Even the most advanced crypto platforms can fail if trades don’t go smoothly. There have to be a solid liquidity provider on your side, or users will leave because of insufficient reliability.

This piece will explain what crypto liquidity providers (LPs) are and the different kinds of them. It will also include a list of important LPs that you should consider while planning your project.

You acquire trust, audience, and money if you pick the best crypto liquidity provider. Read all the way through, and you’ll have a clear picture of how to make the right choice.

The importance of crypto liquidity for your platform

Trading only works when there is enough liquidity. It lets people quickly buy and sell goods at market prices. Tight spreads, quick execution, and a smoother trading experience can be found only on a platform with good liquidity.

Now for the harsh truth: if you don’t have enough cash, your platform stops working. Traders have a lot of slippage, deals fail, or get stuck while waiting for orders to fill. Users quickly lose trust in this. Most people won’t give your platform another chance in competitive markets.

Even worse, not having enough cash on hand can make you a target for arbitrage or manipulation. This can cost you money and hurt your image, so that you might not be able to recover from it.

That’s why liquidity should be a fundamental part, not something added to everything else. You need to work with the right funding provider if you want to build a crypto exchange, the DeFi protocol, or an over-the-counter (OTC) service.

Types of crypto liquidity providers

Liquidity sources are different for each platform, trader, and project. If you pick the wrong one, your order book could be empty, or your spreads could be very wide. When you want to make smart, strategic decisions about whether to build a DEX or a high-frequency trading platform, you need first to understand the different liquidity provider companies.

Some of them are huge institutions with deep, stable cash pools. Others focus on collecting information from many sources, putting accessibility over complexity. Then there are decentralized choices, which are newer, riskier, but can be more useful in the right situation. Let us break them down:

| Type | Description | Best for |

|---|---|---|

| Tier 1 institutional LPs | Large financial firms providing deep, consistent liquidity across multiple assets and markets. | Centralized exchanges, large-volume platforms |

| Retail market makers | Smaller, tech-savvy entities offering liquidity through APIs and algorithmic strategies. | New exchanges, niche markets, altcoin support |

| Aggregator LPs | Pull liquidity from various sources (CEXs, DEXs, OTC desks) to offer the best available price. | Platforms needing broad asset coverage and price depth |

| Decentralized liquidity pools (AMMs) | Liquidity comes from users via smart contracts (e.g., Uniswap, Curve). Pricing is algorithmic. | DEXs, DeFi platforms, token launches |

| Internal LPs | The platform itself acts as a market maker, providing its own liquidity to control the spread. | Proprietary platforms, OTC desks, closed ecosystems |

| Prime brokers / LP networks | Offer plug-and-play access to multiple LPs through a single connection or interface. | Institutions, fintechs, exchanges scaling rapidly |

Each type has its own pros and cons. You can match the goals of your platform to the right kind of LP now that you know what’s out there.

We’ll now talk about some of the top tier liquidity providers crypto, so you know who can deliver you what you need.

6 best liquidity providers 2025

It’s vital for any trading tool, exchange, or token project to pick the right liquidity provider. Here is a look at some of the most important players in 2025.

1.Huobi

Huobi is the world’s biggest and most trusted bitcoin exchange. It offers the best liquidity and the most reliable service. Its exceptional liquidity infrastructure guarantees that anyone who works with them enjoy quick, smooth, and dependable trading.

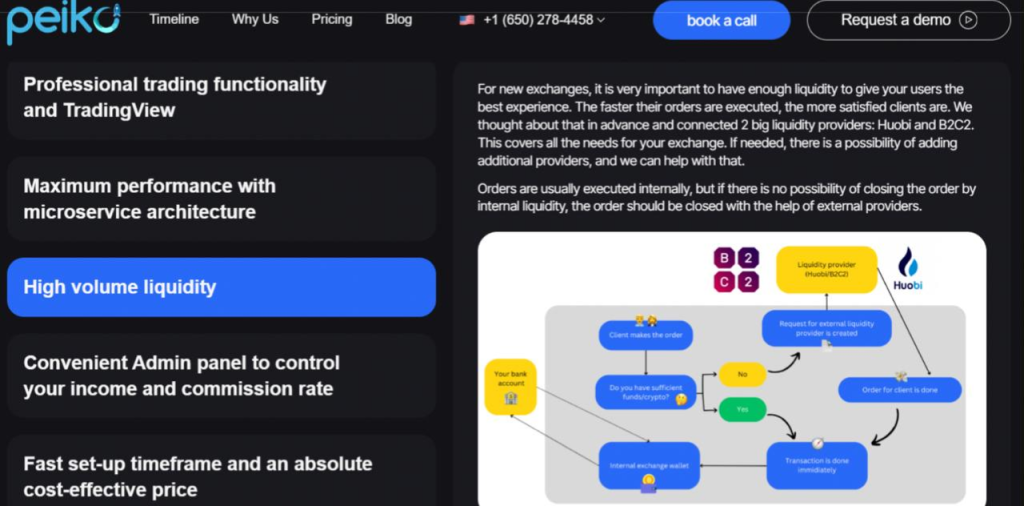

Because the exchange supports many cryptocurrencies and has strong security measures, transactions are quick and easy. Huobi’s liquidity solutions have been successfully added to Peiko’s platform. Through this collaboration, Peiko gives clients better market execution and more accurate data collection.

2. B2C2

People willing to get into crypto trust B2C2 firmly. With a reputation for high reliability and deep liquidity, B2C2 makes it easy for both individual and institutional clients to trade on the market. Their liquidity network is known for its high trade volume and smooth transaction flows.

Peiko uses B2C2’s strong liquidity services to make sure that clients get quick onboarding, clear pricing, and a smooth trade experience overall. Because of the B2C2’s reliability, it’s a great partner for projects that want to keep performance and stability high in the crypto field.

3. Cumberland

Cumberland has been in the market for years, offering over-the-counter (OTC) liquidity and algorithmic trade services. They run a solid business and have made a network of partners in both crypto and traditional banking.

Still, their method is more rigid and not as flexible regarding specific or quickly changing project needs. In the liquidity providers list, they work well for big deals or steady demand, but compared to more flexible providers, they might feel a bit stiff.

4. The Wintermute

Wintermute has grown quickly and is now a strong part of both CEXs and DeFi systems. A lot of different assets can use their technology, and they are often present in the first token markets. But sometimes, their focus on speed and scale makes them less interested in getting to know their clients better.

The help can feel like a transaction for projects that need long-term strategy advice or help shaping the market. Still, they work well for quick access to a lot of cash.

5. Flow Traders

There is trust in Flow Traders among liquidity providers list because they follow a strict and legal business plan. Their systems work well and they are careful with risk, but that means they take longer to add new tokens or ecosystems.

Flow Traders is a good choice for companies that value rules and long-term stability over new ideas or flexibility. Some people might feel like the pace is too slow.

6. GSR

GSR sees itself as a partner in structuring and liquidity, specializing in options, derivatives, and project help in the early stages. The disciplined way they work shows that they come from a background in standard finance, but their services are usually best for people with more complicated or long-term needs.

GSR might not be the best choice for projects that need instant, high-volume liquidity or quick market activation. Still, they are admired for the work they do behind the scenes to support the ecosystem and start new tokens.

Some top tier liquidity providers are better than others. Jump, Cumberland, and Wintermute, are strong in more specific areas. Peiko stands out for being flexible and offering exactly what you need. What you require will determine the best choice, but Peiko is a suitable option for most situations.

Key factors to consider when choosing a liquidity provider

Liquidity affects almost every part of performance on any exchange or trading platform.

Here is a crypto liquidity providers list based the most important technical, operational, and strategic factors for 2025 when judging liquidity providers.

Depth of liquidity

A good provider keeps the depth stable in both regular and high-volatility situations. If you want to target certain types of assets, check if the provider offers them directly or through aggregation.

When you think about control, pricing, and execution reliability, you should also consider the difference between private internal liquidity and external aggregation. Instead of using benchmarks or sales metrics, test in a live or mirrored production setting.

Market coverage and asset support

A capable provider should support a wide range of assets:

- Spot, margin, and derivatives markets, depending on your platform offerings

- Fiat and stablecoin ramps, where required for regional compliance

- Efficient handling of wrapped tokens, synthetic assets, or tokenized securities if applicable to your model

Also examine whether they require formal onboarding for new tokens. Or if token additions can be self-managed via admin tools or APIs.

Latency and execution quality

Order execution speed makes trade stand out from the others. If your latency is bad, you could lose money and have trades fail. Measure:

- Execution latency when the system is busy, ideally in milliseconds (less than 50ms is okay).

- Fill rates for orders of different sizes and types of assets.

- Smart order routing.

Ask top crypto liquidity providers for documented latency measures instead of just hearing about how well it works.

Integration and API infrastructure

A provider must have clean, scalable equipment. Pay close attention to their APIs to see if their systems work with common protocols.

Wrongly designed APIs cause internal teams extra work and slow down platform development. Over time, you see the cruciality of version control and stable endpointsl when working with multiple service systems or adding more users.

Risk management

A good provider should deal with oddities, instability, and “black swans.” It should:

- Have tools to protect clients from harm during flash crashes or deals that don’t make sense.

- Keep an eye on dashboards or APIs for health checks and actual messages.

Sites that aren’t closely watched can lose millions of dollars due to a single mistake.

Regulatory compatibility and licensing

They can either have their own license or be set up in a way that won’t hurt your legal standing in regulated areas. If you’re building in the EU, the UAE, or Singapore, make sure that their licensing systems work with MiCA, VARA, or MAS.

Ask them directly to learn where they can’t legally do business, how they handle calls for compliance and if they’ve had any problems with regulators or audits.

Operational support

You need to know exactly what will happen if something goes wrong. Does the service provider give technical support 24 hours a day, seven days a week? How long do they usually take to respond? Are there any ways for things to get worse?

Data transparency

Regulators and institutional users need detailed deal reporting and order book analytics. If they are a good service, they should:

- Full trade logs with timestamps, order IDs, and source route (direct vs. aggregated).

- For regulatory review or internal research, audit trails are used.

- APIs for reporting on volume, delay, and spread, both in real time and in the past.

Not having access to data makes it harder to improve or fix processes.

Pricing model

Look for any unclear fees. Like those for adding new token pairs, platform updates, or custom support.

If a service provider seems cheap during the MVP stage, it might not be cost-effective when there is a lot of traffic. What if your business plan changes in the future to include derivatives or fiat currencies? Make sure the provider can adapt without needing a whole new deal.

Reputation and proven record

Lastly, ask for case studies or platforms they currently support. Review sites, service trackers, and GitHub repositories. A seller with a good product will almost never refuse to be examined.

Any claim that isn’t clear or hasn’t been checked by a third party should be a red flag. When the success of your trade depends on how well this integration works, you have to do your research.

The ultimate advice to choose Peiko for crypto projects

Peiko is one of the top crypto liquidity providers that offers complete crypto exchange options. Our solutions can be fully customized based on modern microservice architecture.

Real-time execution, spot and market orders, smart order matching, integrated liquidity management, and an admin dashboard for full operational control- all of that you got from partnering with us. We combine technical execution with a delivery attitude for projects that need to be done quickly.

Bitsten is an example of this. It’s a cryptocurrency exchange made for the South African market but has room to grow internationally. The client came to Peiko with a limited budget, high hopes, and a long list of needs, ranging from safe storage of crypto to payments across borders.

In just 240 hours, Peiko’s team quickly made a high-performance white-label swap. The system had a trading engine, liquidity integrations with Huobi and B2C2, and TradingView for advanced charting. We also added strong security measures and connected services such as Stripe, PayPal, and SendGrid to allow advanced functions.

Along with the technical release, Peiko ensured the system was fully ready for use. The client’s team was taught how to run the platform independently, and there was clear documentation and help after the launch. Bitsten could go live quickly and keep the freedom to grow or change.

The platform is now a solid foundation for future blockchain projects. This is exactly the kind of result that shows Peiko’s strengths: speed, dependability, and your desired delivery.

Conclusion

Liquidity is one of the most important parts of any trading site. It changes prices, how things are done, and the general user experience. Taking care of it early on will help your platform run easily and stay competitive over time.

Among top liquidity providers, Peiko gives projects that want to start or grow quickly a clear and useful way. It’s a good choice for teams that want speed, dependability, and long-term flexibility because it has a ready exchange system, built in liquidity, and a structured delivery process. Let’s discuss your idea if you want to make a crypto platform that exceeds your expectations!

FAQ

A cryptocurrency liquidity provider makes sure that there are enough assets for smooth dealing. During high market movement or volatility, top liquidity providers keep order books full and prevent price slippage. They help buyers and sellers make deals quickly.

Liquidity lets traders instantly join and leave positions at prices they can predict. Users may experience slippage, delays, or failed sales without it. The reputation of the site, user trust, and making a reliable, scalable trading experience depend on it.

Institutional LPs have a lot of money. Retail market makers use algorithms. Aggregators put together sources. Decentralized AMMs are driven by users and internal LPs. There are different uses and levels of market volume for each type.

Many people know that Binance has the most liquid assets and the tightest gaps. But Coinbase, OKX, Kraken, or Bybit might be better for you based on where you live or the currency you’re trading.

The best liquidity provider crypto depend on what business needs. The depth and dependability of institutional LPs are great. Peiko has a strong liquidity management so that your solution can reach its best.