In Q2 2025, combined spot volume across the top 10 CEXs slipped to $3.9T (–27.7% QoQ from $5.4T in Q1). Binance kept the lead with roughly 37–39% share. Its monthly spot volume dipped below $500B in April and again in June. With DEX spot volumes rising to $876.3B, the DEX:CEX ratio hit a record ~0.23. (CoinGecko, Q2 2025).

The numbers make clear that despite the rise of DeFi (decentralized finance), centralized venues still set the tempo for liquidity, price discovery, and early-stage ROI (return on investment).

This article dissects that dominance from every angle. We’ll start by defining a CEX listing meaning and why it remains a milestone for crypto projects. From there, we’ll map the listing process—application, due diligence, fees, market-making obligations—before weighing the strategic upside against the regulatory, financial, and operational landmines teams often overlook.

You’ll also find a cost breakdown, a post-listing playbook to sustain volume, and a comparison of CEX versus DEX (decentralized exchange) listings.

Whether you’re a CEX founder, an investor evaluating listing catalysts, or a marketer, read every section – the insights ahead could be the difference between a cool debut and an expensive lesson.

What is a CEX listing?

A CEX listing occurs when a centralized exchange (an order-book platform run by a single legal entity) adds your token to its tradable asset roster and opens one or more trading pairs (e.g., $ABC/USDT). In practical terms, the exchange:

- integrates your smart-contract address into its custody system,

- spins up deposit & withdrawal wallets,

- creates order books and market-maker accounts,

- exposes the asset to millions of KYC (know-your-customer) – verified users under the exchange’s ticker and UI (user interface).

Each CEX listing is carefully selected and authorized by a single party that controls the underlying systems. Tokenomics, code audit reports, KYC paperwork, and, in many cases, a legal opinion addressing securities law risk are all parts of the comprehensive applications that project teams submit before the first trade prints.

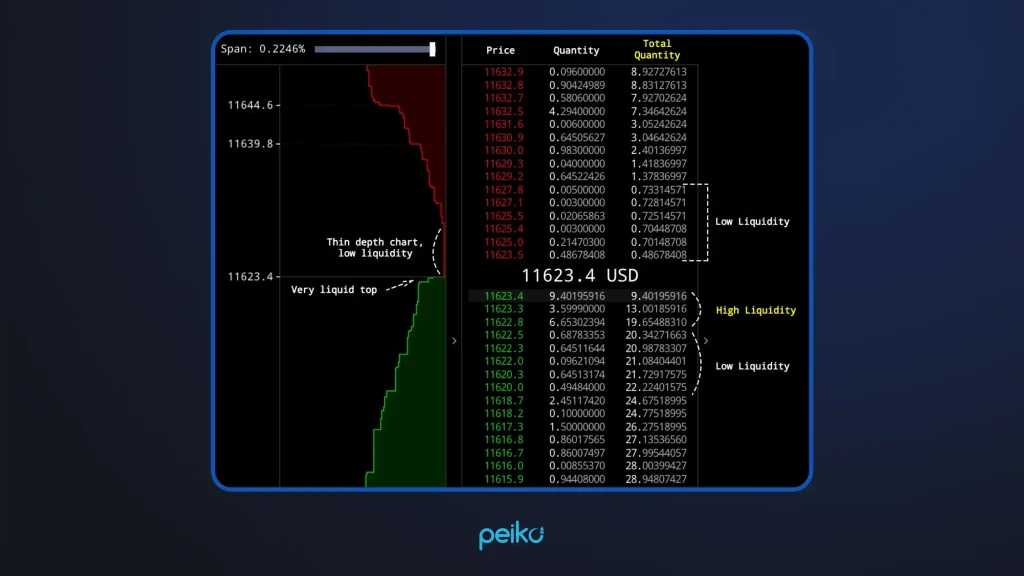

The exchange’s product, compliance, and risk teams carefully examine the dossier, discuss the project’s liquidity responsibilities with the market-makers, and plan the “listing announcement” that will notify millions of verified users through social feeds and push notifications. For instance, here’s how a newly listed token appears inside a CEX order book:

This creates an easy way for mainstream liquidity to enter the market. Individual traders can buy and sell using familiar web or mobile dashboards, institutions can choose and send the best APIs (application programming interfaces) orders straight into deep order books, and fiat on-ramps let newcomers buy the token with a debit card instead of a self-custody wallet.

A CEX listing basically turns an on-chain asset that exists on its own into something that works and feels like a stock on Nasdaq (National Association of Securities Dealers Automated Quotations, the world’s second-largest stock exchange, famous for hosting major technology companies such as Apple, Microsoft, and Amazon). However, the finality of the blockchain outside of the exchange is still maintained.

Why CEX listings matter for crypto projects

CEX listing crypto has become one of the most decisive inflection points in a token’s life cycle.

When a project graduates from purely on-chain swaps to a regulated order-book venue, it gains instant access to professional market infrastructure, a wider capital base, and the credibility halo that only third-party vetting can confer. These advantages multiply rapidly, reaching liquidity, brand-equity, and flexibility to product-cycle. These are the primary reasons why a CEX listing is of importance to crypto initiatives:

- Deep liquidity & price discovery

- Two-sided quotes made by market-makers are tighter spreads and allows large block purchases and sales without whipsawing the graph.

- The algorithmic strategies can be executed with an institution with REST/WebSocket API, which establishes strict 24-hour volume.

- Credibility signalling

- Successful legal, security, and KYC/AML screening of an exchange is an implicit audit, which appeases investors and partners.

- It is amplified by media cover (where the listing is automatically surfaced by media outlets and data aggregators) and data aggregators (e.g., CoinGecko, Bloomberg).

- Frictionless user acquisition

- Millions of pre-verified users can buy the token with fiat rails, debit cards, or bank wires – no self-custody hurdles.

- Mobile push alerts and launch campaigns funnel fresh holders into the project’s community channels.

- Ecosystem integration

- Index providers, lending desks, and derivatives venues often add newly listed spot pairs, expanding utility.

- Portfolio trackers, tax tools, and custodians pull price feeds directly from the exchange’s APIs.

A solid CEX debut keeps the token’s value stable: smaller spreads stop predatory arbitrage, and bigger books let the team focus on adding features instead of fixing liquidity gaps. In the long run, this consistency leads to better tokenomics. Less fluctuation makes staking, collateral, and payment more useful to more people.

Finally, a marquee listing unlocks strategic leverage. Crypto exchanges may co-host hackathons, provide market-making rebates, or list derivatives once spot volume matures. Venture funds that were previously hesitant now view the project through a derisked lens, opening doors to strategic capital and partnerships that accelerate roadmap milestones.

The process of getting listed on a CEX

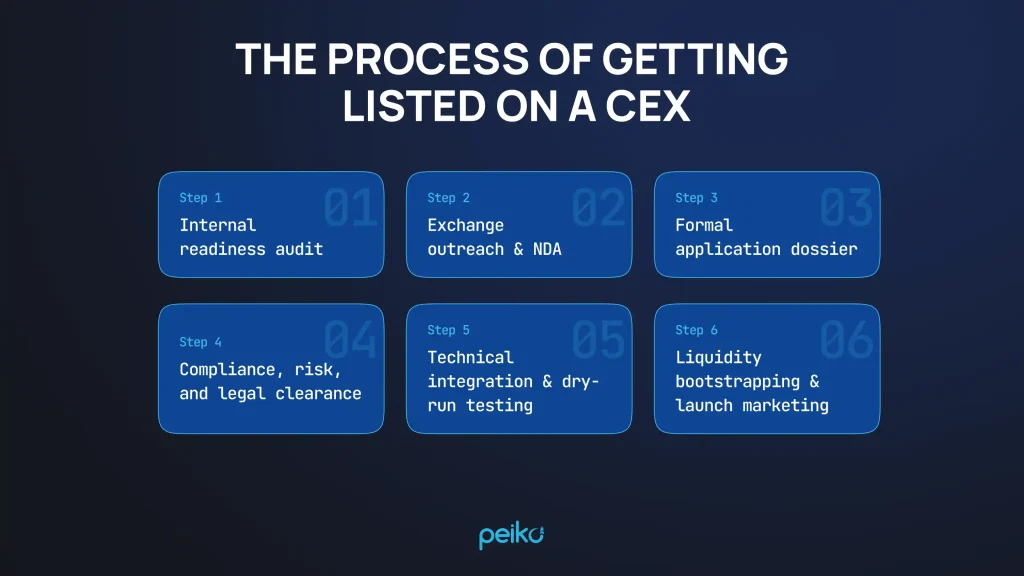

Centralized exchanges apply a bank-grade onboarding workflow, so successful teams treat listing as a multi-month project rather than a marketing stunt. The process blends business development, legal work, and deep engineering collaboration; skipping any layer almost guarantees delays or rejection.

Step 1. Internal readiness audit

Before speaking to an exchange, run a gap analysis of tokenomics, code quality, treasury controls, and brand assets. Produce a self-audit package (smart-contract hash, security-audit PDFs, circulating-supply table, fully diluted valuation model, cap-table snapshot) so you can answer hard questions on day one.

Step 2. Exchange outreach & NDA

Identify venues that match your chain, region, and liquidity goals, then secure an intro to the listings or BD (business development) desk. After a mutual NDA (non-disclosure agreement), you’ll receive a requirements checklist and a secure data room for uploads.

Step 3. Formal application dossier

Put in that data room a legal opinion on the state of the securities, KYC/AML (anti-money laundering) policies, a white paper, a roadmap, team IDs, smart-contract audit certificates, and proof of funds for market-making. Exchanges often demand notarized corporate docs and a short video KYC of founders.

Step 4. Compliance, risk, and legal clearance

Internal committees vet your project against sanctions lists, travel-rule obligations, and regional securities law. Expect follow-up requests for chain-analysis reports, OFAC ( Office of Foreign Assets Control) wallet screening, and vesting-schedule attestations. Clearance ends with a conditional “green-light” memo.

Step 5. Technical integration & dry-run testing

Engineering teams map your token’s contract functions, spin up hot and cold wallets, and run deposit/withdrawal regression tests on testnets and mainnet. You’ll supply endpoint seeds, multisignature whitelists, and emergency-halt procedures. A private sandbox listing lets both sides verify decimals, fee logic, and ticker rendering.

Step 6. Liquidity bootstrapping & launch marketing

Sign the listing agreement (fees, launch date, market-maker obligations) and pre-seed order books with inventory. Coordinate a joint PR (public relations) timetable: teaser tweet, full announcement, countdown banners, AMA (ask me anything), and launch-day social push. Post-listing, maintain tight communications for wallet upgrades, fork notices, and quarterly compliance renewals.

When handled properly, the CEX crypto listing journey unlocks order-book liquidity and forges an ongoing partnership with the exchange. One has open doors to staking, lending, and derivatives products that can compound the token’s reach long after the first trade prints.

Pros and cons of CEX listings

A CEX listing crypto is rarely “all good” or “all bad”—its value depends on what your project needs at a given stage. Understanding the trade-offs lets founders negotiate better terms with venues and coordinate complementary DEX or on-chain strategies.

| Dimension | Pros of a CEX listing | Cons / Trade-offs |

| Liquidity & spreads | Deep order books, tight spreads courtesy of professional market-makers; supports larger block trades | Liquidity can vanish if market-makers disengage or exchange limits leverage pairs |

| User acquisition | Millions of KYC-verified accounts, fiat on-ramps, and polished mobile apps simplify onboarding | CEX audience may trade, not hold—can increase speculative churn and short-term volatility |

| Price discovery | High volume plus API access attracts arbitrage desks, leading to robust, “discoverable” spot price | Listing exposes the token to predatory HFT (high-frequency trading) strategies that can exploit thin moments |

| Credibility signal | Passing legal, security, and compliance due diligence reassures institutions, lenders, and media | Rejection or delisting carries a reputational scar that’s hard to erase |

| Ecosystem integrations | Index providers, lending desks, and derivatives platforms often piggyback on CEX data feeds | Exchange exclusivity clauses or long lock-ups can limit where else you can list |

| Security & custody | Exchange handles hot/cold wallet management, reducing end-user self-custody errors | Central custody introduces a single point of failure; hacks or bankruptcies freeze assets |

| Regulatory positioning | Listing team’s legal opinion helps clarify token’s non-security status in multiple jurisdictions | Projects can inherit venue-specific regulatory probes or sanctions exposure |

| Operational support | 24/7 customer service, fiat settlement desks, and dedicated account managers | High recurring listing, market-making, and maintenance fees eat into treasury runway |

In short, CEX listings excel at scale—liquidity, visibility, and institutional access—but they import centralized risks and ongoing obligations. Most mature projects adopt a hybrid approach. Leverage a marquee CEX for reach and credibility while maintaining DEX pools for censorship resistance, community farming, and permissionless innovation.

Costs and hidden challenges of CEX listings

A debut CEX cost rarely ends with the press-release headline. Beyond the headline fee—a 2025 industry survey places tier-1 listing charges anywhere between ≈ $20,000 and “mid-six figures,” depending on user reach and reputation (retailtechinnovationhub.com). Projects must pre-fund liquidity desks, run KYC on founders, and furnish securities-law opinions that can survive a regulator’s subpoena.

Legal teams draft Howey-test memos, PR crews coordinate embargoed launch teasers, and engineers stand ready for 24-hour wallet monitoring the minute deposits open. Each deliverable has a price tag, a deadline, and a penalty if it slips.

The hidden burn continues after go-live. Exchanges bake SLAs (service level agreements) for wallet upgrades and chain forks into the contract, while smart-contract security audits from $5 000 to $15 000+ for a plain ERC-20 must be refreshed whenever code changes (cointelegraph.com).

Quarterly compliance renewals, treasury wallet attestations, and mandatory bug-bounty escrows add recurring costs that don’t decline with age. Finally, operational friction persists after go-live. Custody integration, on-chain upgrade support, 24/7 incident SLAs (service level agreements), quarterly compliance re-certifications, and mandatory bug-bounty programs all generate recurring burn.

None of those costs is refundable if the token underperforms or the venue delists, proving that a CEX listing is not just a splashy marketing event but an ongoing, capital-intensive partnership. In short, a CEX listing is less a one-time splash than an open-ended partnership that obliges the project to budget capital, talent, and legal margin for the lifespan of the token.

2025 regulatory check (MiCA & SEC)

- EU (MiCA): In 2025, MiCA (Markets in Crypto-Assets) moved from headlines to homework. CASPs face finalized Level-2/3 RTS/ITS on record-keeping, complaints handling, and operational risk. Issuers listing in the EU need a MiCA-compliant white paper, and marketing must align with it. Transitional “grandfathering” keeps firms operating only if they file for authorization in 2025 (deadlines vary by country). Budget for white-paper updates, marketing compliance reviews, and regulator feedback cycles.

- U.S. (SEC): In early 2025, the SEC’s (Securities and Exchange Commission) rescission of SAB (Staff Accounting Bulletin) 121 eased balance-sheet treatment for custodians, potentially reducing pass-through costs. Meanwhile, enforcement emphasis tilted toward fraud/market-abuse over broad venue theories (with several high-profile cases winding down), which lowers binary delist risk but does not relax disclosure or market-integrity expectations.

Post-listing strategy

A token’s life on a CEX really starts after the opening print. Once the initial marketing glow fades, projects need structured, day-to-day routines that keep books deep, compliance current, and community interest steady. Exchanges measure liquidity and operational hygiene continuously, so a “set-and-forget” approach risks wider spreads, lower volume, and—eventually—delisting.

The essentials are straightforward but non-negotiable:

- Contracted liquidity—maintain at least one designated market-maker agreement that sets spread and depth targets and includes an inventory buffer for volatile periods;

- Treasury support—mark a part of tokens or stablecoins for market-making and incentive campaigns, especially during the first six months post-listing;

- and Regulatory upkeep—track MiCA/AML filings in the EU and any SEC-CFTC developments in the US, updating legal opinions and sanctions screening at least quarterly.

These routines protect price discovery, reassure the exchange, and signal reliability to new stakeholders.

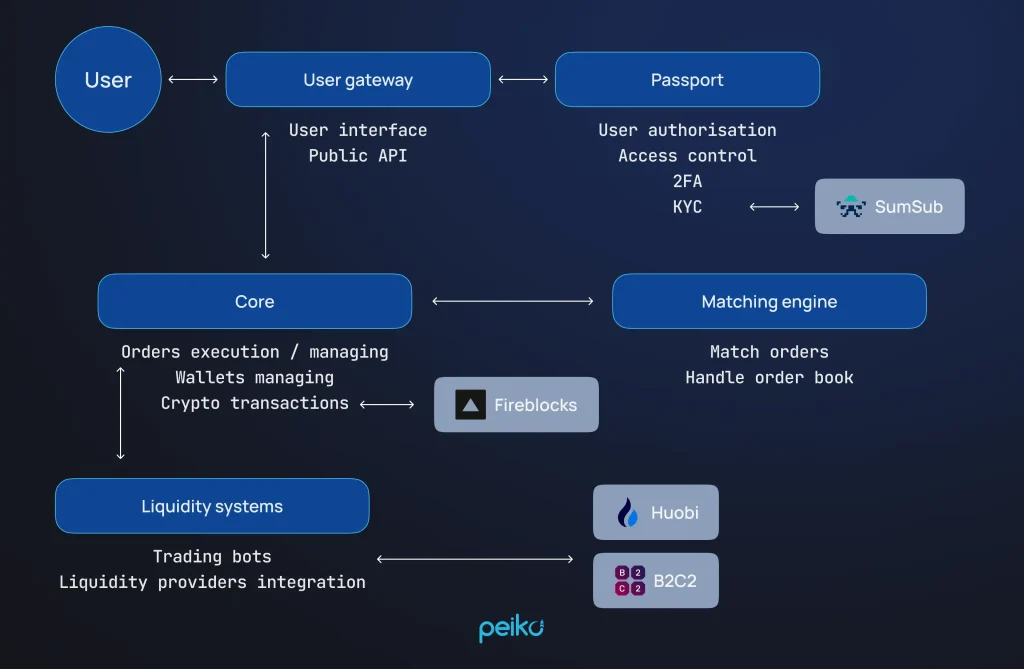

If growth plans include spinning up your own trading venue or satellite market, this is where Peiko’s white-label crypto exchange solution comes in. Owning an exchange rail gives the team fuller control over liquidity programs, fee structures, and community incentives, while Peiko handles the heavy lifting on infrastructure, security, and ongoing updates.

Peiko’s white-label bundle condenses eight years of exchange engineering into a fixed-price, turnkey package that pays for itself faster than in-house builds. For US $95 000, you receive a production-ready microservice stack—order-matching that handles millisecond fills, Fireblocks-secured custody, SumSub KYC/AML, and a TradingView front end—deployed on AWS, Azure, or Google Cloud in roughly 3 weeks.

The codebase is fully open for later customisation, liquidity bots and 52 ready-made trading pairs come pre-integrated, and an intuitive admin panel lets you set fees, add new pairs in minutes, and monitor volume in real time.

Crucially, Peiko’s team (Clutch “Best Blockchain Developers” 2021-2023, 5-star average rating) provides end-to-end support – architecture, branding, security hardening, and post-launch maintenance. So you start earning trading commissions immediately without the talent hunt, long timelines, or security guesswork of building from scratch.

CEX listing vs DEX listing: Which is better?

CEX listings excel at liquidity. Because professional market-makers and arbitrage desks seed order books, projects usually see tighter spreads and deeper volume than they would on a DEX. That depth matters for institutional flows: in Q2 2025, CEXs still cleared roughly 86% of all spot trades despite a record‐high 14 % share for DEXs, underscoring how large tickets still gravitate to centrally matched books (cointelegraph.com).

A DEX listing, by contrast, optimises for self-custody and censorship resistance. Traders keep private keys, pools stay open 24/7 without account freezes, and pairs can be created permissionlessly.

The trade-off is that liquidity is spread out across AMM (automated market maker) pools and can disappear as LPs (liquidity providers) look for better yields. This can cause slippage that would be unacceptable for treasury moves or institutional rebalances. Protocol-level risks like temporary loss and MEV (maximal extractable value) extraction are still the project’s responsibility, not the exchange’s (esma.europa.eu).

Regulation changes the balance. Since December 2024, Europe’s MiCA (Markets in Crypto-Assets Regulation) framework has required CEXs to have licenses, publish white papers, and keep capital buffers. This gives token issuers more legal protection.

DeFi venues are outside of MiCA’s current scope, therefore a DEX-only strategy can limit distribution to areas where on-chain trading engines are still unclear.

Which is better?

Early-stage, community-driven tokens often start on a DEX to prove traction, then graduate to a marquee CEX for scale once liquidity incentives and legal opinions are ready. Conversely, tokens aimed at institutional treasuries or regulated geographies benefit from launching on a reputable CEX first, then adding DEX pools for cross-chain reach.

In practice, successful projects employ both: a CEX anchor for depth and fiat gateways, plus DEX pools for permissionless access and ecosystem integrations.

Conclusion

A CEX listing meaning is less about code and more about meeting clear standards for custody, compliance, and liquidity. Projects that clear these requirements gain access to a wider CEX exchange user base and deeper markets, acquiring a solid platform for growth.

Need a reliable path to get there? Peiko’s white-label exchange solution bundles the essential compliance tools, liquidity connectors, and user-friendly interface you’ll need—so you can focus on your project while we handle the infrastructure. Contact Peiko to see how our solution can support your CEX listing plans.

FAQ

To list a cryptocurrency on a centralized exchange means to add it to the list of tradable assets on that exchange. Trading the token directly on the platform’s order book requires meeting stringent liquidity, security, and compliance conditions.

More liquidity, better customer service, and fiat gateways. Decentralized exchanges (DEXs) facilitate peer-to-peer (P2P) trading but are notoriously unreliable in terms of volume, institutional trust, and compliance.

A CEX listing increases a token’s exposure, trustworthiness, and liquidity, which in turn attracts both individual and institutional investors. Project growth and long-term valuation can be accelerated with increased market exposure, easier user acceptance, and access to fiat trading pairs.

The crypto exchanges list requires projects to submit financial, technical, and legal information. Among these are metrics for communities, audits, and tokenomics. Preliminary considerations for approval and negotiation of listing fees or market-making obligations are compliance, demand, and security.