Opening a crypto exchange isn’t just about providing a trading platform; it’s about designing a profitability model that balances user satisfaction. At its core is one of the most important levers: fees.

In 2025 to date, fee flows have shifted: on Ethereum L1, average gas fell from 6.9 gwei in Q1 to 3.5 gwei in Q2 as post-Dencun L2s cut transaction costs by up to ~99%, while Bitcoin fees spiked around the April halving/Runes burst before easing (according to CoinGecko). For crypto-exchange creators, mastering these evolving network and venue fee levers is essential to pricing, liquidity planning, and product margins.

Fee models directly influence user acquisition, trading volume, platform liquidity, and ultimately, your crypto exchanges’ success. In this article, we will consider the most popular fee models (spread-based, flat fee, maker-taker, and others), compare fee models by exchange type, discover future changes in fees, and more.

What is an exchange fee model?

It is the structured system by which a cryptocurrency exchange generates revenue from user activity. It outlines how and when users are charged for actions, such as making trades, depositing or withdrawing funds, or using advanced features like margin or staking.

The fee model is a core element of the exchange’s business model. A well-designed model can attract liquidity providers, foster active trading, and engender platform loyalty, while a poorly designed one can lead to user frustration, low volume, or regulatory problems.

Let’s consider the primary roles of a fee model:

- Revenue generation: Fees are often the primary source of revenue for centralized exchanges.

- Market positioning: Low-fee or free-fee models will attract specific groups of users, for example, high-frequency traders.

- Behavior shaping: Tiered fees or token-based discounts can nudge users toward desired behavior, for example, trading more.

Every cryptocurrency exchange can choose various models depending on:

- Their target market (retail vs institutional)

- Product offerings (spot, derivatives, staking)

- Competitive landscape

- Regulatory considerations

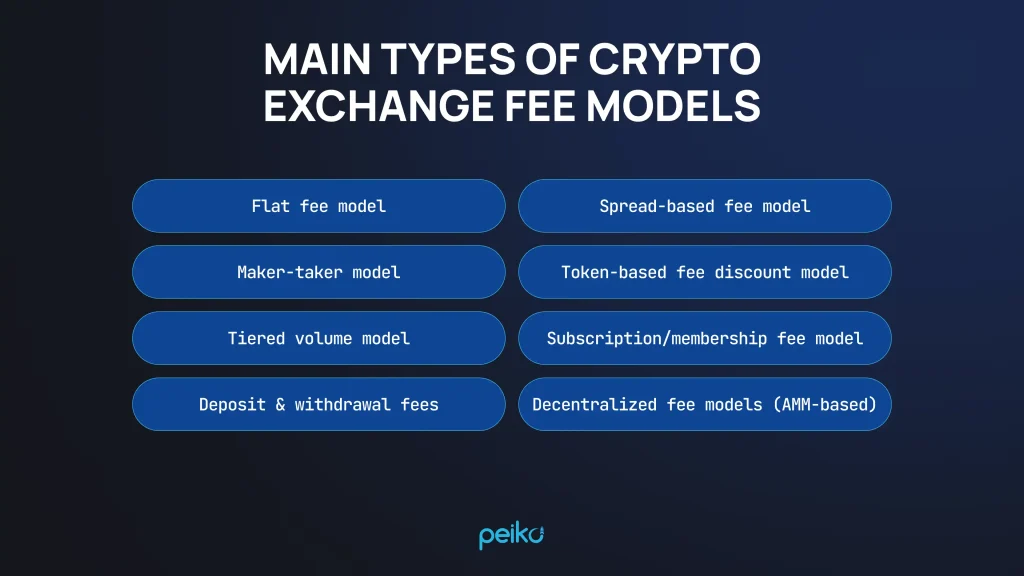

Cryptocurrency exchange fee model types

Cryptocurrency exchanges use a range of fee models to extract revenue, manage liquidity, and shape the behavior of users across a range of trading environments.

Flat fee model

Best for: Small exchanges, new market entrants, retail-focused platforms.

A flat rate structure in which a percent or flat rate is charged per transaction, regardless of volume or party. This model is simple to deliver and easy to explain to users, but may fail to maximize revenue potential, especially from high-frequency or high-volume traders.

Maker-taker model

Best for: Exchanges with order books, high-volume traders, institutional users.

Most appealing to mature exchanges, the maker-taker model charges fees that are differentiated based on whether or not the user is a maker or taker in the order book.

Makers, who add liquidity by posting limit orders, are compensated with rebates or reduced fees that encourage a deep order book and narrow spreads. Takers pay more because they are consuming liquidity. Operating this model requires tight monitoring of the order book and user role classification.

Tiered volume model

Best for: Scaling user base and increasing loyalty.

This model charges varied fee levels based on users’ volume of trades or other criteria like account age or staking status. More-active customers are provided with discounts to encourage volume and stickiness. Tiered implementation involves constant user activity monitoring and dynamic fee adjustment, which might be complicated but improves retention.

Deposit and withdrawal fees

Best for: Managing network costs, fiat services, custodial operations.

Crypto exchanges typically charge fees on fiat and cryptocurrency withdrawals and deposits to cover transaction and network charges. Creators need to create variable fee schedules by currency type, withdrawal paths, and blockchain network fees and build systems that can dynamically adjust with regard to network congestion.

Spread-based fee model

Most appropriate model for: Simple UI apps, beginners, fiat ramps.

Unlike explicit fees, others integrate fees into the bid-ask spread. While this could simplify fee representation to users, it could conceal revenue transparency. This places burdens on spread management algorithms for a prudent balance of profitability and market competitiveness for creators.

Token-based fee discount model

Best for: Exchanges with a token ecosystem.

Users are presented with the choice of paying fees in native platform tokens, like BNB or KCS. This also boosts demand for said token and pushes it further into the exchange’s ecosystem. The discount could be flat or tiered based on a user’s balance or staking levels.

Subscription/membership fee model

Best for: Advanced or frequent traders; premium platforms.

There are some exchanges that offer paid subscription tiers or VIP accounts that remove or lower transaction fees, unlock premium functionality, or offer higher API rate limits. This model creates steady revenue streams and is appealing to active or high-frequency traders.

Decentralized fee models (AMM-based)

Most appropriate for: AMM DEX protocols, trustless DeFi platforms

DEXs (decentralized exchanges) don’t involve intermediaries. Fees are not dictated by a central authority but are built into the smart contract framework. Most AMM-based DEXs charge a percentage per trade, distributed to liquidity suppliers. In addition, users must pay network gas charges, which vary with congestion on the chain and transaction complexity.

Some examples are: flat swap fees, liquidity provider incentives, gas fees, and protocol revenue sharing.

Digital asset exchange fee model overview

Token and cryptocurrency trading is facilitated by digital asset exchanges, which make their revenues from transaction fees. Traders, investors, and developers need to understand fees because they establish profitability, liquidity, and overall market activity.

In general, digital asset exchanges are either DEXs or CEXs, and each of the two categories has a distinct fee model, which they apply in order to incentivize a certain class of behaviors while maintaining the platform viable.

Fees will vary depending on volume of trade, user type, and order type (taker or maker), and can include additional fees such as withdrawal fees, deposit fees, or gas fees in blockchain networks. Choosing an exchange with a leading fee model can significantly influence trading costs and strategy.

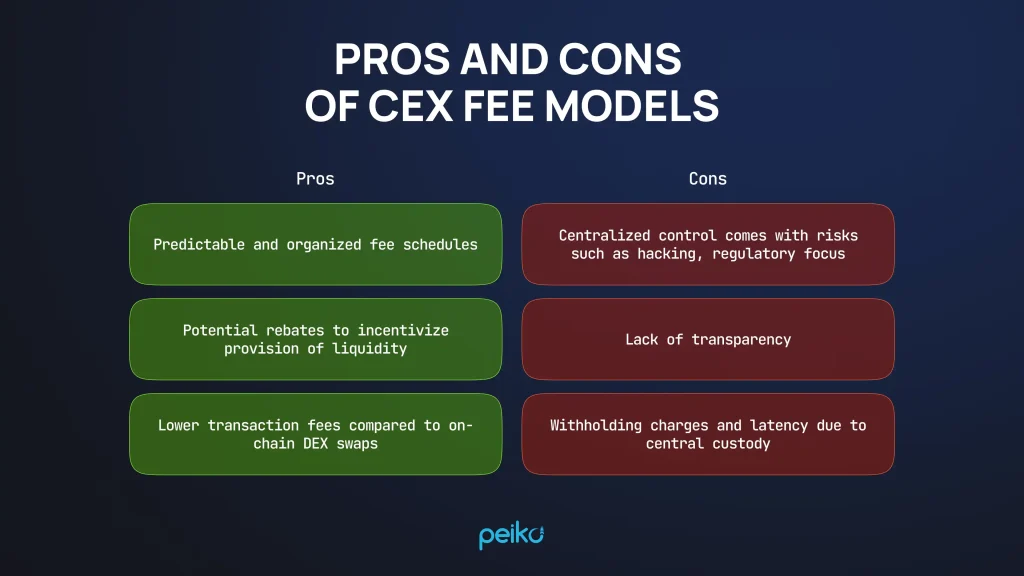

Centralized exchange fee model

CEXs are intermediaries who aggregate assets and exchange them via a central matching engine and order book. Since they hold custody of the funds, CEXs generally offer better liquidity, faster execution, and more pairs for trade. Below are the main fee structures of CEXs:

- Maker and taker fees: The most common fee model on CEXs distinguishes between makers (who bring liquidity by posting limit orders) and takers (who withdraw liquidity by posting market orders). Makers tend to be charged lower fees or even rebates, incentivizing users to provide liquidity, which is beneficial to the exchange’s market depth.

- Tiered fee structure: Some CEXs incorporate volume-based tiers wherein the trading fee decreases as the trader’s 30-day volume increases, providing high-volume or high-frequency traders with lower fees.

- Withdrawal and deposit fees: Deposits are often free or extremely low-cost, whereas withdrawals incur fixed fees or network fees being passed on to customers.

- Subscription models: Some exchanges offer VIP plans or subscription plans that decrease fees or enable better features.

- Additional fees: Certain services, like margin trading or futures contracts, can have separate fee schedules in the form of interest rates or funding fees.

Exchange fee examples

Binance

- Spot trading fees: 0.10% for both makers and takers at the base level (VIP 0).

- 25% discount available when paying fees with BNB, reducing spot fees to 0.075%.

- Futures trading fees: 0.02% for makers and 0.05% for takers on USDⓈ‑M and COIN‑M contracts; an additional 10% discount when paying futures fees with BNB.

- Deposit fees: Free for most cryptocurrencies; bank card deposits may incur fees.

- Withdrawal fees: Varies by cryptocurrency; for instance, Bitcoin withdrawals may have a fixed fee.

KuCoin

- Spot trading fees: 0.10% for both makers and takers.

- Fee discounts: 20% discount available when paying fees with KuCoin Shares (KCS).

- VIP levels: Top VIP users may get maker fees as low as 0.0% and taker fees around 0.05%

- Withdrawal fees: KuCoin charges around 0.0005 BTC for Bitcoin withdrawals, while stablecoin withdrawal fees vary by network and are usually between 5 and 20 USDT.

Kraken

- Spot trading fees: 0.16% for makers and 0.26% for takers.

- Deposit fees: Varies; for example, credit card deposits incur a 3.75% + €0.25 fee.

- Withdrawal fees: Varies by cryptocurrency; for instance, stablecoin withdrawals may have specific fees.

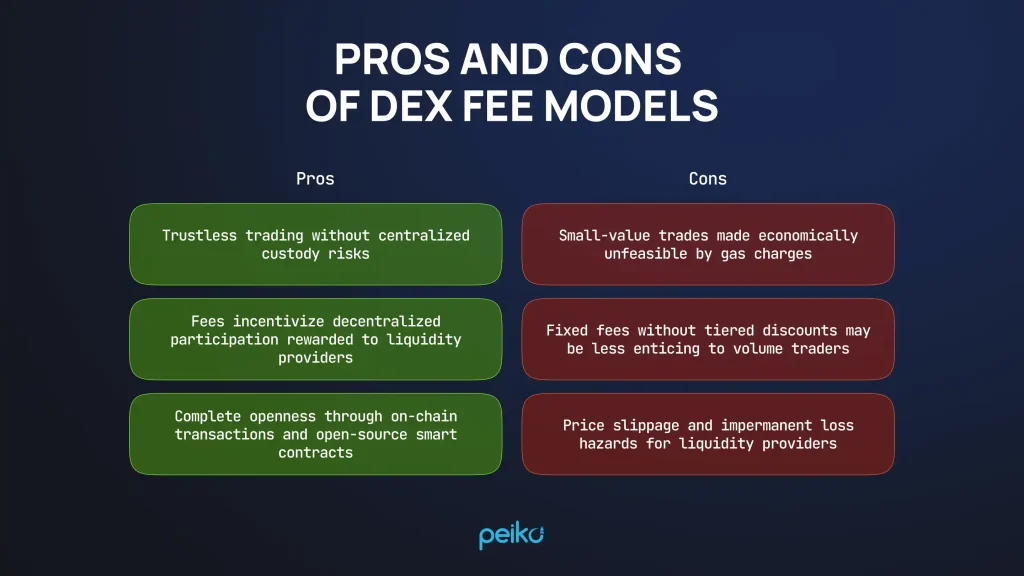

Decentralized exchange fee model

DEXs operate without middlemen, on smart contracts across blockchains like Ethereum, Binance Smart Chain, or others. Traders trade directly from their own wallets, with no one else holding their custody. Here are popular DEX fee models:

- Liquidity provider (LP) fees: In place of maker/taker fees, most DEXs charge a fixed percentage fee per trade (usually 0.3% on highly used AMM exchanges like Uniswap or SushiSwap). The fee is prorated across liquidity providers, incentivizing users to contribute assets to the liquidity pools.

- Gas charges: Since all trades interact with on-chain smart contracts, blockchain network gas charges are also incurred by users, and these can be very high during high demand and dynamically fluctuate.

- Variable or dynamic charges: Some newer DEXs employ variable fee structures based on volatility or trading volume to maximize liquidity and reduce LP impermanent loss.

- Protocol revenue sharing: Some DEXs share a portion of fees with token holders or governance pools as decentralized protocol rewards.

Exchange fee examples

Uniswap (Ethereum-based)

- Transaction fees: 0.30% per trade, distributed among liquidity providers.

- Gas fees: Users pay Ethereum network gas fees, which can vary based on network congestion.

- Fee structure: Flat fee model; no maker/taker distinction.

SushiSwap

- Transaction fees: 0.30% per trade; 0.25% goes to liquidity providers, and 0.05% is distributed to SUSHI token stakers.

- Gas fees: Users pay Ethereum network gas fees.

- Fee structure: Flat fee model; no maker/taker distinction.

PancakeSwap (Binance Smart Chain-based)

- Transaction fees: 0.25% per trade; 0.17% goes to liquidity providers, 0.03% supports platform operations, and 0.05% is used for token buybacks and burns.

- Gas fees: Users pay Binance Smart Chain network gas fees, which are typically lower than Ethereum’s.

- Fee structure: Flat fee model; no maker/taker distinction.

Comparing exchange fee models: CEX vs DEX

Of special significance when making the choice of using a centralized crypto exchange or a decentralized exchange is their fee structure. Pay attention that fees directly influence trading costs, user experience, and the incentives that drive market liquidity.

Fee structure & transparency

CEXs typically use a maker-taker system, with transaction fees of ~0.1%–0.3%. Makers pay less or receive rebates, and takers pay slightly more. Fees can be tiered by account or trading volume level. There may be additional fees, like deposit/withdrawal fees. All but a few of the fees are transparent, however.

DEXs charge a uniform percentage on each trade (usually 0.2%–0.3%), which is all paid to liquidity providers. Maker/taker split does not exist. Fees are transparent and on-chain, but users must also pay gas fees, whose amount fluctuates immensely with network usage.

Other fees

CEXs: May include withdrawal fees (variable or fixed) and deposit fees depending on payment channels. Trades are off-chain and therefore do not charge any gas fees.

DEXs: All transactions are on-chain, so gas charges are incurred on all trades, which can increase the cost, particularly on chains such as Ethereum. Layer-2s and other chains can mitigate this.

Incentives

CEXs employ discount fees, tiered volumes, and rebates to incentivize high-frequency trading and enhance order book liquidity.

DEXs pass trading fees directly to liquidity providers, building an incentive model that is decentralized and provides motivation for users to provide capital.

User experience & control

CEXs offer fast and cheap trades through centralized engines but come with relinquishing custody of funds, risking (for example, freezes, hacks).

DEXs offer self-custody and permissionless access, improving user security and control, but at the cost of greater gas fees and possible slippage.

| Aspect | CEX | DEX |

| Fee model | Maker-taker, tiered volume discounts | Fixed swap fee distributed to liquidity pools |

| Additional costs | Withdrawal/deposit fees, no gas fees | Gas fees for every transaction |

| Incentives | Fee rebates to makers, discounts for volume | Direct rewards to liquidity providers |

| User control | Custodial, faster execution | Non-custodial, slower due to blockchain speed |

| Transparency | Controlled by platform, generally transparent | Fully on-chain, publicly auditable |

Trends in crypto exchange fee models

Let’s explore how crypto exchange fee models are likely to develop in the near future.

Dynamic fee structures

DEXs will focus on dynamic fee mechanisms that respond in real time to market volatility and trading characteristics. Block- and trade-adaptive solutions minimize transient losses, maximize LP profitability, and preserve user participation. Compared to fixed fee mechanisms, adaptive approaches respond more effectively to changing market conditions.

MiCA’s (Markets in Crypto-Assets) impact on fees

EU 2025 exchanges are being pushed toward clear, upfront fee disclosures and tighter conflict-of-interest controls. That means simpler schedules, fewer opaque rebates, and stricter treatment of inducements. New RTS/ITS on complaints handling and conflicts of interest formalize processes and documentation. Articles 70–71 require that all fees and risks be communicated fairly and transparently.

Plugin‑based customizable fee logic

Uniswap v4 introduces “hooks,” through which developers can integrate custom logic, dynamic fees, on-chain limit orders, and advanced liquidity management into pools. Coupled with flash accounting and singleton architecture, these enhancements reduce gas costs and bring more sophisticated, responsive fee strategies.

Hybrid exchanges appearance

Hybrid platforms that leverage the best of the decentralized and centralised model are becoming increasingly popular. Such exchanges offer centralized-like speed and liquidity with decentralised freedom.

Fee waivers to promote stablecoin adoption

Coinbase is itself discounting its fees on PayPal’s PYUSD stablecoin to promote its broader adoption. It allows users to trade and redeem PYUSD for free, enhancing the value proposition of stablecoin-based payments.

Commission-free business models

Centralized exchanges are moving into traditional financial instruments and experimenting with commission-free business models. Kraken recently launched commission-free trading on over 11,000 U.S. stocks and ETFs, a trend towards new fee models in crypto-platform integration with traditional finance.

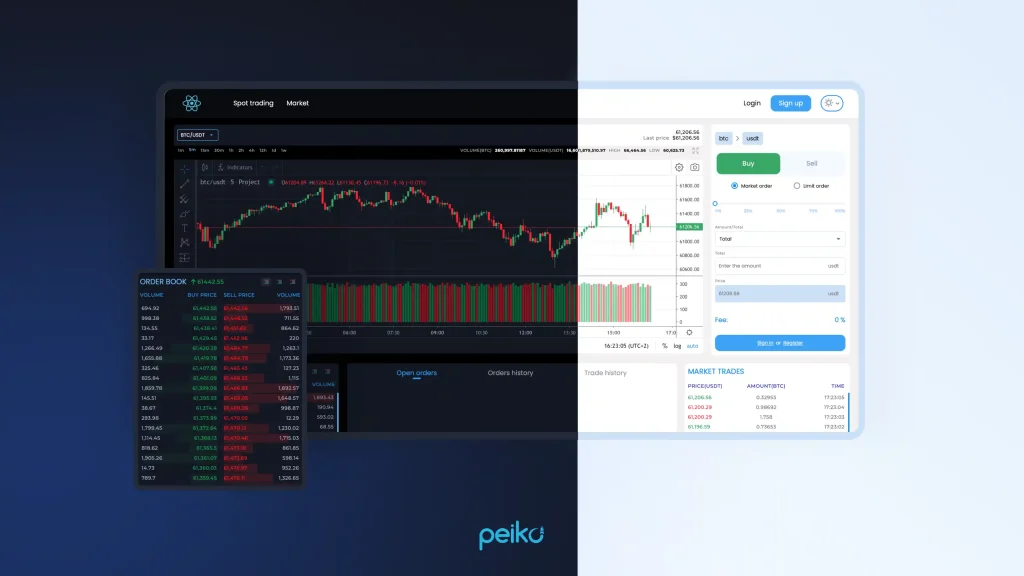

Turn to Peiko to get a robust CEX crypto exchange

For projects that plan to run their own trading platform, control over fee models is most important. It has direct implications for revenue, liquidity, and user incentives. Many teams choose white-label crypto exchange platforms, which allow maximum flexibility at the expense of building one from the ground up.

Compared to third-party platform use, white-label infrastructure allows operators to:

- Set proprietary maker/taker fees and volume-discounted rates

- Implement token-based fee discounts or staking rewards

- Charge dynamic deposit and withdrawal fees

- Host zero-fee promotions or loyalty rewards

- Trial subscription or spread-based pricing

An example is Peiko’s white-label crypto exchange solution. Installed in about 3 weeks, our package includes an order-matching engine, KYC/AML, custody integration, TradingView UI, and a convenient admin panel where you can set or change fee logic in real time without a dev team.

Whether you’re building a new source of revenue or generating community-based liquidity, white-label exchanges let you craft your fee model to fit your strategy.

Ready to define your own fee structure and start taking trading commissions? Peiko’s infrastructure team handles the heavy lifting so you can focus on the business.

Conclusion

The right cryptocurrency exchange fee model drives liquidity, attracts various kinds of traders, and, also, improves user experience. Be it a maker-taker model, tiered discounts, flat-rate swaps, or token-based rewards, selecting the appropriate fee model is paramount to optimizing profitability and platform growth.

If you’re planning to launch your own crypto exchange, having the ability to fully customize your fee model is something that can make you stand out. Our white-label exchange solution lets you do just that with complete control and without the need to begin from scratch.

Want a crypto exchange with customizable fees? Contact us to learn more about Peiko’s white-label solution and go live faster than competitors.

The fee structure defines how a crypto exchange charges users for actions like submitting trades or withdrawing funds. It details types of fees, amounts of fees, and under what circumstances they’re applied.

It typically takes a percentage of each trade. Crypto exchanges use different fee models: maker-taker, membership, tiered free models, and others. DEX fees are often built into smart contracts and paid to liquidity providers.

Actually, excessive fees or poor fee structures can erode profits. Users will use another exchange if they find your fees inadequate.

Centralized exchanges usually use maker-taker or tiered fee structures with additional fee logic control. In contrast, DEXs usually use fixed swap fees and gas payments but offer complete transparency and self-custody.