For the majority of jurisdictions, cryptocurrency is classified as property or a digital asset. This means that your business’s activity (like trading, token issuance, fees, and staking rewards) can all generate taxable events. Crypto taxation may be tricky for businesses. However, with the right tools and knowledge, you will achieve compliance and continue to get revenue without problems.

Special tax software like TaxBit, Lukka, and Koinly for Business reports for you, whereas new regulations such as IRS Form 1099-DA, MiCA, and CARF inform you what and how to report.

With this guide, you will know how is crypto taxed and how to keep your crypto business compliant and audit-ready.

Understanding how crypto is taxed

If you run a crypto business — a crypto exchange, a wallet provider, a DeFi (decentralized finance) protocol, or an NFT (non-fungible token) marketplace — your tax bill goes far beyond individual crypto trades. You’re dealing with a range of taxable events: from platform revenue and token offerings to user incentives and cross-border payments.

Around the world, crypto is not usually legal tender (El Salvador is an exception). Rather, it’s viewed as property or digital assets. That can mean your business will be taxed on:

- Gains from disposing of crypto assets

- Service or trading fees in crypto

- Token sales or initial offerings

- Staking, mining, or validator rewards

These are usually taxed as business income or capital gains, depending on the jurisdiction and nature of your operation.

In the US, the IRS (The Internal Revenue Service) views crypto as property, and not as a currency. From 2025, platforms that fall under the definition of “crypto brokers”, such as centralized exchanges and a subset of custodial wallet providers, will be required to submit Form 1099-DA. The new form involves stringent reporting on user transactions, including asset type, date, proceeds, and cost basis, similar to traditional securities reporting.

In the European Union, crypto asset service providers will be required to automatically report users’ transaction data to tax authorities in EU member states from 2026 onwards under the DAC8 directive. This includes centralized and decentralized platforms, custodians, and certain wallet applications.

On the international front, the OECD’s CARF (Crypto-Asset Reporting Framework) is being adopted by different countries to enable cross-border data exchange between tax authorities.

If your enterprise is diversified and operates across multiple jurisdictions, you should comply with the Crypto-Asset Reporting Framework (CARF) standards. That includes sharing the detailed information like crypto wallet addresses mapped to customer identities confirmed in real-time (KYC), the number of transactions, and information about recipients with the tax authorities to enable cross-border data sharing.

You should understand that crypto companies are no longer playing in a grey area. Worldwide tax compliance is a necessary requirement. Anticipating your data and infrastructure requirements now will prevent penalties, audits, or operational limitations down the line.

Below is a summary of the main global cryptocurrency tax reporting mandates going into effect in 2025-2026. Familiarizing yourself with these will keep your business prepared for compliance, as well as save you from incurring exorbitant penalties.

| Region / Authority | Regulation name | Main requirements | Implementation year |

| USA | IRS Form 1099‑DA | Crypto brokers like centralized exchanges and custodial wallets must submit detailed user transaction reports | 2025 |

| European Union | DAC8 Directive | Crypto platforms are required to automatically report user transaction data to EU tax authorities | 2026 |

| OECD Member States | Crypto-Asset Reporting Framework (CARF) | Facilitates international exchange of tax information including wallet IDs, transaction values, and counterparties | From 2026 (gradual rollout) |

| USA | IRS Notice 2014-21 | Classifies cryptocurrencies as property rather than currency, making capital gains tax applicable | Currently active |

| European Union | MiCA Regulation | 15 Sep 2025 updates add Level-2 RTS/ITS for ART authorisations; in force Oct 2025, applying Jan 2026. | Phased 2024–2025 |

Reporting crypto taxes accurately

Correct tax reporting is crucial for cryptocurrency enterprises, both to stay compliant and build trust with regulators and users.

Start with having impeccable records of all transactions: trades, fees, payouts, and any crypto held or paid out. Any move of crypto may have tax implications, especially when you are dealing with customer funds or internal accounts.

You will also need to separate different kinds of activity clearly:

- What constitutes business income (like trading fees or commissions)?

- What constitutes a capital gain or loss (like disposing of held crypto)?

- What is customer activity (which you may have to report under KYC and tax laws)?

Most crypto businesses use specialized software like TaxBit, Lukka, or Koinly for Business to monitor automatically and report. They help create the reports you will have to pay taxes locally and abroad, and to be prepared for audits.

And yes, regulations are becoming stricter, and tax authorities are taking a closer look at crypto. That’s why transparency, clean data, and proactive reporting are now requirements for any crypto business.

Using a crypto tax calculator

Crypto companies handle a staggering volume of transactions: trades, platform fees, disbursements, staking rewards, and token distribution. One person’s tax calculator just can’t handle that level of complexity. That’s where cryptocurrency tax systems at the enterprise level step in.

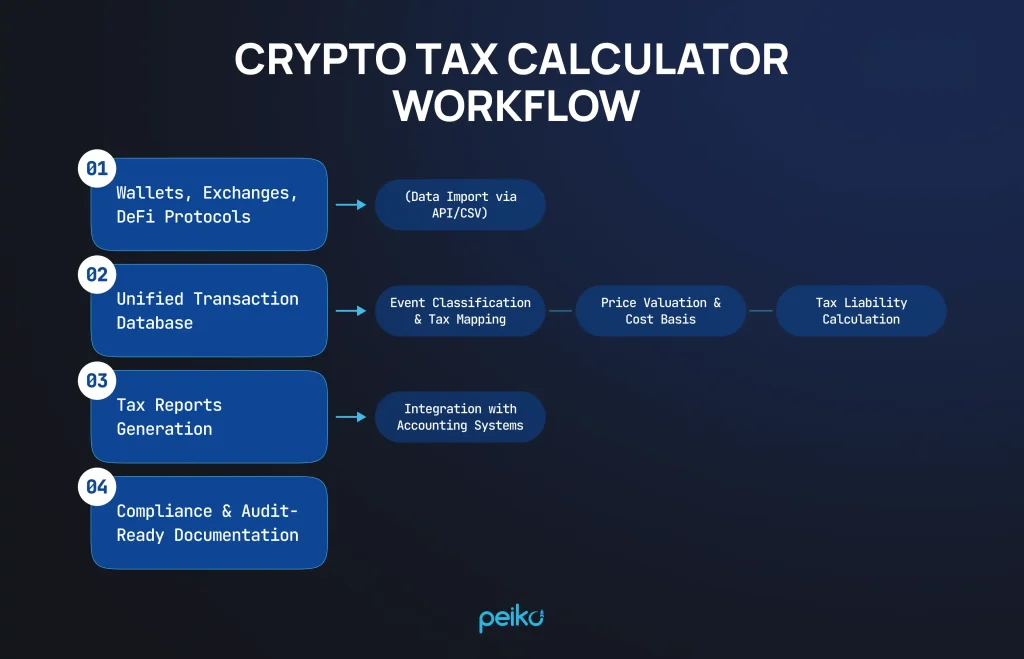

Let’s consider how these enterprise-grade calculators work:

- Automated data aggregation: The platform connects to your wallets, exchanges, and smart contracts using APIs (application programming interfaces) or by importing CSV files (comma-separated values), making it easy to consolidate all transactions in one place.

- Event classification & mapping: The calculator categorizes and identifies each transaction as taxable events: capital gains, income, staking, token issuance, airdrops, and others. It does this through custom rulesets to map over tax law in your region.

- Valuation & cost basis calculation: Each asset is assigned its value at the moment of sale based on real-time or historic pricing data. Cost basis, fair market value, and gain/loss are then calculated by accounting standards like FIFO, LIFO, or custom ID. (In the next section, we’ll take a closer look at these accounting methods.)

- Tax liability estimation: Following classification and valuation, the software calculates what the company must pay. These can be income tax, capital gains, or VAT (where applicable for regions).

- Reporting & compliance: It generates tax reports (IRS Form 1099-DA, Form 8949, Schedule D, or local equivalents), and multi-jurisdictional reporting for international operations (for example, as per MiCA, DAC8, CARF). Some software platforms include audit trails and Certified Public Accountant (CPA) review features.

- Integration with accounting systems: Some tools integrate with established accounting systems (Xero, QuickBooks, or NetSuite), so your bookkeeping and tax reporting stay in sync. This is a critical bonus for investor reporting and financial transparency.

Accounting methods for cryptocurrency taxes

How you account for crypto capital gains or losses from trades depends primarily on the accounting technique you use to determine cost basis. That is, the original value of the asset when you acquire it.

Different countries allow different techniques, and your choice can have a significant impact on your tax outcome. The following are the primary ones used in cryptocurrency taxes:

FIFO (First In, First Out)

Longest-held coins purchased are presumed to be sold first. For example, if you had bought 1 BTC at $20,000 and another at $30,000, then sold 1 BTC — based on FIFO, profit/loss is calculated with the $20,000 coin. This method is used in the US, EU, and majority of other nations.

LIFO (Last In, First Out)

Most recently bought coins are presumed to be sold first. In the same example as above in FIFO, the sale would be matched with the $30,000 coin. This method is not accepted everywhere (banned for individuals in the UK), but generally accepted by companies.

Specific identification (custom ID)

You select manually or programmatically which specific asset units (e.g., a specific UTXO or token lot) were sold. This method offers the highest flexibility and best tax optimization, like selling the most expensive coin to keep the capital gains at a minimum.

The method is legal in all countries but a few jurisdictions, but requires careful tracking and clear documentation.

Apart from the above, some other models may be legal in some jurisdictions or used internally for analytics:

- Average Cost Basis (ACB): Very common in Canada and much of the EU. Calculate gains/losses on the average cost of all coins within a class.

- Highest-In, First-Out (HIFO): A form of Specific ID that always sells the most costly coin first — oftentimes used to reduce capital gains, but not technically valid to most tax systems except under the Specific ID rules.

Your accounting method must usually be consistent year to year and align with what is permitted by local taxation law. For cross-border businesses, accommodation of multiple methods per country may be required.

Best crypto tax software for 2025

Here is a hand-picked list of top cryptocurrency tax software in 2025, offering solutions to different needs in the space — from DeFi platforms to centralized exchanges.

Leading tax solutions for different crypto companies

They are ideal for platforms that deal with smart contracts, staking, NFT transactions, and multi-chain operations — such as wallets, token launchpads, or DeFi protocols:

ZenLedger

Strong for NFT-intensive, DAO, and DeFi businesses. Offers tax-loss harvesting, multi-protocol support, and integration with performance analytics via TurboTax.

CoinLedger

Suited for websites dealing with user portfolios and NFTs. Offers full history transaction import, broad DeFi coverage, and audit trail support.

TaxBit

Suitable for businesses that need tax compliance with advanced reporting. It plays nicely with some exchange integrations and offers real-time tax previewing.

Koinly

Supports over 6,000 wallets and exchanges, imports automatically, and handles DeFi, lending, and staking transactions. Perfect for cross-platform companies that operate in several different jurisdictions.

Top tax solutions for сentralized exchanges (CEX)

For large-volume user trades, withdrawals, deposits in crypto exchanges and require jurisdictional tax compliance:

TokenTax

Best for CEXs with complex operations — margin trading, mining, staking. Offers CPA-audited reports and tax filing integrations (TurboTax/TaxAct).

Blockpit

Designed with regulation in mind. Prepared to produce audit-ready, multi-jurisdictional tax reports and have integrations suitable for exchange infrastructure.

Koinly

Also highly suitable for CEXs due to comprehensive API (application programming interface) support, accounting method flexibility (FIFO/LIFO/etc), and multi-region support. It is a great gateway between user activity and back-office reporting.

| Tool | Best for |

| TaxBit | Mid-to-large crypto companies, live tax previews, reporting |

| TokenTax | Centralized exchanges, complex tax activity, CPA validation |

| ZenLedger | DeFi/NFT platforms, DAOs, multi-protocol tracking |

| Blockpit | CEXs in multiple countries, regulatory compliance, audit |

| CoinLedger | NFT/DeFi-focused businesses, transaction history |

| Koinly | CEXs, wallets, multi-chain activity, DeFi, global coverage |

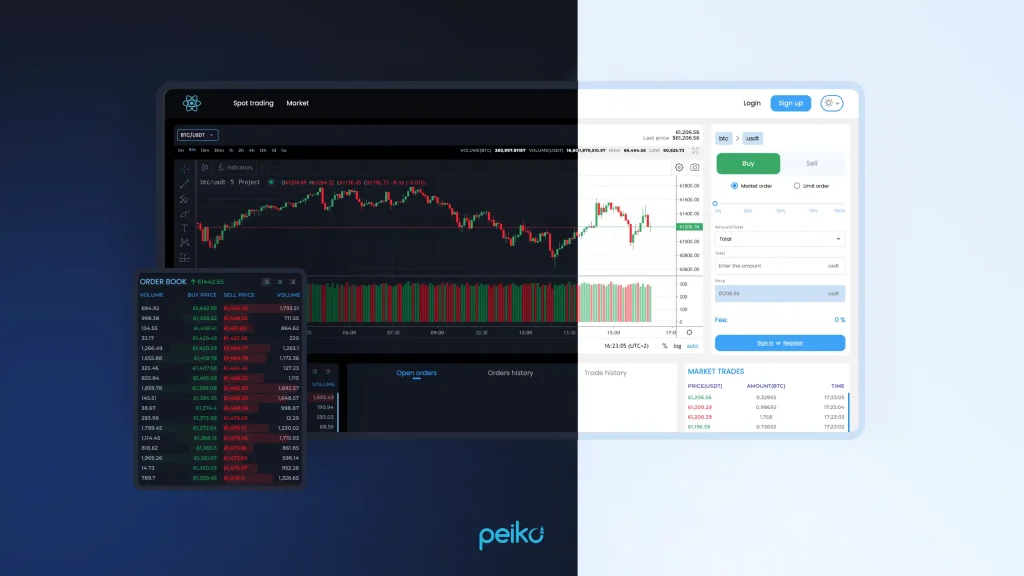

If you’re launching or growing a centralized exchange, chances are you don’t require tax reporting so much as you require infrastructure. That’s why we offer an off-the-shelf white-label crypto exchange solution that can be launched in 3 weeks.

Our platform is completely customizable and accommodates the complete range of a CEX’s operations: trading, liquidity, KYC/anti-money laundering (AML), and the integration of tax modules if desired. It’s an accelerated, more versatile replacement for off-the-shelf platform, providing you with complete control over functionality, branding, and compliance.

Tips for filing cryptocurrency taxes smoothly

For crypto businesses, tax reporting is an issue of compliance, risk, and operational insight. Do you run a centralized exchange, a DeFi protocol, or a token project? Reporting about bitcoin taxes (or any other cryptocurrency taxes) starts with the appropriate setup from the very beginning.

The foundation is clean, centralized data. Your business might be interacting with dozens of wallets, exchanges, blockchains, or smart contracts. Relying on manual spreadsheets creates room for error. Instead, use platforms like Koinly, TokenTax, or Blockpit to import, consolidate, and categorize transactions automatically.

Make sure you’re classifying taxable events correctly. Crypto businesses typically deal with:

- Revenue — such as trading fees or platform commissions

- Income — staking rewards, airdrops, or validator payouts

- Capital gains/losses — on the sale of digital assets

- Operational expenses — gas fees, service fees, and salaries (sometimes paid in crypto)

Mis-categorizing any one of these can impact your bottom line or even initiate compliance problems. It’s generally a good idea to have a crypto-experienced CPA review your transaction categories, especially if you’re operating across multiple jurisdictions.

Be consistent when valuing. Employ a specific cost basis method (FIFO, LIFO) and correctly capture the token prices at the time of each transaction, with local fiat conversions if your jurisdiction so requires.

And then there’s documentation. Officials may request 5 years of historical information, e.g., trades, income, and reporting records. Utilize tax software with audit-ready reports and keep off-platform secure backups.

To make tax time easier, it is best to:

- Automate where you can (API integrations and live data syncs)

- Check in quarterly (instead of waiting until the end of the year)

- File early (to avoid errors, penalties, or last-minute choices)

Get the proper systems set up, and taxes don’t have to be a cause of anxiety. They can be a sign that your business is running professionally and transparently.

Wrapping up

Crypto businesses have no option but to be tax-compliant. It’s a necessary part of running a legally compliant and scalable business.

From reporting platform revenue and user-paid fees to handling cross-border taxation and adhering to evolving frameworks like MiCA, CARF, or IRS 1099-DA, crypto businesses must embed taxation as a core operational process. With the proper tools, processes, and professional guidance, tax reporting is a streamlined regimen.

If you’re opening or expanding a centralized exchange, we provide an out-of-the-box white-label crypto exchange solution that can be implemented in just 3 weeks. It is customizable, offers integration support, and provides control that generic platforms cannot.

Contact us when you’re ready to launch a professional crypto exchange with true market readiness and flexibility.

FAQ

You have to report all activity relevant to your jurisdiction — income, revenue, profits — according to the regulations of your jurisdiction, with acceptable documentation and valuation.

Yes, if you earned crypto as staking, mining, or fees. Having crypto in general is not taxable, but crypto income is.

For businesses, the best choices are TokenTax, Koinly, or Blockpit — depending on your business and compliance needs.

You can end up getting audited, fined, lose reputation, or even get regulatory action, since reporting becomes more stringent around the world.