Want to create a top-notch cryptocurrency exchange in 2025? Maybe you have done some research and understand that it’s not a cheap endeavor.

On the basis of functionality and size, initial investment can range from $137,000 to well over $300,000—assuming you are also adding state-of-the-art features. These functionalities include real-time Order Book systems, margin trading capabilities, institutional-level security, and more. Licensing, hosting, and ongoing technical support also add cost to the final cryptocurrency exchange software price.

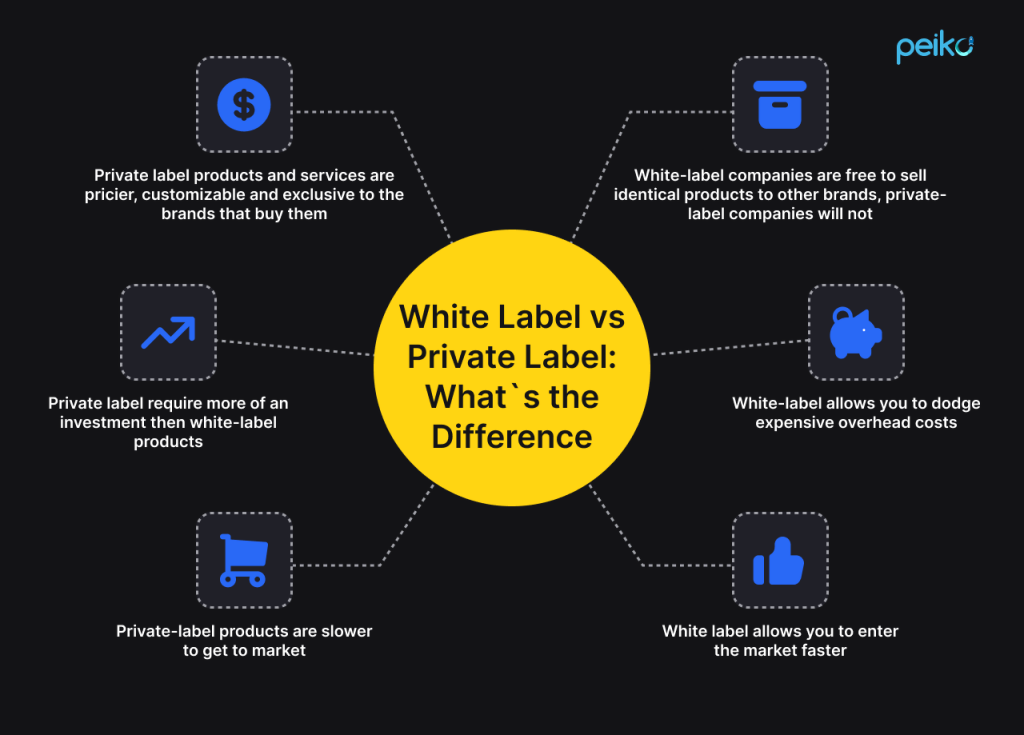

But for those who prefer to enter the market without shouldering the expense of the high upfront cost, there is a smarter way. Our white-label crypto exchange offering is a fast, affordable way in—only $95,000.

Now, let’s talk about the cryptocurrency exchange development cost and consider which expenses are included in this development process.

Core development costs

Projected cost: $80,000 – $120,000

How to start a crypto exchange and how much the development services cost? Creating a CEX from the ground up is a multidisciplinary process that takes more than coding. To be successful, an exchange needs to possess a sound technology base, legal soundness, and a trustworthy operational component.

A typical startup budget to start cryptocurrency exchange will significantly depend on the location of the development team and experience.

How expertise and team location influence pricing

Development cost and quality rely on geography and team expertise:

India: Developers might provide full-platform builds for as little as $10,000, but they tend to be weakly optimized and unstable. Firms that charge $50,000–$80,000 manage to provide somewhat higher quality, although concerns about quality and reliability among developers remain.

Ukraine: Prices can begin at $40,000–$50,000 for novice teams, but skilled Ukrainian developers usually charge between $150,000–$400,000, depending on the feature set and complexity of the exchange.

Europe: European businesses usually operate between the $400,000 to $600,000 range, which reflects a balance between the level of quality, project management, and security.

United States: Development firms based in the United States are the most expensive, ranging from $400,000 to over $1 million. These generally include high-level development practices, robust compliance systems, and constant maintenance.

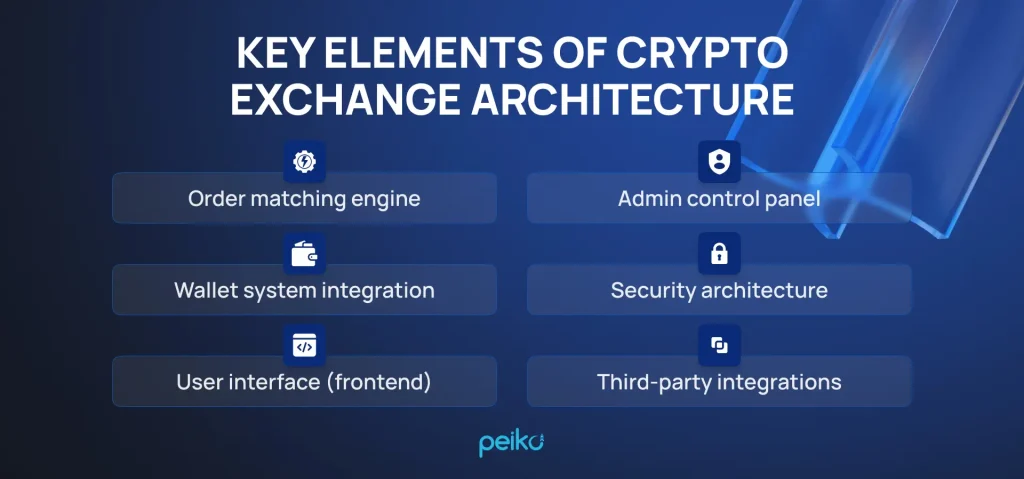

Essential crypto exchange development components

Below is a segmentation of the key development elements necessary to build a robust exchange infrastructure.

Order matching engine

This is the core of the exchange—handling matching and executing trades properly and quickly. Building a low-latency fault-tolerant engine requires special knowledge and extensive testing.

Wallet system integration

Having hot and cold wallet infrastructure support is vital to create cryptocurrency exchange , ensure that users’ funds are secure and that fast transactions are supported. Wallet integration needs multi-blockchain support and be capable of supporting deposits, withdrawals, and secure storage.

User interface (frontend)

A fluid and user-friendly interface is the heart of a good trading experience. This includes the aesthetics and feel of trading dashboards, order pages, asset overviews, and individual account sections.

Admin control panel

Platform operators need to be able to access a secure backend for support request handling, fee changes, trade watching, and user administration. The backend should also provide reporting and access controls.

Security architecture

Securing user information and funds is crucial. This entails:

- Implementing 2FA (two-factor authentication)

- Using end-to-end encryption

- Implementing anti-DDoS and anti-phishing security

- Implementing role-based access management

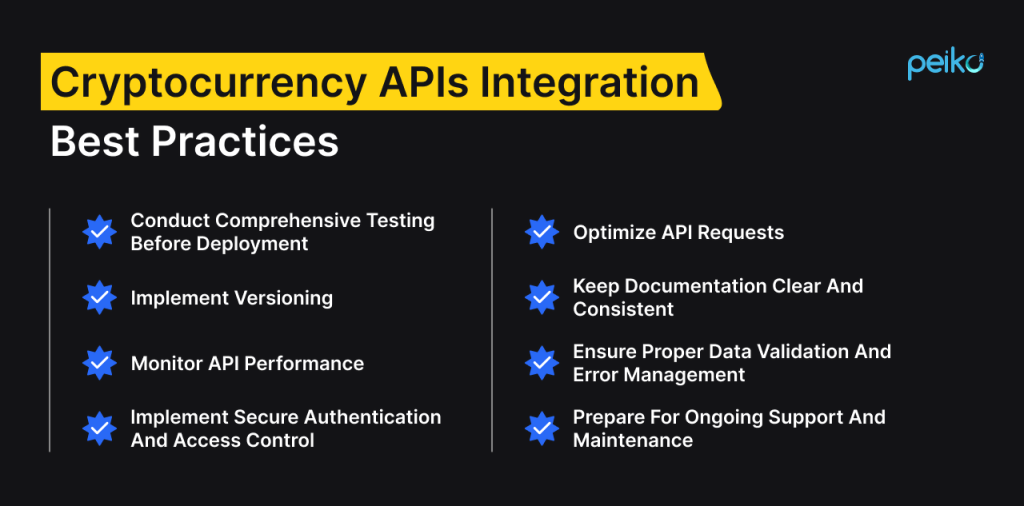

Third-party integrations

Outside services are sometimes necessary for exchanges to use for KYC (know your customer) verification, liquidity, payment processing, and blockchain access. These exchange services must be integrated with secure connections and strong APIs (application programming interfaces).

Legal and compliance costs

Projected cost: $20,000 – $40,000+

Compliance is no longer an option for the crypto world—it’s operationally a fact now. Your exchange requires time, paperwork, and expert advice to meet local and global legal standards. All these services also influence the price to start cryptocurrency exchange.

Entity development & jurisdiction establishment

Selecting your jurisdiction and making your operation formal is step one. Keep in mind that legal setup, licensing, and ongoing compliance services costs vary greatly depending on jurisdiction.

- UAE (Dubai): Crypto-supportive jurisdiction with licensing typically ranging from $50,000 to $100,000.

- USA: One of the most expensive and bureaucratic regions, with fees often in excess of $150,000–$300,000+.

- Europe & Offshore: In jurisdictions like Poland, Baltics, or offshore destinations (e.g., BVI), adherence can be cheaper—usually $20,000 to $70,000.

Licensing requirements

How to start a crypto exchange legally? Most crypto exchanges utilize a license, which includes:

Virtual Asset Service Provider (VASP) license

This license is required in certain jurisdictions for firms that have dealings with digital assets, i.e., crypto exchanges or wallet services. It ensures that these firms are compliant with regulations intended to avoid money laundering and terrorism financing.

Money Services Business (MSB) registration

In the US, all businesses that engage with cryptocurrency are required to register as an MSB with FinCEN. This classification includes businesses that engage in money transmission or currency exchange, and they must have anti-money laundering policies and submit regular compliance reports.

Cryptocurrency exchange license

A broad term to describe the legal authorization necessary to run a crypto exchange. Nations vary in their licensing needs, but typically encompass regulatory control, protection of customers, and financial accountability.

KYC/AML compliance

You will need to implement an identity authentication system for users and report suspicious activity, according to anti-money laundering (AML) and know your customer regulations. This typically encompasses:

- Issuing KYC/AML guidelines

- Installing identity verification vendors

- Logging and monitoring transactions

Legal documentation

Clear, well-written legal papers are crucial to protecting your business and building trust with users. They are:

- Terms of service

- Privacy policy

- Risk disclosures

- User agreements

Continuing legal counsel

With changing laws, continuous legal guidance is required to stay compliant across jurisdictions and keep internal policies up-to-date.

Regulatory errors can lead to heavy fines or being shut down. Investing in compliance ahead of time reduces legal risk and instills credibility into your platform.

Operational costs

Projected cost: $2,000 – $40,000

How much does it cost to start a cryptocurrency exchange? The price consists of many components. Apart from development and regulation, running a crypto exchange comes with operational overhead. These are the backend and periodic costs needed to have your platform up and running and scale with demand.

Server infrastructure and hosting

Crypto exchanges must be hosted on high-performance servers with scalability, data redundancy, and 24/7 uptime. Solutions such as AWS or Google Cloud are utilized for this purpose.

System maintenance and support

Continuous enhancements, bug fixes, and updates are part of running a live trading environment. These include server monitoring, version upgrades, and performance tuning.

User support services

Active customer support helps users to cope with issues like delayed transactions, login problems, or identity verification problems. Choices include live chat, ticket systems, or outsourced helpdesk services.

Fraud detection and monitoring

To maintain platform integrity, you’ll need tools for detecting suspicious transactions and monitoring user activity. Advanced analytics and alert systems are often integrated for this purpose.

Marketing strategy and community building

An exchange’s success depends heavily on user acquisition and retention. Initial marketing campaigns, influencer partnerships, SEO, and referral programs should all be factored into the launch strategy.

Sustained operations determine the long-term viability of your exchange. Launch success is only the beginning—getting users engaged and keeping the platform stable is what drives sustained growth.

Ongoing maintenance and upgrades

Typical yearly cost: $20,000 – $50,000 (scale and complexity dependant)

Having a crypto exchange operational is only the first hurdle—the true challenge is keeping it efficient and reliable. In the fast-evolving digital asset environment, technology evolves rapidly, as do user demands and regulatory obligations. To be competitive, your exchange will require continuous technical maintenance and the occasional update.

How much does it cost to make a cryptocurrency exchange? To provide a clear answer, we should consider what continuous technical requirements include:

Security monitoring and updates

Given the high-risk status of crypto exchanges, both centralized and decentralized, regular vulnerability scanning is crucial. This means the application of security patches, firewall updates, and the performance of penetration tests to identify and fix potential threats before they reach users.

System and software updates

Matching engines, wallets, APIs, and admin panels on exchanges need continuous updates for performance improvement, bug fixing, and compatibility with emerging tech standards.

Blockchain networks frequently release updates or forks, which require timely adjustments to your platform to maintain uninterrupted services and ensure compatibility with current chain protocols.

New feature development

To retain and grow your user base, you’ll want to introduce new functionalities—such as margin trading, staking, fiat gateways, or mobile trading apps. These updates are critical for meeting evolving market expectations.

Compliance modifications

Regulations are constantly shifting. Your system must be adapted to reflect new AML/KYC rules, data protection laws, and regional compliance frameworks—often on short notice.

Performance scaling

As your platform grows, you’ll need to scale cloud infrastructure, optimize backend processes, and enhance database performance to support increasing volumes of users and transactions.

Continuous maintenance is not an option but a necessity. In the absence of updates, your exchange is susceptible to security compromises, regulatory violations, and customer dissatisfaction. Regular maintenance ensures long-term stability and competitiveness.

Contingency and unexpected costs

Recommended reserve: 10–15% of initial budget (~$15,000 – $30,000)

No matter how diligently your initial planning is, unexpected costs are inevitable in creating and introducing a crypto exchange. Experienced founders prepare for this by earmarking a reserve budget to mitigate these surprises without compromising quality or delaying launch.

Here are some examples of common unexpected costs:

Legal or regulatory hurdles

New approval procedure delays or licensing needs can create additional legal counsel, document filing, or re-filings. This all can increase your total expenses.

Service provider changes

Third-party service providers such as payment processors, KYC providers, or liquidity aggregators may modify terms, prices, or availability, requiring fast switch and re-integration work.

Emergency fixes and quick deploys

Catastrophic bugs or security flaws introduced post-launch will likely need instant developer fixes. Last-minute fixes may mean overtime fees or exposure to additional software quality testing.

Infrastructure expansion

If your platform has seen exponential user growth past expectations, you may need to host environments at scale, add support capacity, or add cloud infrastructure at short notice.

Marketing strategy adjustments

If you’re lagging on initial campaigns, you might need to re-invest in paid acquisition, influencer collaborations, or community-building initiatives to meet user growth objectives.

Your contingency budget is your financial safety net. It provides cash flow agility to quickly solve issues before they become bigger problems, and maintain your exchange on track—regardless of the unforeseen turns life may bring.

Summary of estimated costs (2025)

Launching a centralized cryptocurrency exchange in 2025 is a considerable but manageable investment when done with careful planning.

Below is a detailed breakdown of the primary crypto exchange development cost categories involved, along with estimated ranges based on current industry standards.

| Cost category | Estimated range (USD) | Description |

| Platform development | $80,000 – $120,000 | Design and build of the exchange infrastructure, including the trading engine, wallet systems, frontend/backend, and security measures. |

| Legal and compliance | $20,000 – $40,000 | Licensing, regulatory filings, KYC/AML procedures, and legal documentation. |

| Operational infrastructure | $2,000 – $40,000 | Hosting costs, transaction monitoring, ongoing operations, customer support, and marketing expenses. |

| Ongoing maintenance and upgrades | $20,000 – $50,000 (annually) | Regular system updates, feature enhancements, and compliance adjustments. |

| Contingency fund | $15,000 – $30,000 | Funds reserved for unexpected expenses such as legal delays, vendor changes, or unplanned maintenance. |

| Final price | $137,000 – $280,000 | The total one-time setup cost, excluding ongoing maintenance and unforeseen costs. |

Keep in mind that the total cryptocurrency exchange development cost may vary depending on the specific requirements, jurisdiction, and scale of your project.

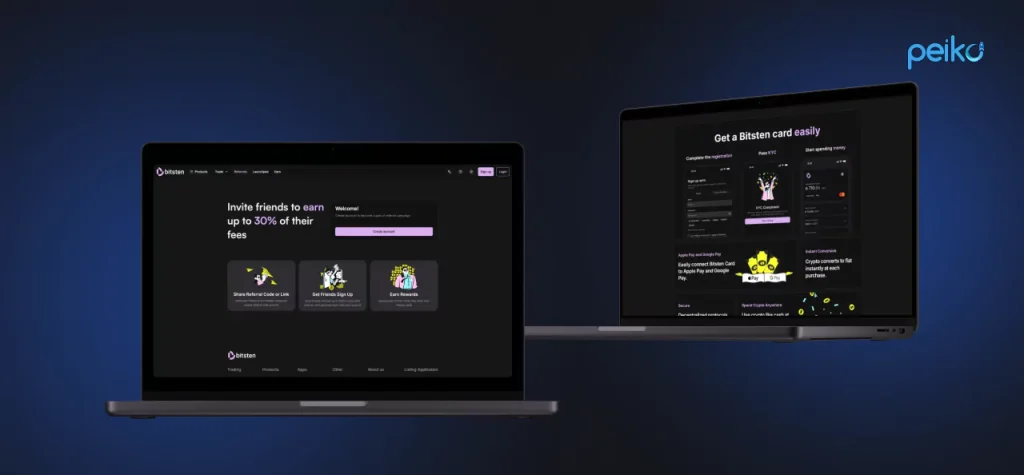

Launch a full-featured crypto exchange at an affordable price

If building from scratch seems overwhelming or resource-draining, go the more simplified route. You can start your own crypto exchange with our white-label solution, which offers a fully featured, customizable platform for just $95,000.

Here are the main benefits of our crypto exchange solution (these features you definitely need to engage users and ensure a seamless trading experience):

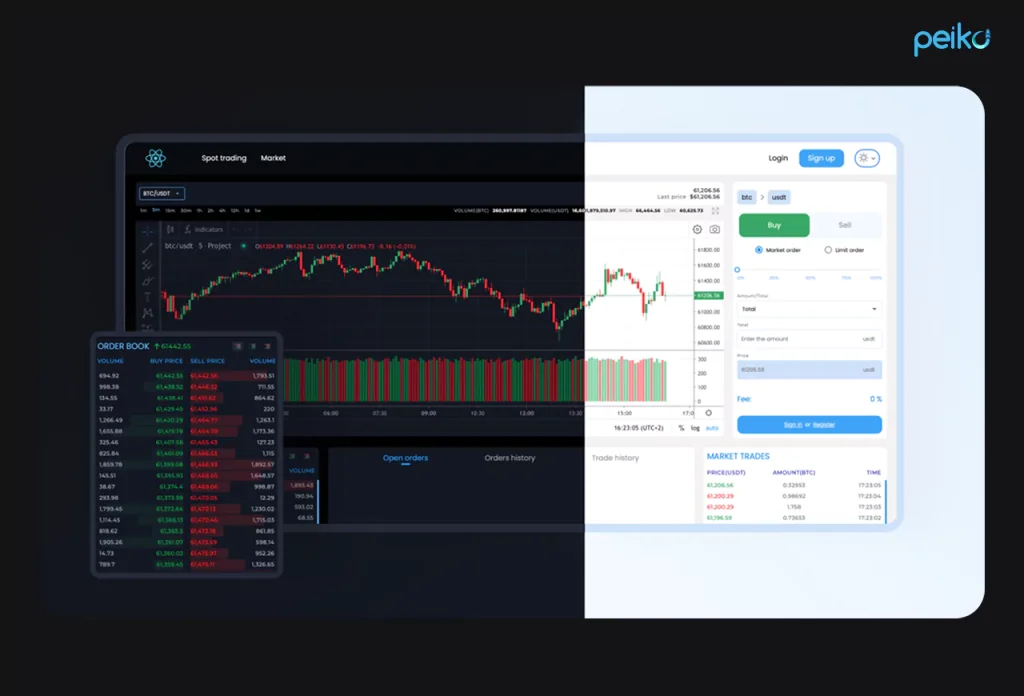

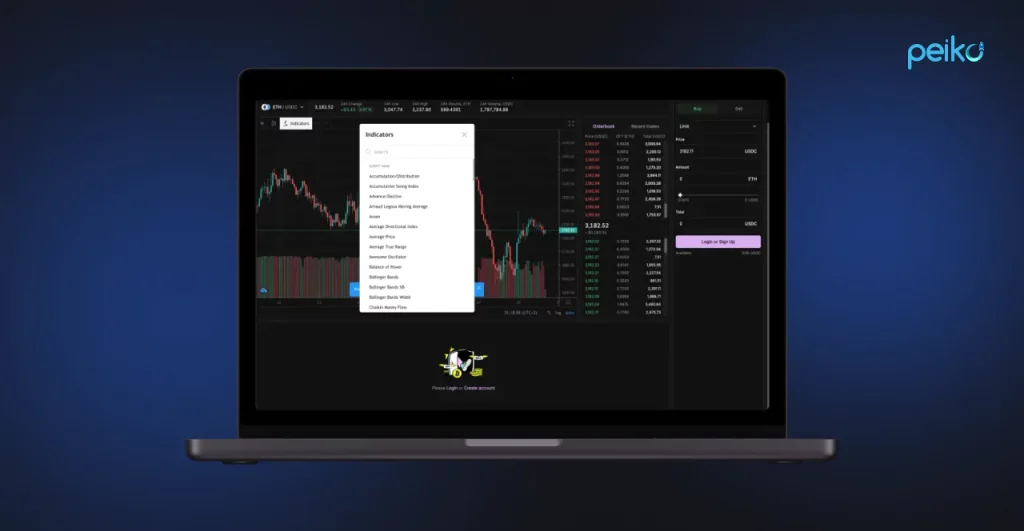

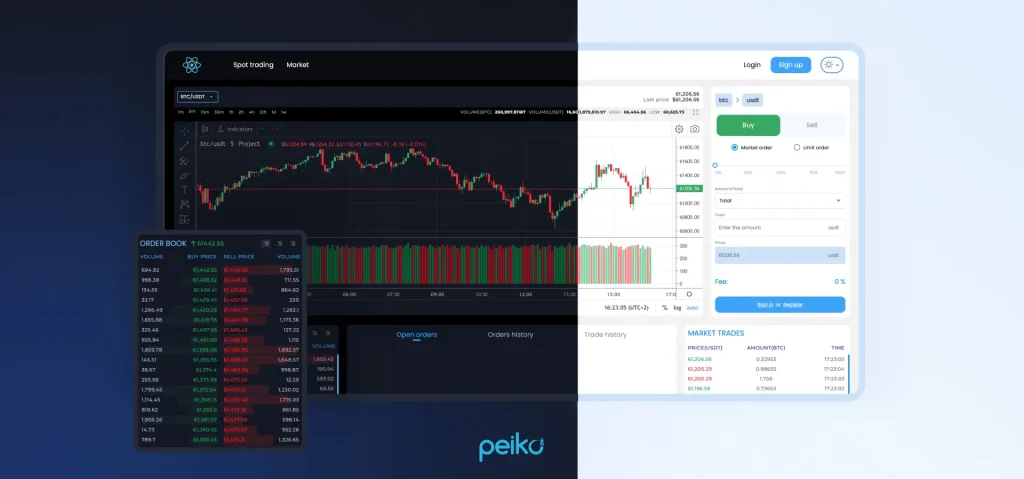

Advanced trading tools & TradingView integration

Deliver a professional-grade trading experience with real-time Market and Limit orders, executed in milliseconds thanks to our lightning-fast matching engine. Integrated TradingView charts give your users the visual tools they need to analyze market trends and make informed trades, live and on the go.

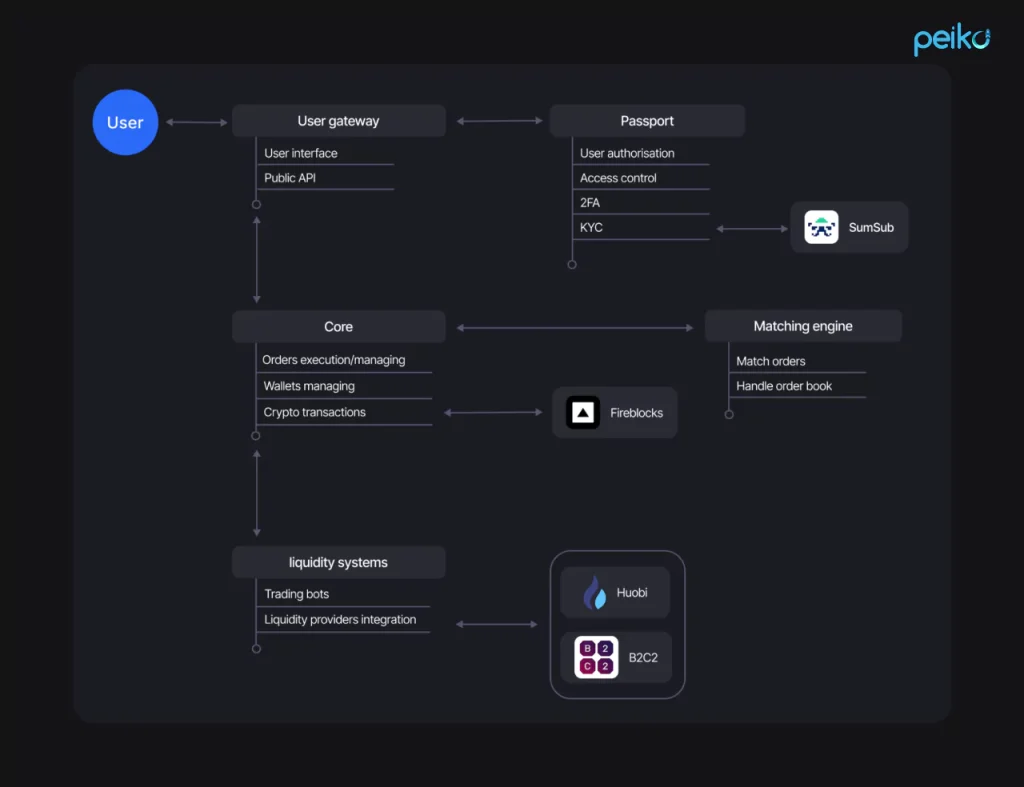

Microservices architecture for peak efficiency

Our platform is built on a microservices-based system, ensuring high reliability, modular scaling, and top performance. The exchange handles up to 10,000 transactions per second, and performance can be boosted instantly with additional server power.

With auto-scaling built in, your system adjusts resources based on real-time demand, keeping costs low while maintaining maximum performance.

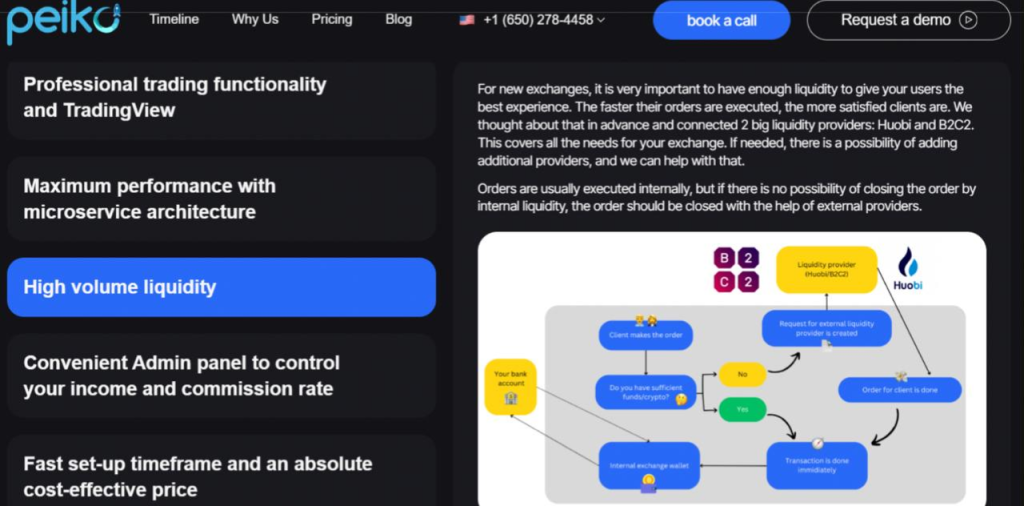

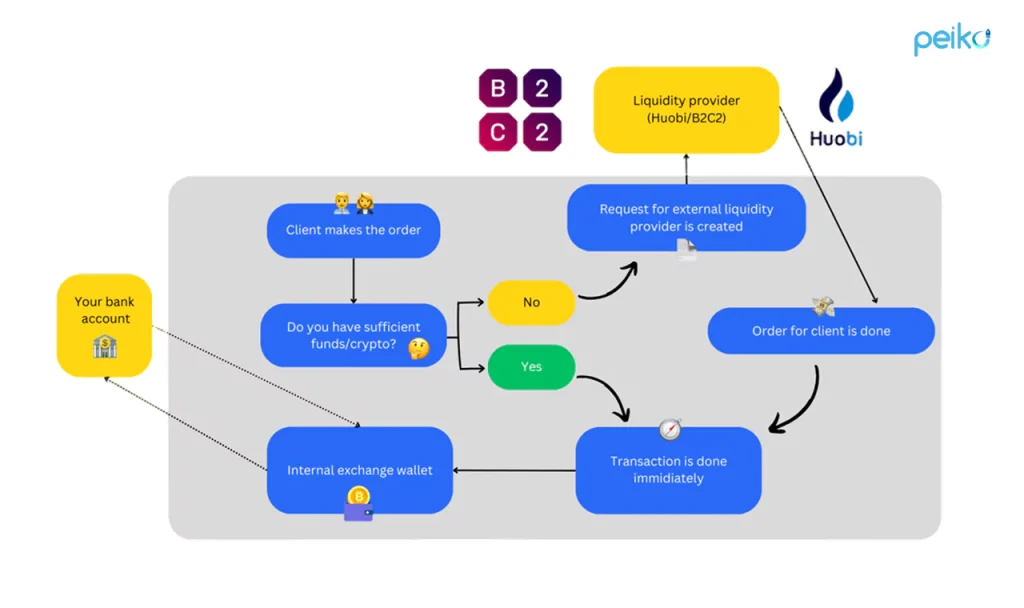

Robust liquidity from global providers

We’ve partnered with leading global liquidity providers Huobi and B2C2 to ensure that your exchange has deep liquidity from the start. This ensures quick order execution and a seamless trading experience for your users. Internal order matching is prioritized, with external providers used only when necessary.

Need more liquidity options to build cryptocurrency exchange? We can help integrate additional providers to fit your strategy.

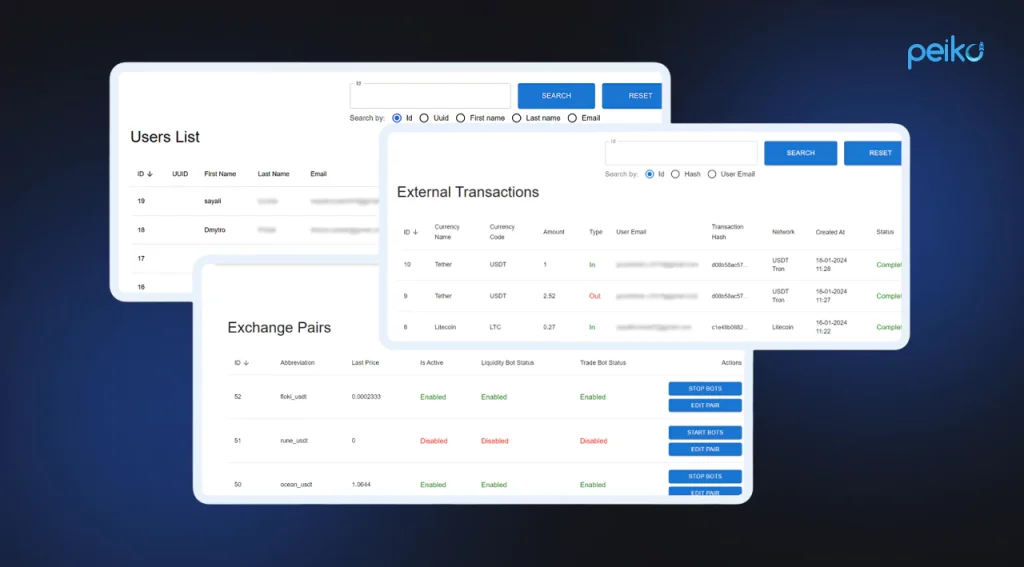

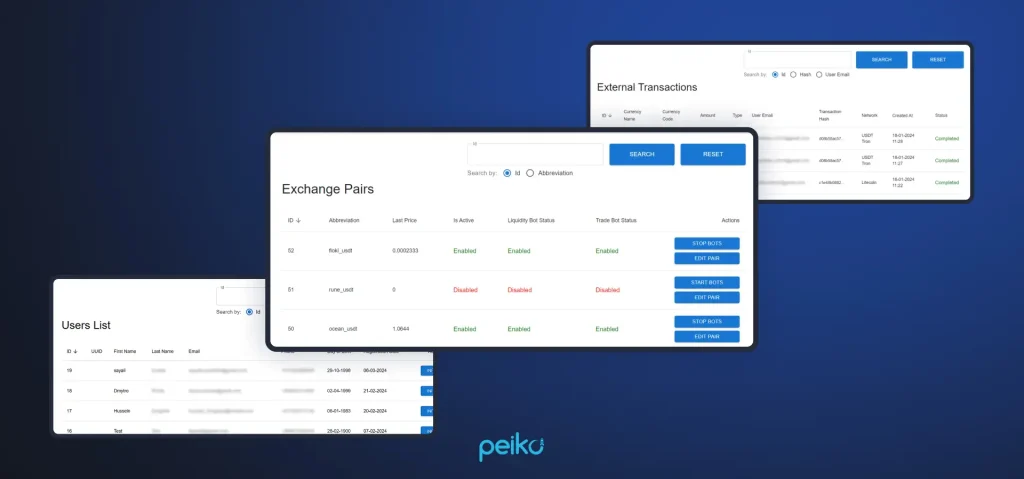

Comprehensive and secure admin control

Manage your platform with ease through a feature-rich admin dashboard. Adjust trading fees, oversee user activity, assign trading tiers, and monitor platform performance—all from a single control panel.

For maximum security, admin access is limited to operational controls—funds are never accessible through the admin panel. You stay in control while keeping assets safe.

Quick setup, full ownership, huge savings

You don’t need to wait 18–24 months and spend a fortune to start your own crypto exchange from scratch. Our solution is fully developed, tested, and ready to deploy on your own servers, giving you complete ownership and freedom to scale.

In just 3 weeks, you can create crypto exchange platform at a fraction of the usual cost—up to 5–6 times more affordable than custom-built platforms.

You save time, money, mitigate risk with a white-label crypto solution, and have complete control of branding and business operations.

Conclusion

Starting a crypto exchange in 2025 can be life-changing for you as a business owner but it requires a lot of investment and responsibility. How much does it cost to create a cryptocurrency exchange this year? On average, starting a professional platform can cost anywhere from $137,000 to $280,000 to create, establish legally, provide infrastructure, and meet operational needs.

For those looking to fast-track the process and reduce initial expenses, a white-label crypto exchange is a strategic option. For just $95,000, Peiko’s turnkey solution offers a fully functional, customizable trading platform with built-in security, wallet systems, and compliance tools—just go to market.

If you’re willing to get into the crypto market without the wait or frustration of building from scratch, Peiko can help you build cryptocurrency exchange quickly and inexpensively. Let’s get started—get in touch with us today.

FAQ

Prices tend to be between $165,000 and $280,000, depending on complexity and scope. An exchange can be rolled out white-label for as low as $95,000.

Key drivers of cost are complexity of features, security setup, legality compliance, payments and KYC integrations, and your development strategy.

A peer-to-peer exchange will cost anywhere from $80,000 to $150,000, depending on the core functionalities and system design.

Yes. You can either start from scratch or implement a white-label solution in order to save time and reduce development costs. How much does it cost to start a cryptocurrency exchange? Our white-lable solution costs just $95,000.

It may be challenging due to technical, legal, and operational requirements—but white-label options make it easier in a big way and very fast.