To create a successful crypto exchange platform, it is important to integrate strong and reliable APIs (application programming interfaces).

With these APIs, you will ensure seamless market interaction, greater security, and enhanced user experience. The right API solutions can literally make the complicated operations of your crypto exchange simple.

Here, we will discuss a few essential APIs for crypto exchanges, including Fireblocks for the safe handling of digital assets, Twilio for automated messaging, Huobi, B2C2, SendGrid, and others. All of these APIs are designed to make cryptocurrency platforms work securely, efficiently, and without any issues.

Essential API categories for crypto exchanges

Adding the right APIs is extremely crucial when creating a cryptocurrency exchange platform. They provide a number of key functions that help enhance the performance, security, and usability of your platform.

The following are the main types of APIs that are important for an effective crypto exchange:

Security and asset management APIs

Security-focused APIs are used to protect confidential data, manage private keys, and offer secure transaction methods. These APIs utilize encryption and safe transfer protocols to prevent unauthorized access and minimize the chance of cyber attacks.

Trading and market data APIs

These APIs are an important part of facilitating real-time trading and providing users with current market data. Such APIs offer clean price feeds, historical data, and other key trading features to enable users to make trades on the basis of accurate and up-to-date data. Include the crypto exchange rate API and other vital APIs to ensure a great experience for users.

Liquidity provider APIs

Maintaining adequate liquidity is crucial for the smooth operation of any crypto exchange. Liquidity provider APIs connect the exchange with off-exchange liquidity sources to enable rapid filling of orders with low slippage. Liquidity provider APIs prevent the exchange from being overwhelmed by high trade volumes and becoming a market risk.

Communication and notification APIs

It is important to notify users in time and keep them engaged on the platform. APIs under this category handle real-time notifications like trade confirmations, price alerts, and account updates. Such APIs help ensure timely information to support users in managing their trades and account activities well.

REST (representational state transfer) APIs are involved in communication (e.g., retrieving data from an exchange or sending transaction data). But, they are better for scenarios where stateless interaction is sufficient, such as querying price information or sending a transaction request. If you need constant updates or live interaction, WebSocket APIs are often preferred.

Compliance and KYC/AML APIs

AML (anti-money laundering) and KYC (know-your-customer) regulations are a matter of concern for crypto exchanges.

Compliance APIs assist with validating user identities, checking their background, and maintaining the platform compliant from a legal as well as regulatory point of view.

Order management and trading engine APIs

APIs play a role in the execution of buy and sell orders. They manage order matching, transaction processing, and tracking of open and finished trades. These APIs ensure trades go smoothly, particularly during times of high market demand, by facilitating efficient order execution and real-time monitoring.

Beyond the main order management functions, Trading Bot APIs significantly boost the exchange’s capacity for automated trading. These APIs facilitate the development and control of trading bots that autonomously carry out trades according to predefined conditions, streamlining trading strategies and enhancing overall operational efficiency.

Top API providers for crypto exchanges and their features

The APIs facilitate everything from trading and secure asset management to compliance and communication. Here are some of the most popular API providers for cryptocurrency exchanges:

Fireblocks

It is a comprehensive platform designed to secure and manage digital assets. It offers trustworthy crypto API solutions for secure custody and transaction handling with top priority on asset safety in crypto commerce.

- Multi-layered encryption for secure custody of assets

- Secure from cyber attacks through robust security protocols

- Effective workflows for secure transfers of assets

- Focusing on securing against theft and unauthorized use

Twilio

This provider offers powerful communication APIs by which exchanges can embed messaging services like SMS, voice, and email notifications. These best crypto APIs enable real-time customer communication required for notification and verification procedures.

- SMS, voice, and messaging automation APIs

- Global scalable communication infrastructure

- Real-time user notifications and alerts

- Easy integration for automated user communications

Huobi

This crypto exchange offers a complete set of APIs for exchange integration with its trading platform. The APIs offer real-time market data and instant order execution of buy and sell orders to enable seamless trading and access to liquidity.

- Real-time price feeds and integration of market data

- Instant order execution of buy and sell trades through crypto Trading API

- High level of liquidity and access to a large number of crypto pairs

- Secure API access through multi-level user authentication

B2C2

This provider offers liquidity solutions for exchanges with an API that connects them to deep pools of liquidity for effortless trading of high-volume trades, primarily OTC (over-the-counter) transactions.

- Multi-source liquidity aggregation for best trading

- Consistent and fast order execution, particularly on large trades

- Institutional-grade API for cryptocurrency OTC trade

- Guarantees minimum slippage even in gigantic transactions

SendGrid

It is a leading email API vendor that facilitates automated transactional and marketing emails. It is used extensively by crypto exchanges to send notifications, such as account status updates and trade confirmations, to customers.

- APIs for sending automated transactional and marketing emails

- Robust email tracking and analytics for performance monitoring

- Scalable infrastructure that supports large volumes of emails

- Easy integration for user notifications and system updates

SumSub

Offers a KYC and AML compliance API solution. It helps exchanges verify the identities of their users and stay compliant with regulations.

- KYC and AML identity verification and fraud prevention tools

- Biometric authentication and document verification features

- Automated background checks for compliance assurance

- Compliance with international regulatory requirements is supported

CoinGecko

Provides a powerful API for fetching real-time cryptocurrency data like pricing, market cap, volume, and historical trends. This best crypto API is essential for exchanges wishing to display accurate and timely market data to their clients.

- Real-time market data like price feeds and trading volumes

- Historical data and market trends for informed trading

- Detailed statistics of over 6,000 cryptocurrencies

- Free and paid API cryptocurrency plans to cater to different user needs

CoinMarketCap

It is one of the leading sources of cryptocurrency data. Its API offers real-time pricing, market cap, and other detailed coin statistics, making it an excellent choice for exchanges needing minute-by-minute market data.

- Real-time crypto pricing and market data

- In-depth coin statistic and price history data access

- Visibility into worldwide market trends and crypto performance

- Free and premium tiers for various levels of utilization

Binance

This leading cryptocurrency exchange provides a powerful API that connects exchanges with its market for hassle-free trading, real-time data retrieval, and account management.

- Full-featured best crypto trading API for account management and order placement

- Real-time market data and price of trading pairs

- Extensive support for a wide range of cryptocurrencies and tokens

- WebSocket support for real-time price feed and notifications

These crypto exchange APIs help to provide a seamless, secure, and user-friendly platform that will attract users and generate profit.

Factors to consider when selecting the best APIs

When choosing API for crypto trading, it’s essential to prioritize the most influential factors that promote security, performance, and long-term prosperity:

Security

Opt for the best crypto API solutions that have robust security features, including encryption, secure authentication, and data transfer mechanisms like HTTPS. Two-factor authentication (2FA) and key management features are necessary to protect users’ information and avert cyber-attacks.

Scalability

Ensure the API crypto solution will scale with your platform. It should be capable of handling increasing traffic and high-frequency requests with no performance degradation, especially during periods of market volatility.

Reliability and uptime

Select cryptocurrency APIs with high reliability and uptime SLA (service level agreement) guarantees. A highly reliable API offers high availability with minimal downtime and graceful operation, which is critical to providing a smooth user experience.

Data accuracy and timeliness

Real-time and reliable data are essential. APIs must offer low-latency price feeds, market data, and historical data to help traders make sound decisions.

Ease of integration

Pick the best crypto exchange API with comprehensive documentation and well-structured endpoints, which will make integration more straightforward. RESTful APIs are usually the easiest to implement.

Compliance and regulation

Select APIs that adhere to regulatory needs, especially KYC/AML procedures, to help your exchange stay in line with legal requirements.

Customization and flexibility

The best APIs offer the potential to tailor to your exchange’s specific needs, whether for personalized trading functionality or custom algorithms.

Cost-effectiveness

Evaluate pricing models to identify a crypto currency API that fits within your budget and offers required features and scalability, with consideration of subscription and transaction costs.

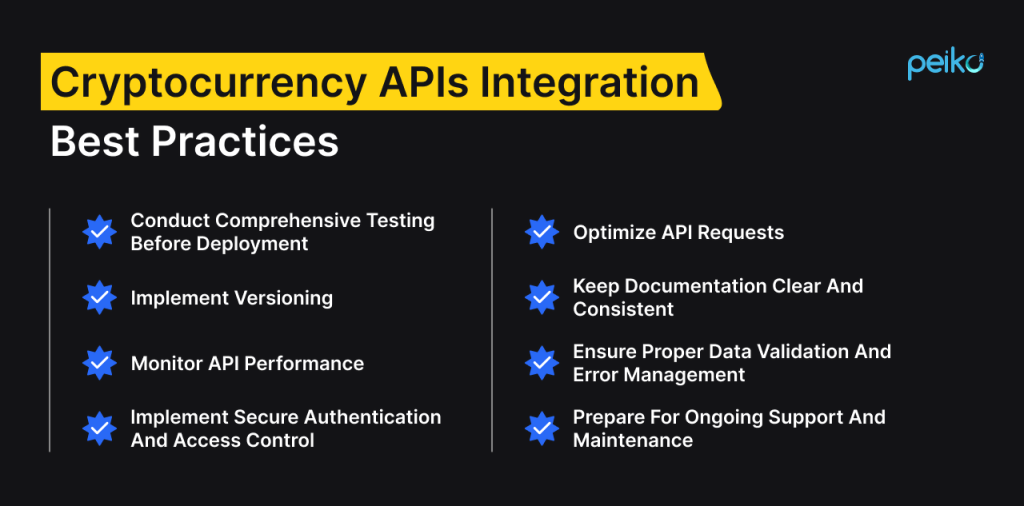

APIs integration best practices to follow

API integration in your crypto exchange website must be well-planned and executed to achieve seamless operation, security, and performance. We recommend to adopt the following best practices throughout the process of integration:

Conduct comprehensive testing before deployment

Carry out thorough pre-production testing of the APIs. This includes functionality, performance, security testing, and testing error handling. Use staging environments to simulate the real world, testing how the best cryptocurrency API will react to high traffic, unexpected inputs, and various error states.

Implement versioning

API versioning is important to avoid the disruption of your platform when APIs are updated or modified. Ensure that you keep a close eye on and control API versions, maintaining compatibility when updates or upgrades are made to avoid breaking existing functionalities.

Monitor API performance

Track the performance of your integrated APIs on a regular basis. Set up mechanisms to track response time, uptime, and error rate. Utilizing monitoring tools will allow you to identify potential issues earlier and tune performance so that your platform runs smoothly.

Implement secure authentication and access control

While integrating API crypto, prioritize secure authentication. Use methods like OAuth (open standard for access delegation), API keys, and token-based systems. Encrypt sensitive data in transit always and follow the principle of least privilege to minimize access to the API.

Optimize API requests

Reduce the number of API requests to streamline performance and reduce load times. Avoid duplicate requests by batching operations or caching data that is requested often. This helps maintain proper crypto exchange API performance and reduces the chances of server overload.

Keep documentation clear and consistent

Detail the process of API integration thoroughly for external as well as internal developers. Include clear descriptions of API usage, authentication methods, error-handling mechanisms, and custom features. Proper documentation makes troubleshooting easier.

Ensure proper data validation and error management

Implement robust data validation to ensure that the data being exchanged over the APIs is valid and reliable. Additionally, have comprehensive error-handling mechanisms to deal with issues gracefully and return useful error messages so that the service is not interrupted.

Prepare for ongoing support and maintenance

Cryptocurrency API integration is not a one-and-done process. Ongoing, update APIs, watch for performance, and stay tuned for changes from your API providers. Be prepared to have your team support, debug, and update the integration as needed.

Start an efficient crypto exchange with Peiko in 3 weeks

At Peiko, we have a great solution for entrepreneurs who want to launch their crypto exchange with API super-fast and easily. Our white-label crypto exchange solution is scalable and customizable, so you will get your own branded platform with minimal development.

The solution comes pre-integrated with features like regulatory compliance, multi-currency support, advanced charting capabilities, and real-time market data.

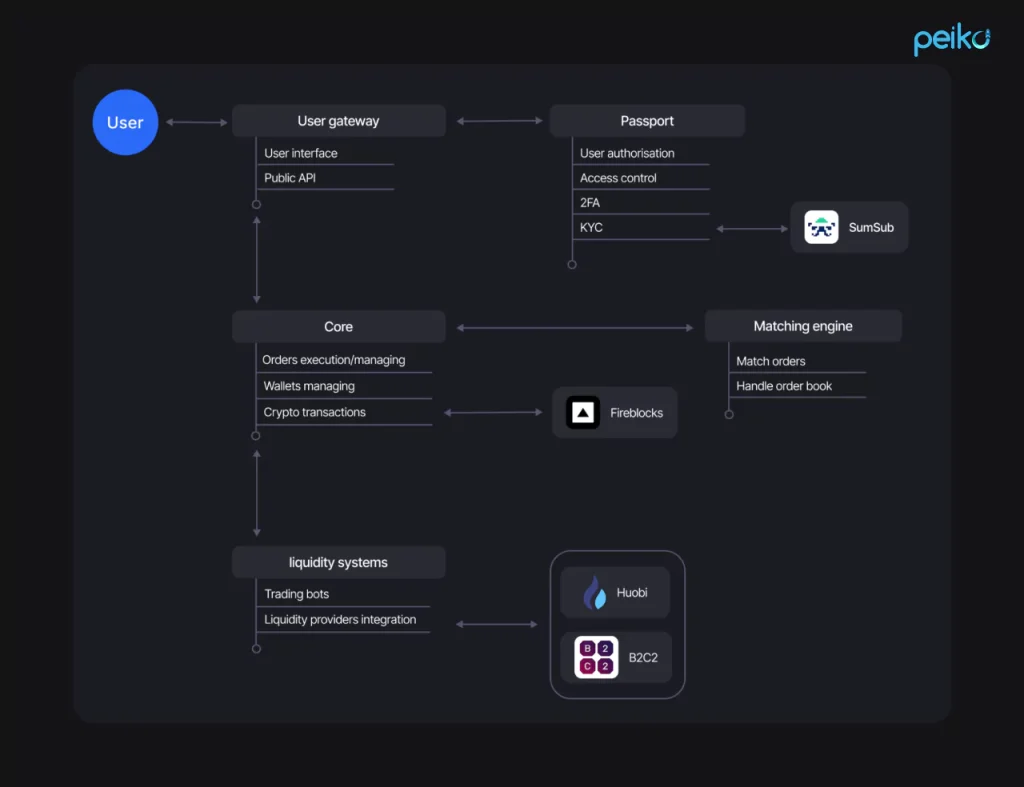

APIs and features integrated

Our solution comprises a comprehensive set of crypto APIs designed to ensure seamless, secure, and scalable trading operations.

- Liquidity provider APIs: Peiko has leading liquidity providers like B2C2 and Huobi, which provide fast order execution and minimal slippage with internal and external liquidity management.

- Market data and crypto trading APIs: Our solution provides real-time market data and historical feeds through cryptocurrency trading API – TradingView, which gives precise pricing and interactive charting facilities to traders.

- Security APIs (Fireblocks): We use Fireblocks for digital asset custody in a safe way, utilizing encryption and multi-signature technology to protect money from being spent without authorization.

- Compliance and KYC/AML APIs (SumSub): We support KYC and AML compliance using SumSub for user identification and regulatory compliance checks, preventing fraud.

- Order management and trading engine APIs: Our white-label solution supports efficient order execution and matching of trades with the ability to support high-frequency trading of thousands of transactions per second.

This white-label solution created by our blockchain development company is a great option for anyone looking to enter the business of crypto exchanges before potential competitors.

Conclusion

Integration of the right APIs will drive the success of any cryptocurrency exchange. You need proper sets of tools, such as liquidity provider APIs, trading data APIs, security integrations, and compliance solutions. With these applications, you will achieve optimal performance, enhanced security, and successful scaling of your platform.

If you want to launch the crypto API trading platform in a few weeks and not spend hundreds of thousands of dollars, use our white-label solution. Contact us to discuss details!

FAQ

APIs are important for smooth and efficient crypto exchange operations. These applications provide features like real-time market data, order execution, liquidity management, and compliance with regulations.

The most suitable crypto exchange API depends on your specific needs. Popular ones include Fireblocks for security, B2C2 for liquidity, SumSub for KYC/AML compliance, and others.

For real-time market data, TradingView is the top choice. It is used for its dynamic charting and accurate price feeds, which help with market analysis and decision-making.