Daily trading volumes reaching billions that shows the popularity of crypto exchanges and their business potential for owners. But the problem is high competition on the market, security threats, and regulatory demands. You know, a single vulnerability can lead to catastrophic losses, while strong execution can position your exchange as a leader, generating impressive daily revenue.

This brief will take you through every stage of starting a crypto exchange. We’ll start with market research. Then, we’ll dive into the technical infrastructure. You will discover how to pick the best technology stack, implement a secure trading engine, and how to make the platform scalable. From there, we’ll break down legal and regulatory considerations, including licensing requirements in major jurisdictions and compliances.

Are you an entrepreneur? A blockchain startup or an institutional investor? This article will provide the insights you require to build crypto exchange that is robust, compliant, and scalable.

Let’s begin our research!

Market research and planning

It takes a strategic approach to create cryptocurrency exchange. You need a solid business plan, deep market research, and a distinct value offer to be successful. Every vital stage will be covered below, from identifying your competitive edge to comprehending your audience.

Identify your target audience

Starting a crypto exchange that attracts and keeps traders requires an understanding of your user base. There are various user groups in the Bitcoin trading market, and each has specific requirements:

- Retail traders: This group consists of individual investors seeking a user-friendly trading platform with competitive costs, a wide range of cryptocurrencies, and support for fiat on-ramps. Platforms that provide sophisticated charting tools, staking opportunities, and reward systems attract a lot of retail traders.

- Institutional investors: Algorithmic trading, hedge funds, family offices, market makers, and prop trading firms require a solid stack. Specifically, it means strong application programming interface (API) access, low-latency order execution, and deep liquidity. Institutions prioritize security protocols, and counterparty risk management. In contrast to retail traders, they frequently look for enterprise grade reporting tools and specialized trading solutions.

Because market preferences and legal regimes differ, geographic targeting also deserves attention. For instance, Asia dominates derivatives trading, whereas the European market strongly emphasizes compliance (MiCA laws). Or, concerns about inflation have led to a significant demand for fiat-crypto on-ramps in Latin America. As you see, an exchange can maximize its products and compliance strategy by recognizing such subtleties.

Analyze the competitive landscape

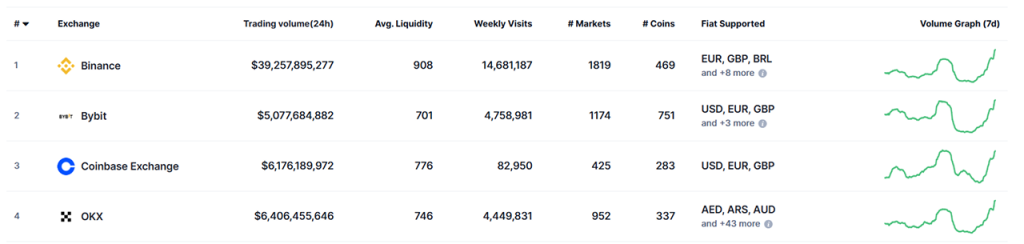

There are only a few giant corporations that control most of the cryptocurrency exchange business. However, to start your own crypto exchange, you can find a niche by examining the advantages and disadvantages of their competitors. Create market gaps and opportunities by knowing where your competitors succeed and fail.

- Binance: Largest by trading volume. It provides many trading pairs, good liquidity, and premium features like margin trading and futures. Its regulatory status is unclear in most territories, though. It is difficult to do business and limits access by users in some areas.

- Coinbase: By emphasizing security, transparency, and fiat on-ramps, compliant exchange Coinbase leads the US market. In contrast to Binance, it has fewer pro trader products and charges much more fees than exchanges.

- Kraken: With its advanced futures and margin, Kraken is appealing to institutional traders and is well known for its robust security features. It is restricted in its use by retail traders due to its less consumer-friendly interface than Binance and Coinbase.

Market trends also have an impact on the competitive landscape. The majority of centralized exchanges (CEXs) have been forced to add decentralized finance (DeFi) features, including staking and liquidity pools. Additionally, regulatory actions taken against specific platforms have made room for regionally compliant exchanges to draw in users looking for stability.

Define your unique selling proposition (USPs)

What will make your exchange stand out? With a market already flooded with well-established exchanges, you must determine how to differentiate yourself in order to start a cryptocurrency exchange that will thrive. A running exchange must incentivize traders to change or join it.

One specialization in a single trading specialization is one. Through ultra-low latency trading, colocation, and best liquidity aggregation, for instance, some exchanges target high-frequency traders and institutions. Others aim at retail adoption through the provision of compelling interfaces, gamified trade experiences, and education.

Positioning by regulations is another differentiation strategy. Due to regulatory uncertainties, most exchanges must curtail services or leave profitable markets. That means that establishing trust is mostly a matter of jurisdictional licensing, conformity with legislation, and secure banking relationships.

Choose your business model

The structure of your exchange defines liquidity, security, compliance, and user experience. Your choice will dictate your exchange’s operational complexity, revenue model, and regulatory exposure.

Centralized exchange (CEX)

- Requires sole control of user funds, creating security and compliance requirements.

- Offers high liquidity, fast transactions, and fiat on or off ramps for easy user access.

- Examples include Binance, Coinbase, Kraken—top exchanges in regulated, high-volume trading.

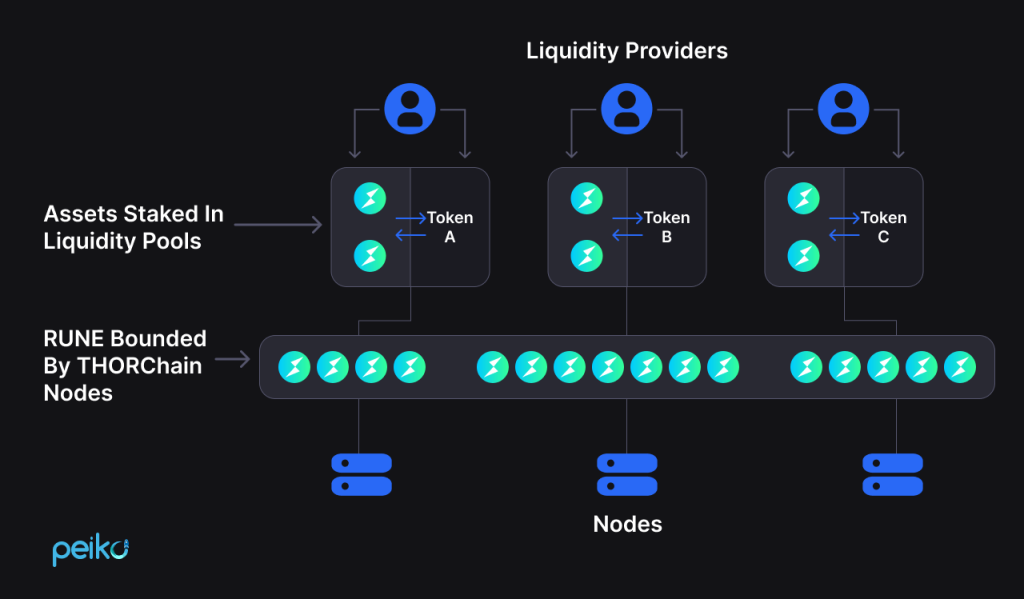

Decentralized exchange (DEX)

- DEXs eliminate intermediaries, relying on smart contracts for trade execution.

- Users retain full control over assets, reducing counterparty risk but requiring self-management.

- Examples: Uniswap, SushiSwap, Curve Finance—top platforms for trustless trading.

Hybrid exchange

- Combines CEX liquidity with DEX security, offering a balanced trading experience.

- Provides decentralized custody while maintaining an order book structure for efficiency.

- Examples include Injective Protocol and DeversiFi—pioneering future exchange models.

Create a detailed business plan

A crypto exchange is a risky venture that requires adequate planning. Even successful ones can collapse as a result of unsustainable business models, regulatory challenges, or liquidity problems if they lack a solid business plan. Successful exchanges like Binance, Kraken, and Coinbase created financial projections, marketing strategies, and operational models.

Here’s what you should do to start a crypto exchange successfully:

Make financial projections

The financial viability of a crypto exchange depends on alternative sources of income apart from trading fees. As much as listing and withdrawal charges are a supplementary source of earnings, an optimal maker/taker fee mechanism drives liquidity. Leading exchanges such as Binance and Coinbase generate billions of dollars a year by diversifying revenues through NFT marketplaces, lending, futures trading, and staking services.

Expenses are steep, however—custom-built exchange systems may run more than $1 million. Sizable reserves are required for liquidity provision. Continued investment in legal, audit, and risk management staff is required to ensure regulatory compliance. These expense and revenue factors are balanced in a sustainable financial plan, which also ensures long-term scalability.

Create marketing strategy

A forceful institutional and retail marketing push is needed to establish a competitive exchange.

Retail adoption is dependent on influencer collaborations, referral programs, and SEO-driven organic traffic. Institutionals deals with market makers and liquidity providers, on the other hand, guarantee deep order books.

To lure in traders, top platforms invest in multi channel marketing that includes VIP incentives, bonus deposits, and commission free trading activities. Coinbase maintains regulatory trust to onboard mainstream customers. Binance utilizes community centered marketing and international influencer networks to expand quickly. Maintaining growth involves an informed strategy for user acquisition, participation, and holding.

Develop operational plan

An exchange’s capacity to manage user pressures, regulatory volatilities, and market volatilities is measured by its operational efficiency. Legal stability is ensured through jurisdiction-based compliance processes and licensing frameworks, which constitute the backbone of a stable foundation.

Main exchanges provide 24/7 multilingual customer support with AI chatbots and VIP customer support, but customer care has to grow with demand. Risk management cannot be compromised. Thus, to avoid fraud and litigation, anti-money laundering/know-your-customer (AML/KYC) procedures, transaction monitoring, and periodic security audits are mandatory. Even the top exchanges run the risk of hitting legal issues, liquidity issues, or security loopholes without these pillars.

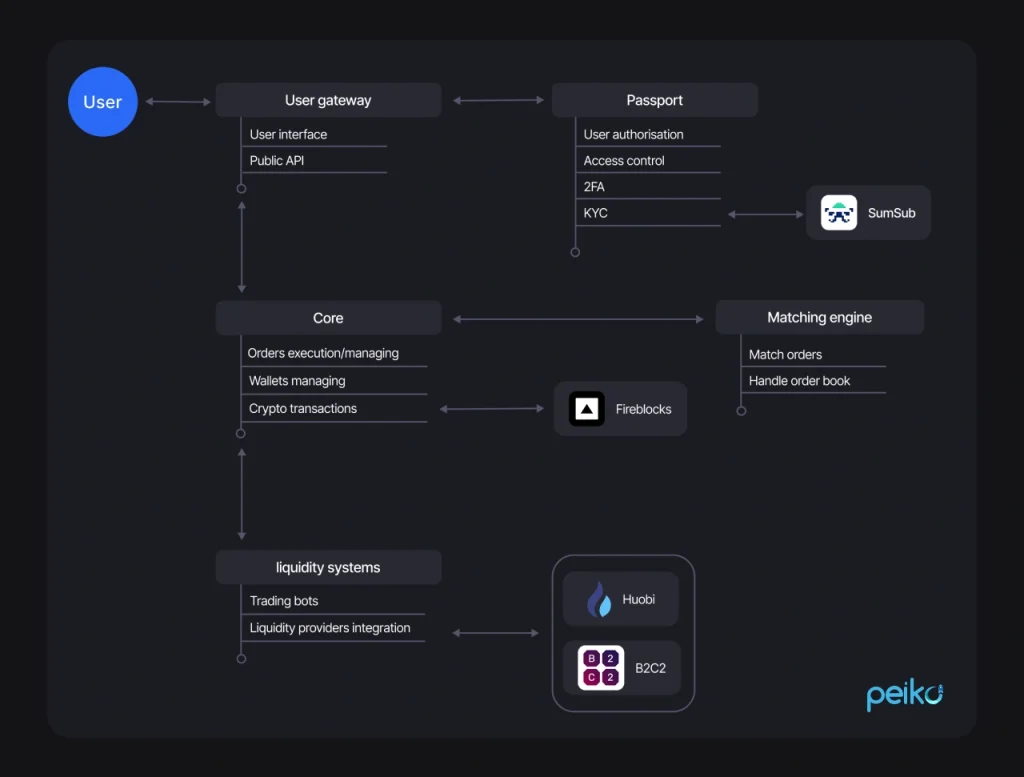

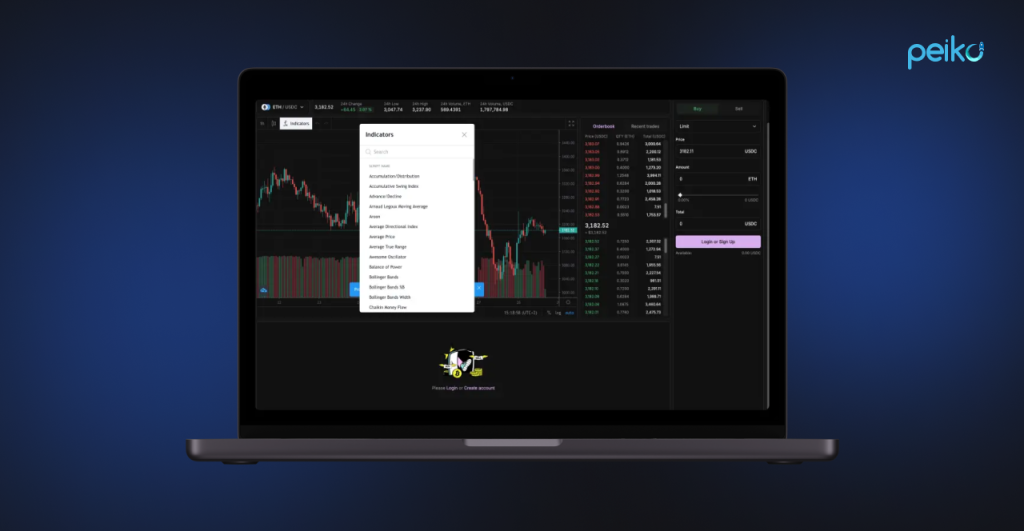

Technical infrastructure

Now, let’s discuss the technological foundation. Beyond a slick user interface, a trading platform that processes millions of transactions per day needs a bit more. We mean a solid infrastructure, fault tolerant systems, and unwavering security. Here are the main technical elements that drive the most popular exchanges.

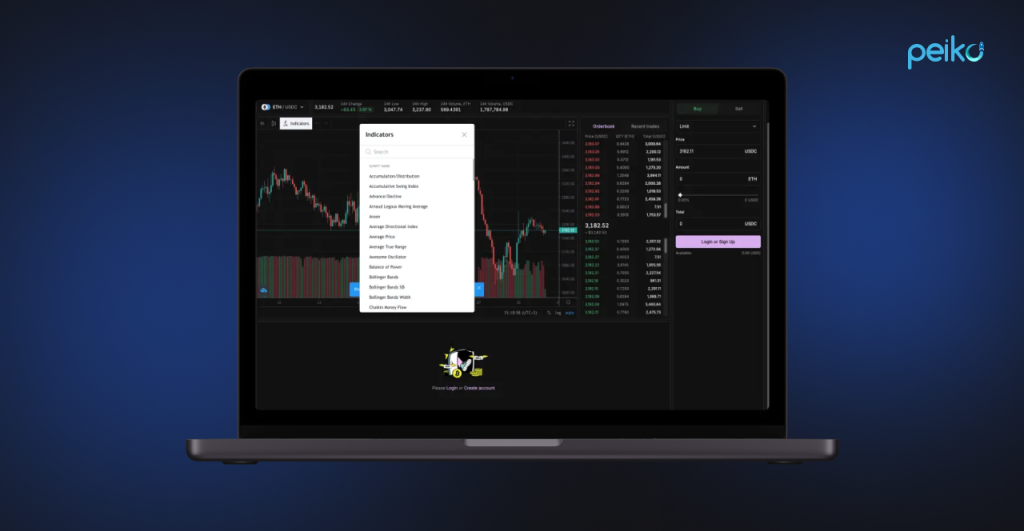

Choosing the right technology stack

A strong, scalable, high-performance technology stack guarantees smooth trade execution, security, and compliance.

Programming languages

They play a crucial role in designing Bitcoin exchanges. Because of the low memory and performance control necessary for order matching and execution, C++ and Rust are preferred. With the flexibility and large library, Python and Node.js are used for backend APIs. Solidity is the de facto standard for Ethereum-based decentralized exchanges on smart contract based platforms.

Databases

Managing user accounts, trade histories, transaction logs, and databases is the foundation of a cryptocurrency exchange architecture. MongoDB provides agility for managing unstructured data, and PostgreSQL and MySQL are frequently utilized for structured relational data.

Reducing latency in the processing of trades, high-frequency trading (HFT) platforms frequently incorporate Redis or Apache Kafka for real data streaming and caching. Exchanges today use distributed database systems like CockroachDB to ensure data scalability and consistency between global servers and avoid bottlenecks.

Cloud services

Owing to their security features, scalability, and compliance certifications, AWS, Google Cloud, and Microsoft Azure dominate the cloud services space. For full control of their security ecosystem, several cryptocurrency exchanges, particularly those operating in highly regulated geographies, go for self-hosted infrastructure. Load balancing and autoscaling capabilities like Kubernetes and Docker can be useful to cope with unexpected surges in traffic—a certainty in volatile cryptocurrency markets.

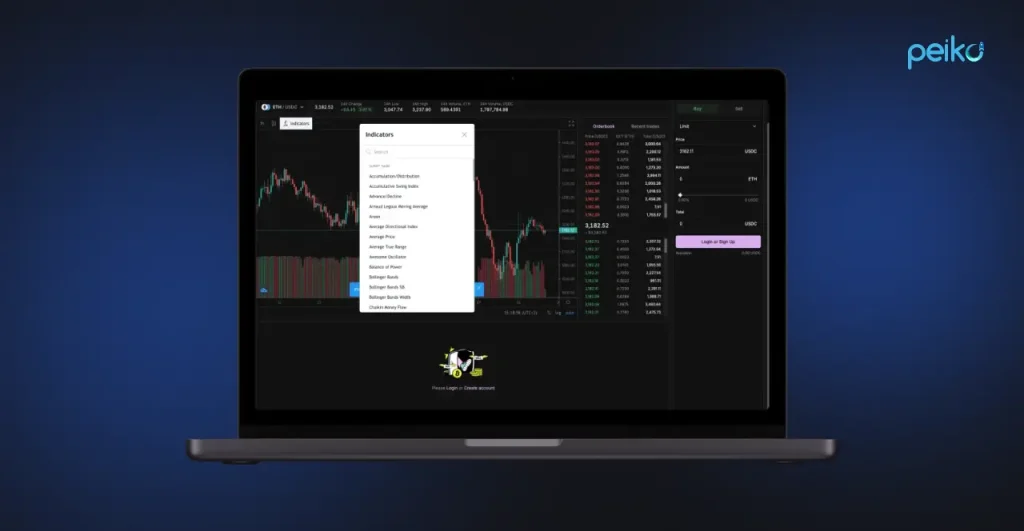

White-label solutions vs. custom development

Choosing to buy a white-label solution or create cryptocurrency exchange on a fully custom base is a critical choice in starting a crypto exchange. White-label systems have pre-built trading engines, liquidity integration, and security procedures. Since that, they provide a quicker and less expensive path to start cryptocurrency exchange. White-label systems, however, restrict customization and tend to need extra work to create special features.

But with custom development, you get complete control over the architecture. It enables you to include risk management features, scalability, and specific processes in trading. The infrastructure for building a crypto exchange like Binance and Kraken was optimized over the years to process millions of transactions per second. But the actual development can easily run from $500,000. Moreover, it needs a team of very experienced blockchain engineers.

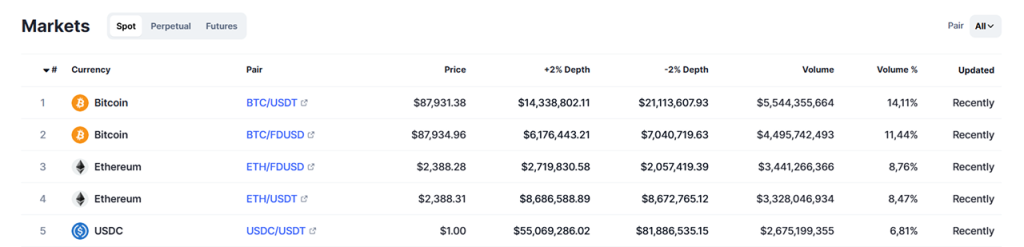

Implementing a robust matching engine for order processing

The most significant component of a cryptocurrency exchange architecture, which is tasked with the effective order execution of buy and sell orders, is a matching engine. In order to ensure price integrity as well as depth of liquidity, it must process the market, limit, and stop orders.

Low-latency engines used in leading exchanges are written in Rust or C++. They handle hundreds of millions of transactions per second. Asynchronous processing and cache memory (e.g., Redis) can further enhance order book management by diminishing latency and frictionless execution of trades.

Setting up secure wallets and cold storage for cryptocurrency assets

To start your own crypto exchange, security on your wallet takes precedence. Immediate withdrawals are handy with hot wallets but expose your wallet to the hackers, while cold storage or off-line wallets protect against hackers using computers.

Exchanges utilise primarily a multi-tier wallet configuration:

- 98% of funds put into multi-signature cold wallets for security.

- 2% kept in hot wallets for liquidity.

- Hardware security modules (HSMs) enforce withdrawal limits and prevent unauthorized access.

Ensuring platform scalability and reliability

To create a cryptocurrency exchange that could maintain the needs of anywhere within the world, one requires a platform strong enough to offer institutional-level infrastructure, high-frequency trade, and access through APIs. This is secured through database sharding, microservices architecture, and load balance through HAProxy or Nginx.

To prevent downtime during periods of high trading volume, leading exchanges employ edge computing and worldwide content delivery networks (CDNs) to lower latency for clients across various areas.

Security considerations

- DDoS mitigation: Use Cloudflare, AWS Shield, and rate-limiting techniques.

- Multi-factor authentication (MFA): Enforce mandatory 2FA for logins and withdrawals.

- End-to-end encryption: Secure data with TLS 1.3 and AES-256 encryption.

- AML and KYC: Automated compliance checks via Chainalysis or CipherTrace.

- Penetration testing: Conduct routine security audits and ethical hacking simulations.

Integrate the latest security features, scalable infrastructure, and a solid matching engine. This way, your exchange will be able to compete with industry giants, being extremely compliant and performant.

Payment processing and banking integrations

Smooth fiat on ramps and off ramps are a critical component of any cryptocurrency exchange. They fuel user adoption, liquidity flow, and regulatory compliance. A solid banking integration plan ensures traders can transfer funds from traditional financial systems to the digital asset space without disruption.

Integrate with fiat currency payment gateways for deposits and withdrawals

To enable fiat deposits and withdrawals, your crypto exchange architecture needs to be complemented with licensed payment processors with multi currency capability and real settlement.

Options like Simplex, MoonPay, and Banxa provide crypto-fiat rails with risk management capabilities, chargeback protection, and fraud detection features.

High-frequency exchanges usually employ direct API integrations with banks and processors to minimize deposit latency, decrease processing fees, and enhance user experience. Furthermore, substituting stablecoins (USDC, USDT, EURS) as an alternative on-ramp can reduce the reliance on legacy banking infrastructure without affecting liquidity.

Establish partnerships with banks and financial institutions

Establishing direct banking relationships is necessary for providing scalable fiat liquidity, fund management, and compliance monitoring. Such crypto banks as Silvergate, Signature Bank, and SEBA Bank provide business accounts, clearance of the tools, and digital asset custody services for crypto exchanges.

But, with the wave of derisking in conventional finance, obtaining a banking counterparty involves being highly compliant with AML/KYC rules, having a clean compliance history, and high levels of transaction visibility. Exchanges mitigate this risk by registering an electronic money institution (EMI) license. Or, collaborating with regulated payment institutions (PSPs) in key jurisdictions.

Offer multiple payment options

An expertly designed payment infrastructure enhances user convenience and offers frictionless crypto conversion. Various payment options suit different trader tastes and local banking realities. Below are the most critical payment options a crypto exchange should offer:

1. Credit/debit cards:

- Instant fiat deposits with crypto purchases.

- Supported by major providers: Visa, Mastercard, UnionPay, American Express.

- Higher fees (1-3% per transaction), but boosts user adoption.

- Chargeback risks require fraud detection and risk management solutions.

2. Bank transfers (Wire transfers & instant payments):

- SEPA (EU), SWIFT (Global), Fedwire (US), ACH (US) for direct fiat funding.

- Lower fees compared to card transactions, suitable for large deposits.

- Settlement time varies: SEPA (1-2 days), SWIFT (1-5 days), ACH (same-day or next-day).

- Requires strict KYC/AML compliance for high-value transactions.

3. Digital wallets & alternative payment methods:

- PayPal, Apple Pay, Google Pay, Skrill, Neteller enable quick deposits.

- Enhanced accessibility, particularly in regions with high mobile payment adoption.

- Transactions are processed instantly or within minutes.

- Ideal for retail users and cross border transactions.

4. Regional and emerging market payment solutions:

- PIX (Brazil), UPI (India), M-Pesa (Africa), Alipay & WeChat Pay (China).

- Expand user base in high-growth crypto adoption markets.

- Often integrated via local banking partners or third party payment processors.

- Requires regional regulatory compliance and licensing.

Manage transaction fees and processing times

Reducing transaction fees and settlement periods has a direct impact on the exchange’s profitability and user experience. Payment processors levy 1-3% per transaction for card payments, while SEPA/SWIFT bank transfers incur fixed fees with longer settlement periods (1-5 business days).

To remain competitive, leading exchanges use dynamic fee models, offering zero fee trading promotions, tiered transaction fees based on trading volume, and cashback rewards for highly frequent traders. Also, with Lightning Network, Faster Payments, and settlement protocols, withdrawal times can be dramatically shortened, raising possible transactions’ volume.

Legal and regulatory considerations

Opening a cryptocurrency exchange requires operating within a complex legal landscape. Legal obligations vary across jurisdictions, and failure to comply can result in heavy fines or shutdowns. A robust legal environment ensures operational stability, user trust, and long-term scalability.

The most critical legal verifications required to start a cryptocurrency exchange are listed below:

- Licensing and registration Procure necessary licenses (MTL in the U.S., VASP in the EU, etc.).

- KYC/AML compliance Implement strict identity verification to prevent fraud.

- Data protection Comply with General Data Protection Regulation (GDPR) or local data laws for user privacy.

- Tax and reporting Register with tax authorities and maintain transparent reporting.

- Custody rules Ensure safekeeping of fiat and crypto assets.

- Cross border compliance FATF (Financial Action Task Force) and international regulation compliance.

- Smart contract audits (for DEX) Conduct security audits of blockchain transactions.

- Regulatory updates Keep up to date and comply with legal updates on an ongoing basis.

Remember that legal compliance is not an isolated action but a constant necessity that evolves with market and regulatory updates. Keep up with updates so as not to catch hefty fines or even forced shutdowns.

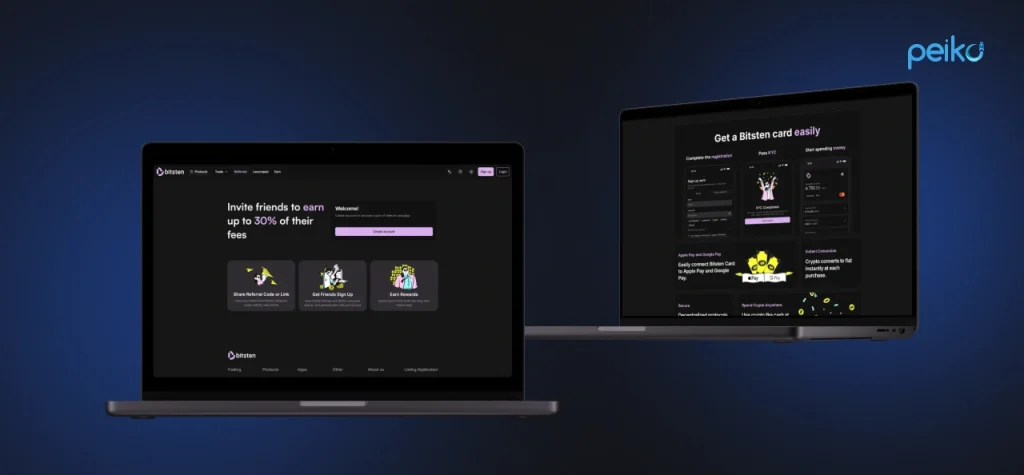

Peiko is your partner to start cryptocurrency exchange

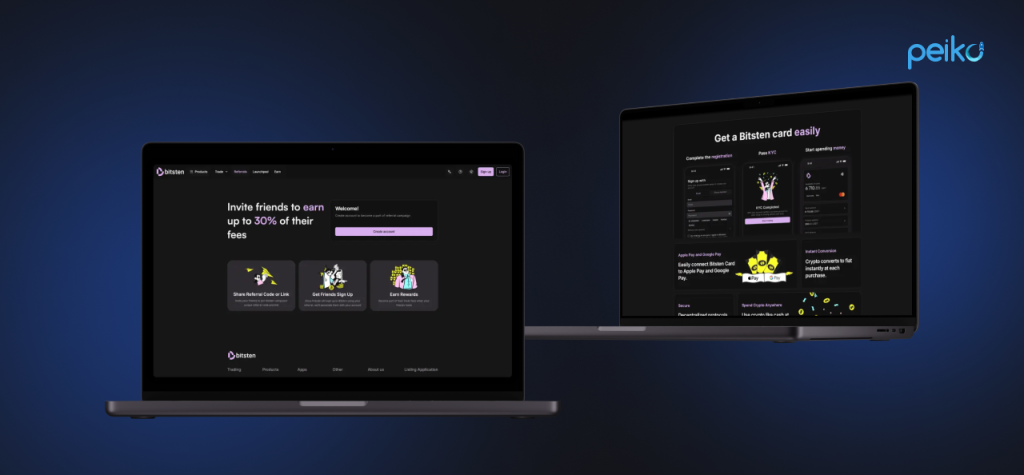

We pride ourselves on being among the top blockchain software development firms, designing specialized cryptocurrency trading platforms. Peiko is a forerunner in developing secure, scalable, and high-throughput financial infrastructures that enable firms to create reliable and appealing trading platforms.

We specialize in the entire development, from UI/UX optimizations, architecture design, security integration, and compliance. To learn more about our specialization, check our portfolio. We will work with you to set and build what you specifically want.

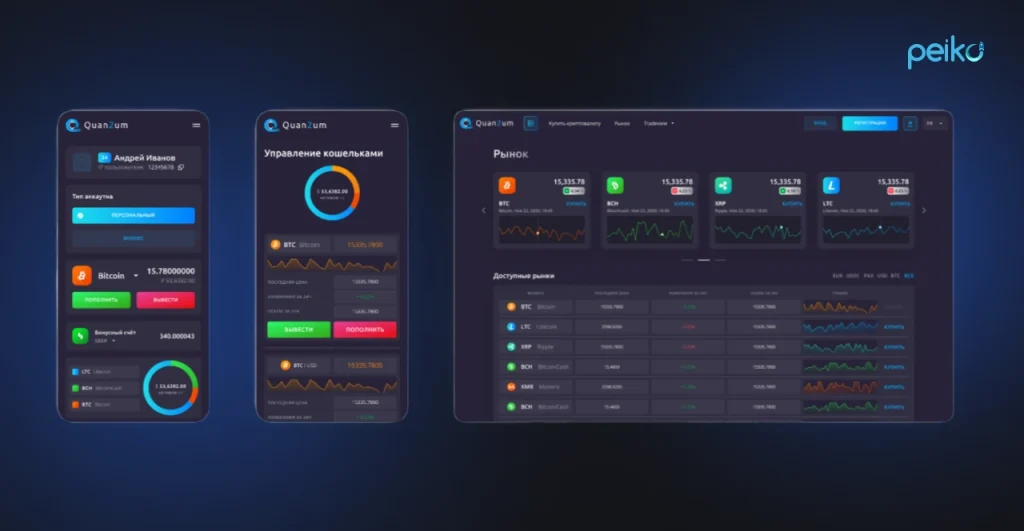

For instance, Quan2um is a highly secure cryptocurrency exchange. In accordance with European laws, the exchange accommodates multiple digital assets and a robust referral and bonus program. Plus, we added investment opportunities in its native BTCA coin for passive income generation. Peiko’s role in the project was that of a full cycle web developer implementing market liquidity solutions and secure storage. All via advanced wallet management.

Solution delivered

- Real time market watch using a focused socket server for the latest price feeds.

- Management of market liquidity using liquidity bots and strategic parsing of prices from Binance, Kraken, and KuCoin.

- Cold, encrypted, safe crypto storage with transaction handling from hot wallets.

- Module for BTCA master node investments and staking for creating passive revenue.

- Support of various orders from high-performing matching engine to enable trading.

- Multi tiered commission and referral scheme for user acquisition and retention.

Why Peiko?

To create centralized exchange like Quan2um or even specialized blockchain expertise, Peiko possesses the skill to make your vision come true. We provide solutions to demonstrate your company’s distinctiveness, whether through smart contracts, stablecoin architecture, or smooth Stripe crypto connections.

If you want to launch your crypto exchange faster in just a few weeks, you can choose our white-label crypto exchange solution. In contrast to the development from scratch, it is a more cost-effective and quick way to start the crypto exchange.

Conclusion

What is important to start your own crypto exchange? You should begin by creating a solid value proposition and understanding your target market.

Another factor of success is scalable and secure infrastructure in addition to conducting market research. The reliability of your platform will also depend on the appropriate technology stack. If you want to create centralized crypto exchange that can boast driving revenue and high user retention, we will help you to choose the best technologies. Furthermore, don’t forget to put in place a high-performance matching engine. Compliance with international regulations is vital, too.

What else? Security. The exchange and its customers should be shielded from online threats and legal concerns with multi-tier wallet systems, strict AML/KYC protocols, and frequent penetration testing.

A competitive cryptocurrency exchange that draws traders and maintains growth can be yours. To sum up, use strategic planning, the latest technology, and a robust compliance structure. And we can help you with all of it. Contact us to build crypto exchange that generates revenue for you!

FAQ

To start cryptocurrency exchange, the price for a typical white-label exchange is in the range of $50k to $100k. Customized platforms can cost more than $500,000.

A decentralized exchange, or DEX, has no middlemen. Smart contracts allow users to trade directly without them. Instead, a centralized crypto exchange (or CEX) provides customer support and quicker transactions. CEXs are all about efficiency and liquidity, while DEXs are all about privacy.

To create cryptocurrency exchange, it is vital to obtain licenses and funding. Implement liquidity, AML, and KYC solutions. Apply cold storage for security. Create a scalable crypto exchange architecture. Integrate payment processors to provide fiat on/off ramps.

Pick a jurisdiction based on compliance needs. We can help you create risk assessment frameworks, AML/KYC protocols, and legal papers. We will also assist you with complying with capital requirements, submitting applications via financial regulators, and preparing for thorough audits before approval.

Technically, yes, anybody can build crypto exchange. But, it is not so easy with security threats, liquidity issues, and regulatory constraints. A successful exchange requires huge liquidity, a reliable tech infrastructure, and a regularly compliant business.