

Real-time processing

Market data, order matching, and balance updates must happen in real time. Technologies like WebSockets, message queues, and in-memory data stores are required to minimize latency and ensure responsiveness.

Compliance and auditability

Exchanges must enable regulatory compliance, e.g., KYC/AML processes, transaction logging, and audit trails. The system must be designed to offer comprehensive logs and reports while ensuring data integrity.

Modular and extensible design

The system should have the ability to integrate third-party services (for example, liquidity providers, custodians, or analytics tools) easily and support future upgrades or new features without requiring substantial reengineering.

Robust database design

Databases should be ACID-compliant to ensure reliable transactional support and high-throughput operations. Performance and durability can be further improved through sharding, replication, and partitioning schemes.

Emerging trends and future of crypto exchange architecture

The architecture of crypto exchanges will change dramatically in 2025 and beyond, driven by rapidly evolving technologies, new regulatory requirements, and rising user expectations. Below are the key trends that are already shaping the future of crypto exchanges.

Modular blockchain Infrastructure

Modular blockchain designs are gaining traction, with flexible solutions that are tunable, rendering them more economical, confidential, and secure.

Projects like AltLayer are providing modular infrastructures that can be conveniently reconfigured, while innovations like zero-knowledge proofs are strengthening transaction security and data confidentiality.

The modular framework allows for exchanges to reconfigure the blockchain components based on specific needs, improving performance and adaptability.

Quantum-resistant security protocols

With quantum computing, traditional cryptographic methods are at risk of being rendered outdated. To prevent this, exchanges are adopting quantum-resistant algorithms to secure transactions and information, ensuring long-term security in a constantly shifting technology landscape.

AI-driven market insights and trading automation

Artificial Intelligence (AI) is revolutionizing crypto exchanges with advanced analytics, predictive market intelligence, and automated trading strategies. AI-driven bots assist traders in making efficient trades, and sentiment analysis tools analyze market sentiment from the news and social media to improve decision-making processes.

Tokenization of real-world assets

Exchanges are expanding beyond cryptocurrencies to tokenized real-world assets such as stocks, property, and commodities. This integration bridges the gap between traditional finance and digital assets, allowing users to trade a broader range of investment products on one platform.

Hybrid exchange models

HEXs (hybrid exchanges) combine the liquidity and user experience of centralized platforms with the security and control of decentralized systems. Users can have control over private keys while taking advantage of the speed and efficiency of centralized order books, offering a balance to trading.

Regulatory compliance automation

With greater regulatory control, exchanges are implementing automated KYC and anti-money laundering processes. AI-driven technologies enable compliance processes to become seamless, enabling them to be legally compliant without any compromise on the user experience.

Decentralized physical infrastructure networks

DePIN projects are enabling decentralized network services and shared computing resources, expanding the use of blockchain technology to the energy and communications industries. These networks construct the resilience and effectiveness of crypto exchange infrastructures by distributing resources on a decentralized platform.

All these future trends contribute to developing a world where crypto exchanges are more secure, convenient to use, and better integrated with mainstream financial systems. This will impact broader adoption and innovation in the digital assets space.

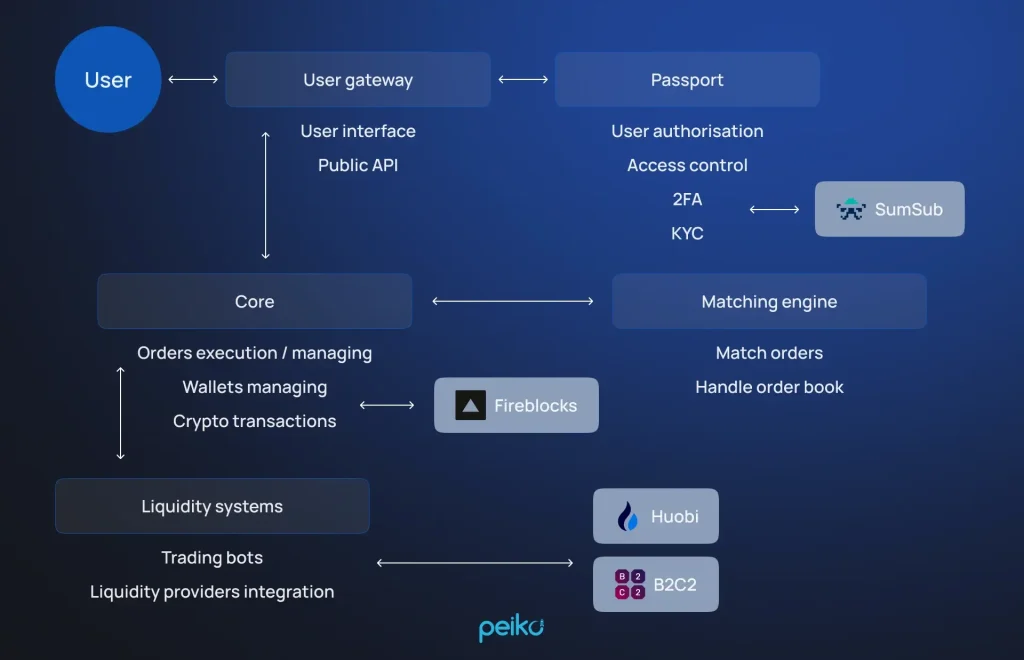

Start your crypto exchange quickly and securely with Peiko

Is it possible to start your own cryptocurrency exchange without starting from scratch yourself? Absolutely! Our white-label exchange solution with robust centralized exchange architecture enables you to deploy a working, highly secure trading platform in only 3 weeks. If you want custom features, we can develop those additionally to tailor the platform to your needs.

What’s included in our solution:

- Battle-hardened core architecture on proven real-world design patterns

- Smoothly integrated with Fireblocks for custody of assets securely

- High-performance matching engine

- Pre-configured liquidity integrations with partners like Huobi and B2C2

- Customizable frontend & branding

- Convenient admin tools

- Azure, AWS, and Google Cloud compatibility

- Sign-in/sign-up with 2FA and KYC

And this is far from a complete list of the pros of our crypto exchange software architecture. But the main thing is that usually white-label solutions are not fully customizable, but you can customize ours to your needs.

Our white-label crypto exchange platform is a much more cost-effective option to launch your project, than spending years on creating a platform from scratch at a time when your competitors will attract your potential users and develop further.

Conclusion

Building the right architecture crypto exchange solution is more than just developing a convenient interface. This includes real-time order execution, a high-speed matching engine, and stable wallet infrastructure for safe asset storage and transfer. No less important are a user-friendly admin panel, integrated liquidity providers, and solid security and monitoring mechanisms throughout the stack.

Creating these components from scratch can be overwhelming and time-consuming, though it needn’t be. All of these core elements of a crypto exchange are included in our white-label offering, integrated and ready to deploy.

With our platform, you can take your own crypto exchange to market in a few weeks. Contact us today and discover how we can help you get to market fast, with confidence.

FAQ

The architecture of a cryptoсurrency exchange consists of core elements, including the trading engine, user interface, wallet system, order management system, and security modules.

The three types are: centralized exchange architecture (CEX), where a company facilitates transactions and funds; decentralized (DEX), where peer-to-peer trading happens by smart contracts; and hybrid, which combines the CEX and DEX features.

Crypto exchanges match sell and buy orders by means of a trading engine. CEXs manage users’ assets and settle in-house. DEXs use blockchain-based smart contracts. Users deposit with crypto, submit orders, and withdraw assets upon the trade.

A reliable infrastructure with scalable cloud services, secure server setups, and backup databases. Essential software components include a trading engine, wallet connectivity, real-time order matching, API layers, and blockchain node access.